The cycle’s crypto bull market commenced in late 2023, specifically around October, but took full shape this year when Bitcoin cracked its 2021 all-time high. However, some digital assets are yet to capitalize on this buoyant market led by Bitcoin.

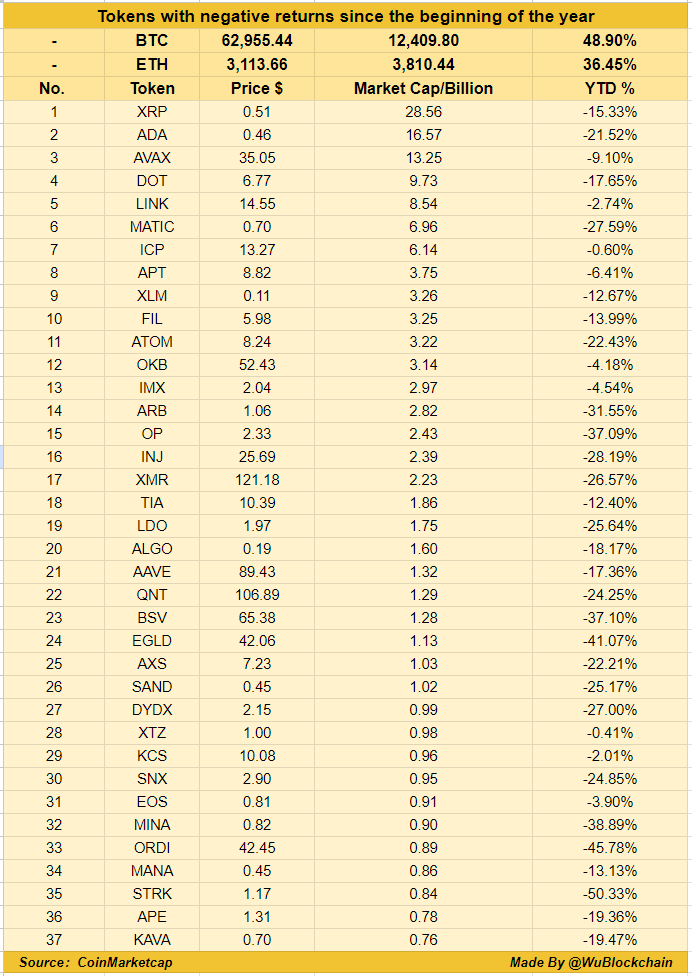

Prominent Asian-based reporter Colin Wu recently compiled a list of the top 37 cryptocurrencies with negative growth on a year-to-date (YTD) scale, presenting discount buying opportunities.

Leading the pack was $XRP, the sixth most valuable cryptocurrency with a market cap of around $28.56 billion. At its current market value of $0.51, $XRP is down 15.33% from the price with which it opened in 2024. The asset entered 2024 with a price in the $0.6 range but has reached a bottom of $0.433 this month.

Meanwhile, since this year, Bitcoin has maintained a 48.9% gain despite the recent massive price collapses. Its closest rival, Ethereum (ETH), mirrored its trajectory by retaining 36.45% despite the dips.

However, the recent market dips led by Bitcoin forced many altcoins, such as Cardano ($ADA), Internet Computer ($ICP), Chainlink (LINK), and Avalanche ($AVAX), which were top performers in the earlier phase of the bull market, to relinquish their gains to the bears.

Specifically, at $0.46, $ADA is down 21.52% from the price with which it commenced the year. Similarly, $AVAX now shoulders a 9.10% loss on a YTD scale with a market price of $35.05 despite growing explosively since November 2023. Also, $ICP now trades at $13.27, with a mild negative growth YTD. Meanwhile, $ICP had soared by over 200% from a low of $5 last December to a high of $19 in March.

Recall that renowned market intelligence Santiment has recently shared data arguing that altcoins, at their current market price, present a massive discount buying opportunity for the impending bull rally.

Other top assets recording negative growth currently, as presented on the list, are APT, XLM, and FIL. While these coins may be trading in the red, they present a buying opportunity ahead of the anticipated bull market, as Santiment suggested.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com