Over the last two days, the price of Algorand ($ALGO) has declined on the daily chart, retracing back to just above a critical support level.

Although a recovery seems possible, the current lack of market bullishness could pose a significant obstacle.

The Challenge of Attracting New Investors

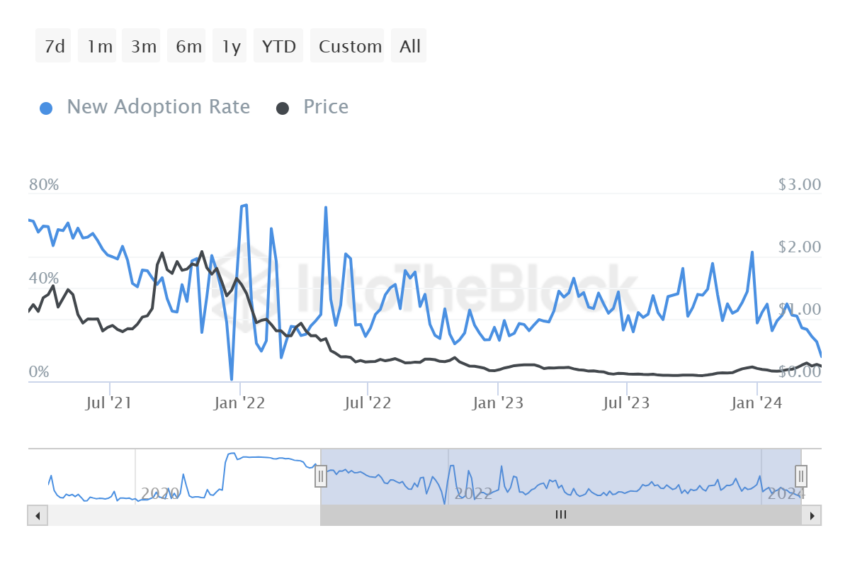

In recent days, a noticeable dip in the price of Algorand has stirred either fear or concern among active and potential investors. This sentiment is reflected in the slowed pace at which new addresses are being created on the network, suggesting a potential decline in investor interest.

This trend is highlighted by the new adoption rate metric, which assesses transactions made by newly created addresses to gauge whether the project is gaining or losing popularity among investors. For Algorand, this metric has hit a two-month low, indicating a potential decrease in market traction.

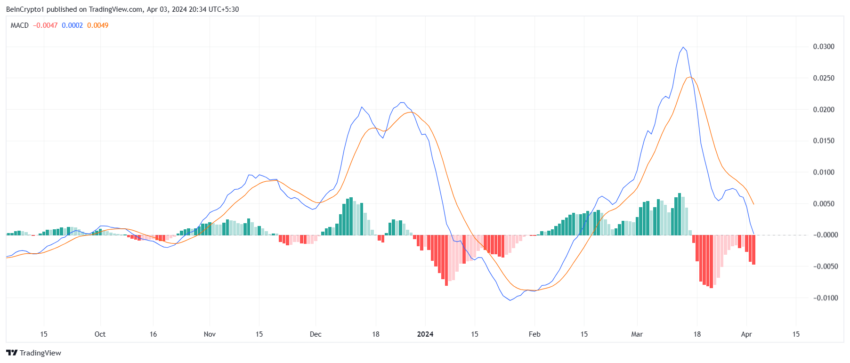

The Moving Average Convergence Divergence (MACD), a trend-following momentum indicator, further substantiates this view.

Currently, the MACD shows extended red bars on its histogram, signaling a continued bearish trend. This suggests that Algorand’s price may continue to face downward pressure.

Algorand Price Prediction: A Forecast

If the current challenges impact Algorand’s price significantly, it could fall to $0.23. A breach of this support level might lead to a further drop to $0.20, resulting in considerable losses for investors.

However, there’s still a glimmer of hope according to the Ichimoku Cloud indicator.

This technical analysis tool, which uses five lines to signal support, resistance, trend direction, and momentum, indicates that there might still be underlying bullishness. Candlesticks positioned above the cloud typically suggest a bullish outlook, while those below indicate bearishness.

Read More: Algorand ($ALGO) Price Prediction 2024/2025/2030

Consequently, if Algorand’s price surpasses $0.24, it could signal the start of a recovery, potentially reaching $0.2532. Successfully turning this level into support could negate the bearish outlook and pave the way for further gains.

beincrypto.com

beincrypto.com