Despite an overall crash in the crypto market with over $230 billion wiped in 24 hours from cryptocurrencies, some assets still hold overbought status on the daily Relative Strength Index (RSI).

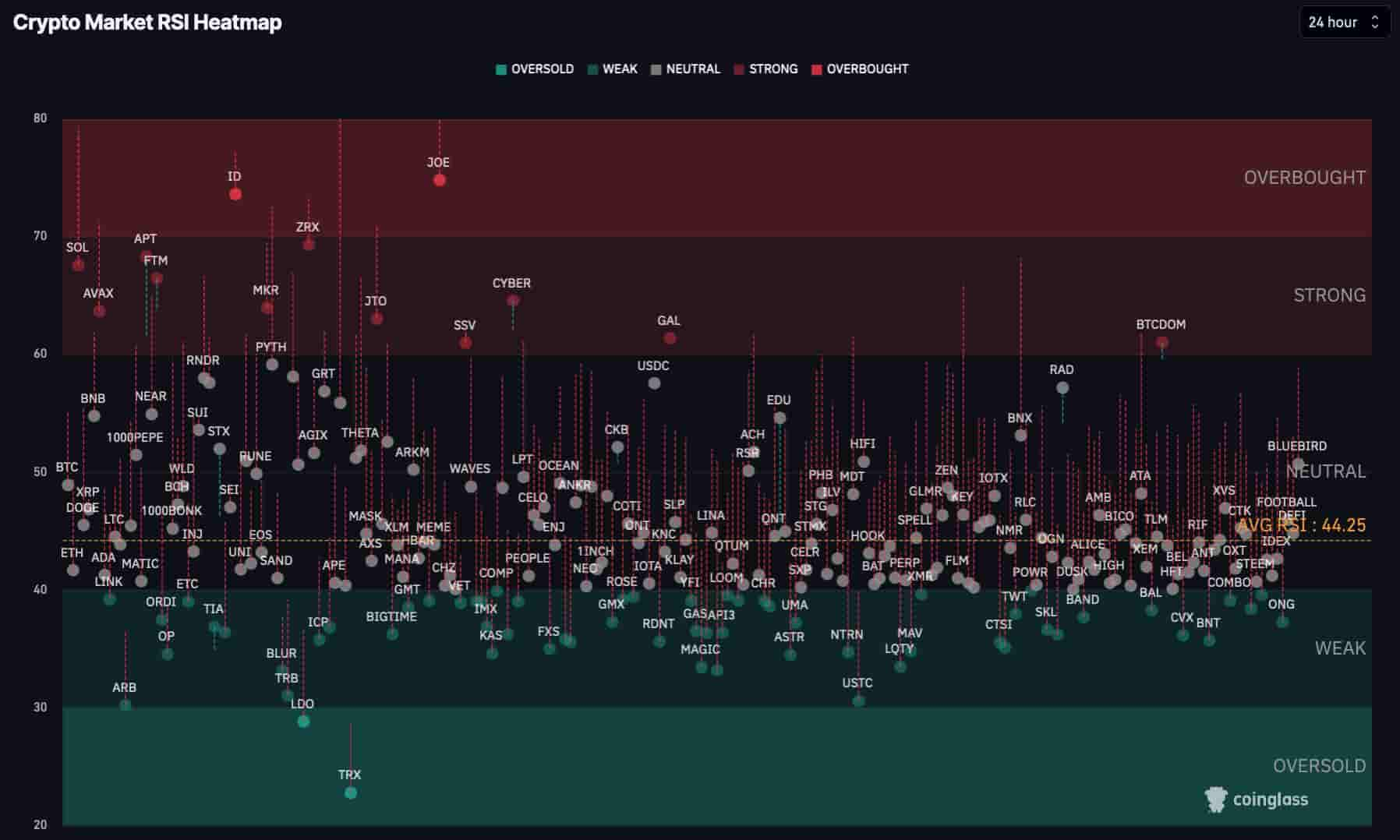

The Relative Strength Index is a powerful indicator of the current state of the market, acting as a momentum thermometer. Currently, the average daily RSI of all cryptocurrencies dropped to 44.25, on the edge between ‘neutral’ and ‘weak’.

This is a significant change from last week’s average above 60 RSI, showing a ‘strong’ market. Finbold retrieved both data from the CoinGlass heatmap.

However, some cryptocurrencies have remained in the ‘strong’ zone despite unfavorable 24-hour price action. In particular, two of these tokens now broadcast a considerable sell signal, remaining in the ‘overbought’ zone — above 70 RSI.

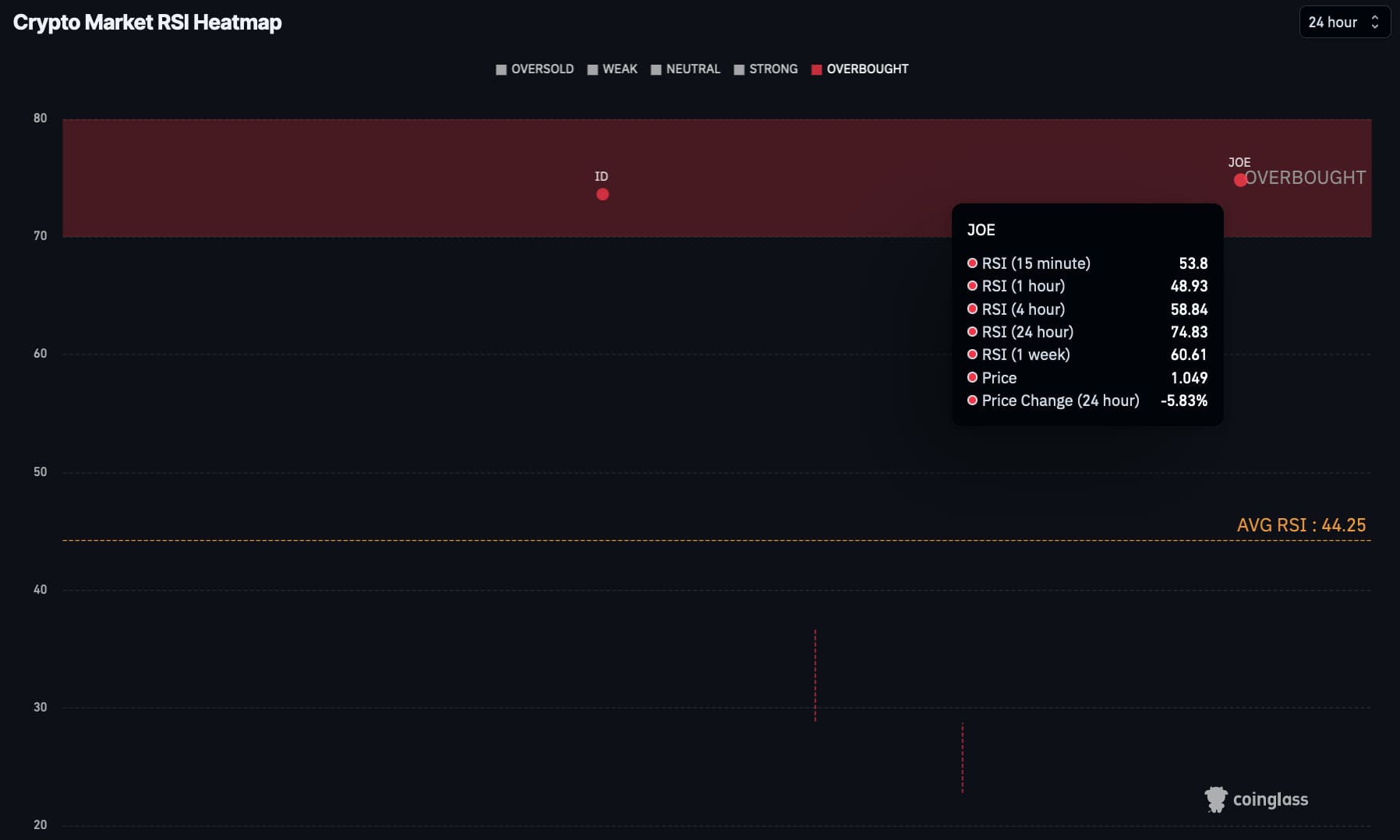

Sell signal for an overbought TraderJoe (JOE)

First, the native token of Avalanche’s (AVAX) leading decentralized exchange, TraderJoe (JOE) is still overbought in the daily time frame. JOE’s 24-hour RSI is currently at 74.83, far above the market’s average.

Interestingly, the token trades at $1.05 with a 5.83% drop, showing signals of strength in the weekly chart. TraderJoe has a 60.61 7-day RSI, which could be enough to invalidate this sell signal if it holds short-term resilience.

Nevertheless, JOE is mostly traded within the Avalanche ecosystem, which could cause expressive lags in price performance during overall crashes.

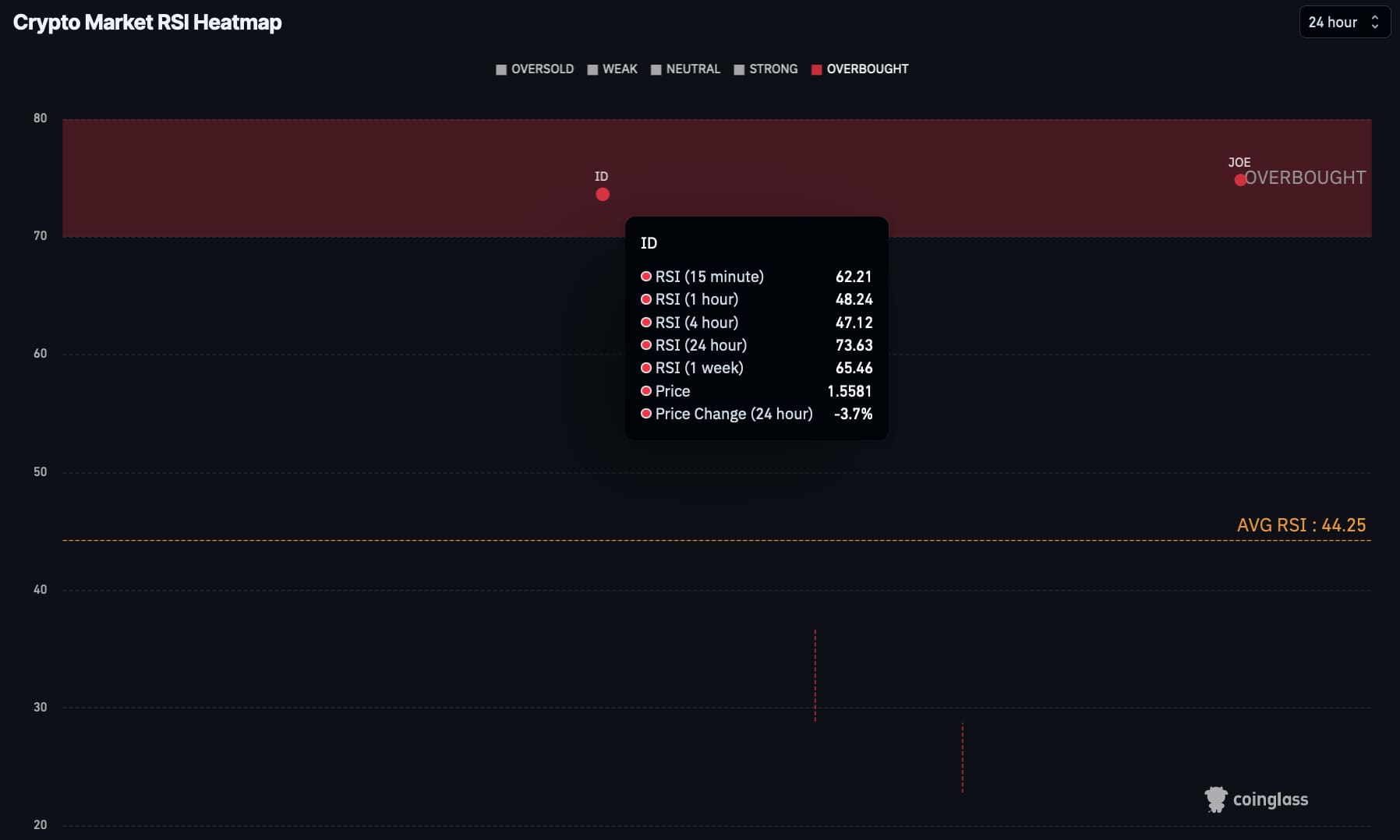

Space ID (ID)

Another seemingly overbought cryptocurrency is Space ID (ID), with a daily Relative Strength Index of 73.63. Notably, the 24-hour price action was even stronger than JOE’s, losing 3.7% to a $1.55 price on spot.

Space ID is a protocol designed to create a name service network, through domains exchange in Web3. A competitor of the popular Ethereum Name Service (ENS), also running on Ethereum (ETH).

However, these two cryptocurrencies could surprise investors and outperform the market, holding their strong momentum, despite the suggested sell signal. Having an overbought RSI does not guarantee an incoming price crash and cryptocurrency traders must consider different factors and technical indicators while making financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com