Crypto market analyst Ali Martinez sees VeChain (VET) skyrocketing to a $0.6 price target, citing the emergence of fractal patterns on the 1-month chart.

With VeChain now looking to recoup the losses of the past weeks, market data suggests its growth trajectory could lead to greater heights. Notably, amid the prevalent market uncertainty, VET is down 34.6% from its yearly peak of $0.0550 attained in late February, and 86.5% down from the $0.2798 all-time high.

VeChain Forms Fractals

However, these losses have not impacted its overall trajectory, with data indicating an imminent substantial upsurge. Trading veteran Martinez identified the formation of fractal patterns on the monthly VeChain chart, confirming the potential emergence of this bullish upswing.

Fractals indicate that #VeChain ( $VET ) is set for a rebound this summer, with a potential explosive growth in the fall. 🚀 pic.twitter.com/gjdJLfreOD

— Ali (@ali_charts) May 10, 2024

Historical data shows that this pattern first formed from Q4 2018. VET recorded five consecutive months of losses from July to November 2018, collapsing 81% during this period. Nonetheless, the first set of fractals materialized in November 2018, and lasted through 19 months, or 578 days, of intermittent price upswings and declines.

When VeChain broke above the resistance at the upper line in July 2020, it registered an impressive price rally that coincided with the 2021 bull run. Riding on the breakout and the prevalent bull market at the time, VET eventually soared to the all-time high of $0.2664 in April 2021. This marked a 2,907% spike in nine months.

VeChain witnessed the formation of a similar fractal pattern this cycle, when it recorded a 31% drop in June 2022. Interestingly, this pattern also lasted for 19 months, with VET staging a breakout upon the 69% monthly gain in February this year.

VET Targets $0.60

Following this breakout, Martinez expects VeChain to secure a price rally similar to the one in the 2021 cycle. Data from his chart shows that he has already set a price target of $0.60, marking a 1,571% increase from VET’s current price of $0.0359.

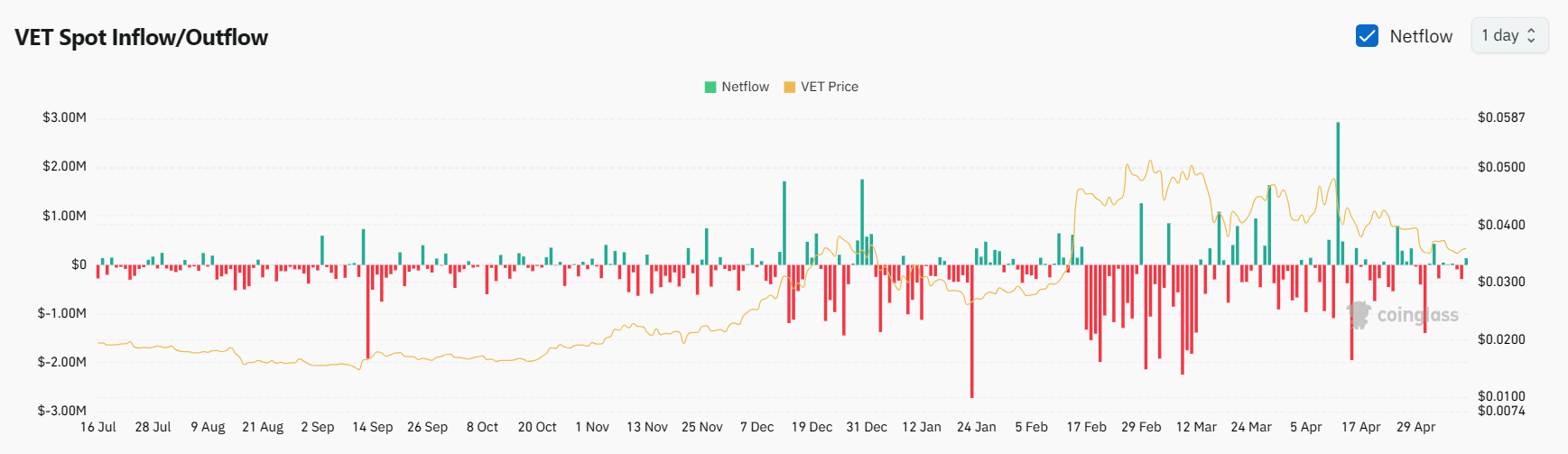

Supporting these sentiments is a cluster of development activities, partnerships and sustained withdrawals from exchanges. Coinglass data indicates that market participants have continued to take out their VET tokens from exchanges, a trend that typically leads to reduced selling pressure.

In addition, as bullish sentiment picks up, futures and derivatives Open Interest (OI) has increased 5% over the last 24 hours to $35.69 million. Interestingly, within this period, the long/short ratio has risen to 1.0169, suggesting that VeChain currently observes a predominance of optimism.

thecryptobasic.com

thecryptobasic.com