The cryptocurrency market lost $430 billion in capitalization since April 12, amid an unprecedented Iranian offensive against Israel. Traders lost over $2 billion in liquidations, which mostly affected Bitcoin (BTC), by $500 million, in an immediate risk-off reaction.

Notably, the crash started a day before the Iranian airstrike against Israel dominated headlines worldwide. On April 13, Finbold reported a $150 billion crash with nearly $1 billion liquidated from cryptocurrency traders in 24 hours. At that time, there were no public confirmations of the later-known escalation of the war in Iran.

After that, the cryptocurrencies took another hit following the subsequent news on Saturday night, in a panic sell-off. On that note, TradingView‘s Total Crypto Market Cap Index registered a drop of $429.11 billion in the 48 hours before the attack, for 17% losses.

The index now registers a $2.258 trillion capitalization, partially recovered from the crash to $2.098 trillion amid the offensive’s fear. Geopolitical tensions like war have had a massive historical impact on risky assets like Bitcoin and stocks.

$2 billion liquidated from the cryptocurrency market crash

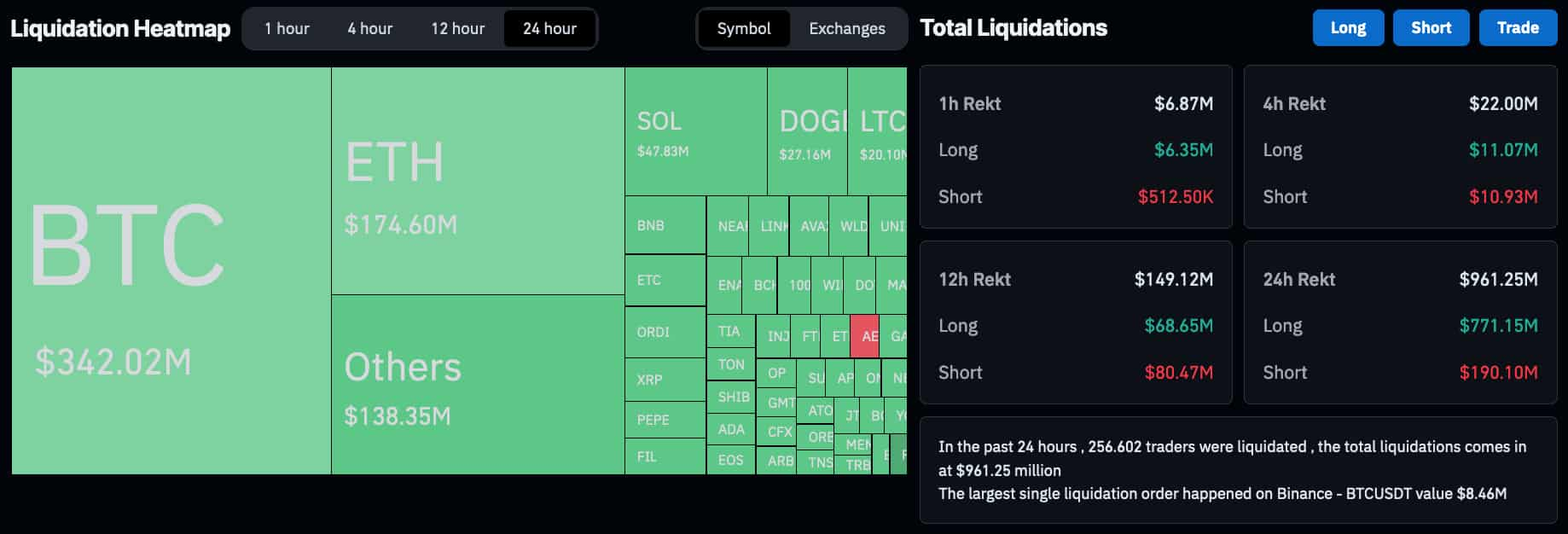

As of writing, data from CoinGlass registers $961.25 million in cryptocurrency liquidations in the derivatives market. This amount sums up to the nearly $1 billion liquidations reported before Iran sent the drones and missiles to Israel.

Interestingly, the previous liquidation event was dominated by ‘Other’ cryptocurrencies instead of Bitcoin and Ethereum (ETH). Now, the two leading projects accumulated the highest losses and Bitcoin traders lost over $500 million in these 48 hours.

In particular, the largest single liquidation happened on Binance with the BTC/USDT pair, for $8.46 million in losses. Again, long positions were the most affected by the cryptocurrency market crash, with $771.15 million in long liquidations.

The QCP Capital Broadcast explained that Bitcoin suffered the biggest hit and acted as a leading indicator for finance markets.

“It is likely that BTC was used as a weekend proxy macro hedge and therefore bore the full brunt of the immediate risk-off reaction.”

– QCP Broadcast

What’s next after the Iranian offensive?

On the other hand, gold-backed cryptocurrencies registered a significant premium over gold indexes. Specifically, Pax Gold (PAXG) traded as high as $2,855 amid the market’s crash, now at $2,433 per ounce. TradingView‘s gold index’s last value is at $2,343 per ounce, $100 lower than PAXG’s current exchange rate.

Historically, the precious metal and leading commodity is known as a hedge amid times of war and fear. Investors run to gold, silver, and similar assets for wealth protection. Therefore, this behavior happened this weekend, following Iran’s drone offensive against Israel.

Fear, uncertainty, and doubt are the current dominating sentiments, and all eyes are now turned to the War of Gaza. Further developments will determine the market’s direction in the following days.

finbold.com

finbold.com