The cryptocurrency market saw renewed interest in 2024, starting what could be a multi-year bull landscape. This has propelled the surge of new projects that bring enthusiasm and innovation, but also relevant risks and fears.

In particular, a new stablecoin-focused protocol appeared with huge promises while prominent cryptocurrency figures showed support and backed the experiment. Guy Young and Arthur Hayes launched Ethena ($ENA) in partnership with popular centralized exchanges like Binance, OKX, and ByBit, and known decentralized protocols like Aave (AAVE) and Curve (CRV).

However, Ethena’s launch has raised fears in memory of what happened to Terra (LUNA) in 2022. This is due to the protocol’s goal being to manage the newly launched algorithm synthetic dollar stablecoin $USDe. Thus, some critics have traced a parallel to Do Kwon’s UST.

In this context, Finbold selected three cryptocurrencies related to the project to avoid trading next week as the industry starts understanding its underlying risks and potential.

Avoid trading Ethena ($ENA) next week

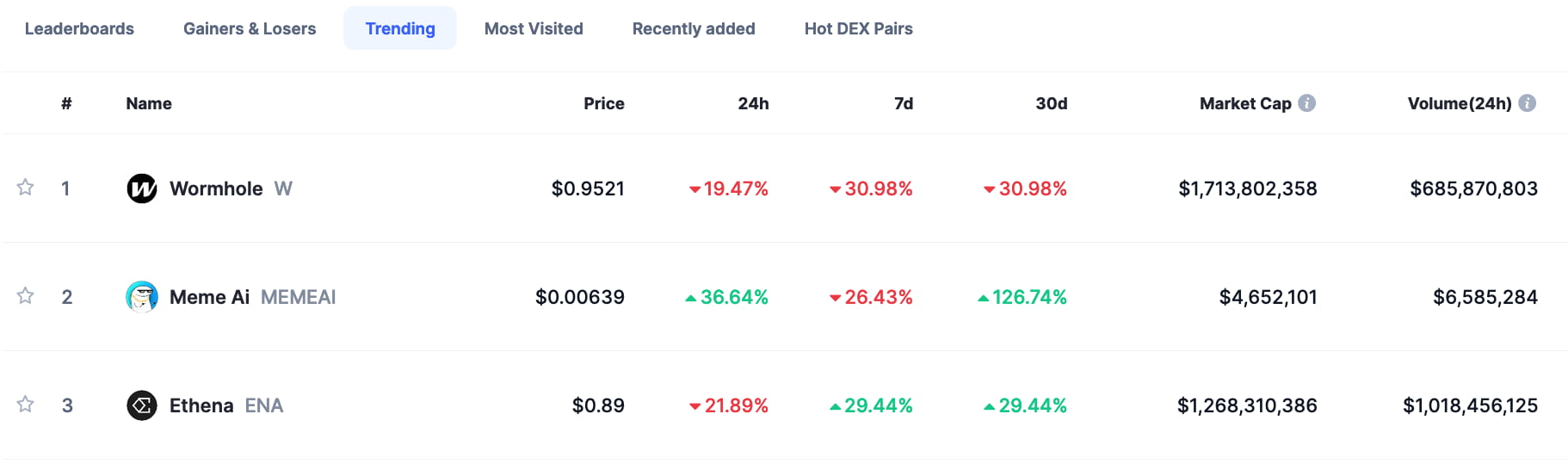

First, Ethena’s governance token, $ENA, entered the trending cryptocurrencies of the CoinMarketCap index on April 5. Yet, the token is down 22% in the last 24 hours amid the price discovery stage following the project’s launch.

So far, Ethena has reached an impressive market cap of $1.26 billion, with a remarkable daily volume superior to $1 billion. This nears $ENA’s capitalization and evidences the market’s interest in the project.

The current hype creates an uncertain environment with considerable risks as investors have not fully understood Ethena’s model and limitations. Thus, traders should avoid trading $ENA at this point, and wait for further developments next week.

$USDe

Second, the protocol’s flagship product is another cryptocurrency traders should avoid using in the early phases of the project. $USDe is a described synthetic dollar token backed by a derivative’s market hedge strategy first proposed by Arthur Hayes.

Ethena is implementing this innovative mechanism in a pioneering way, which means that the model is not battle-tested enough.

Essentially, $USDe’s peg to the dollar is kept by shorting Ethereum ($ETH) in centralized exchanges, while using Lido’s Staked Ether (stETH) as the short position collateral.

Using $USDe now may expose investors to liquidity risks in case the model fails, which could affect its dollar peg.

Lido’s Staked Ether (stETH)

Finally, another token that could be drastically impacted by the Ethena protocol is the stETH itself. When Ethena investors use stETH as collateral to short Ethereum, an $ETH short squeeze threatens to liquidate these positions, in a stETH major sell-off.

Moreover, an increased demand for Lido’s Staked Ether also exposes the whole ecosystem to more capitalized smart contract failures or exploits. On that note, avoiding trading stETH under these uncertainties may help protect investors from undesired outcomes.

Nevertheless, watching and following Ethena is crucial to understanding where this experiment will lead us. The market still has a significant demand for decentralized stablecoin solutions, which $USDe could fulfill if proven solid over time.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com