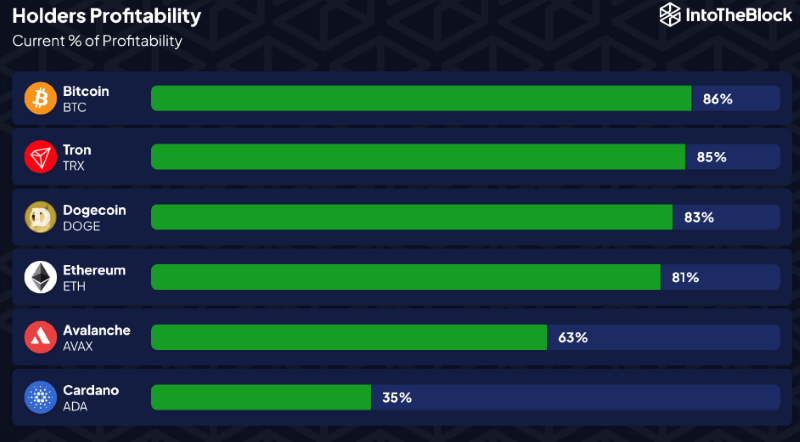

Although the recent bull market in the cryptocurrency sector has brought on massive profits for investors in many crypto assets, Cardano (ADA) remains a mystery, with only 35% of its holders in the green – leaving traders to wonder whether this is an opportunity or a warning sign.

Specifically, Cardano stands out among several top Layer 1 networks, including Bitcoin (BTC), Tron (TRX), Dogecoin (DOGE), Ethereum (ETH), and Avalanche (AVAX), with just over a third of its holders in profit, according to the recent data shared by blockchain analytics platform IntoTheBlock on April 24.

Indeed, as the blockchain platform’s analysts explained, “Bitcoin remains king,” with Tron “being a close second,” while Dogecoin and Ethereum “also have the vast majority of holders in profit,” which makes Cardano a curious exception to the recent trends and a profitability puzzle.

Cardano (ADA) price analysis

As it happens, Cardano is one of the ‘losers’ among assets in the crypto market this year, considering it has declined over 20% since the year’s turn, while the others on the above list have experienced gains – with the exception of Avalanche, which has declined 9.36% during this period.

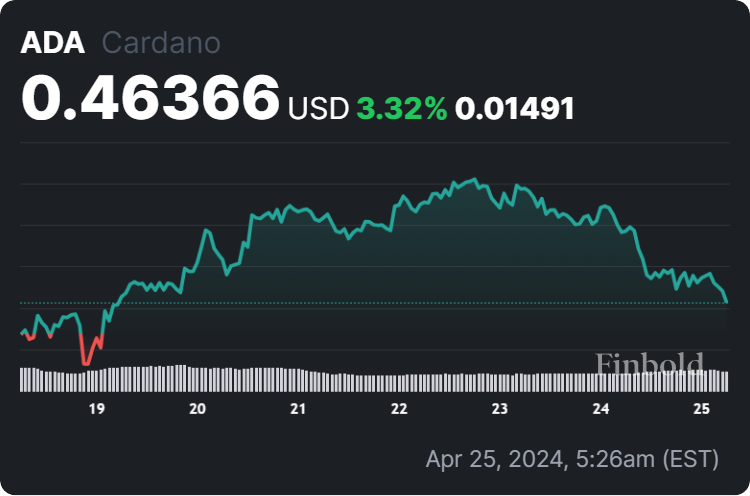

Furthermore, it has experienced declines on its daily and monthly charts, dropping 6.42% in the last 24 hours and losing a more significant 32.01% across the previous 30 days, albeit accumulating a 3.32% gain over the past week, and currently changing hands at the price of $0.4637.

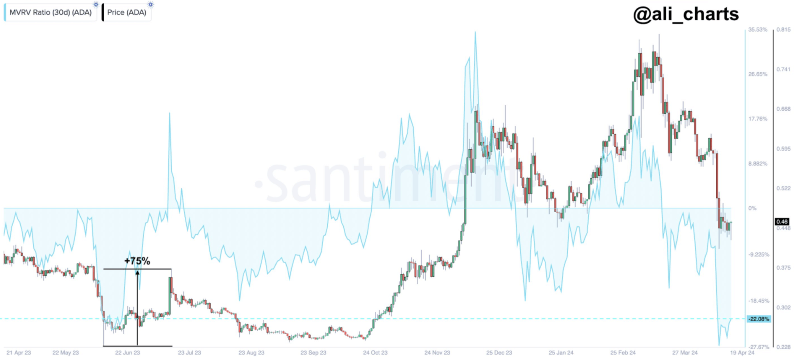

Meanwhile, such price action could represent an opportunity for investors seeking to grow their portfolios, as Cardano has earlier demonstrated a critically low Market Value to Realized Value (MVRV) ratio, which crypto expert Ali Matinez identified as a bullish signal for an “impressive rebound.”

All things considered, ADA could be in for further declines or is preparing to soar if the renowned crypto trading expert is correct. However, trends in the cryptocurrency industry can often change suddenly, so doing one’s own research and weighing all the risks is critical.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com