The cryptocurrency market is in strong momentum overall, with most projects already showing overbought signals through technical analysis indicators. However, some cryptocurrencies have lagged behind, still suggesting strength for continuation—a buy signal for this week.

Finbold has reported buy signals for oversold cryptocurrencies in the past few weeks, considering potential downtrend reversals. Now, the few existing downtrends could hint at fundamental weakness, and crypto investors should be careful when trading them.

In a bull market, there is an opportunity for new narratives and trends that have recently started. Technically, the Relative Strength Index (RSI), usually above 60 points and below 70, can help spot strong momentum.

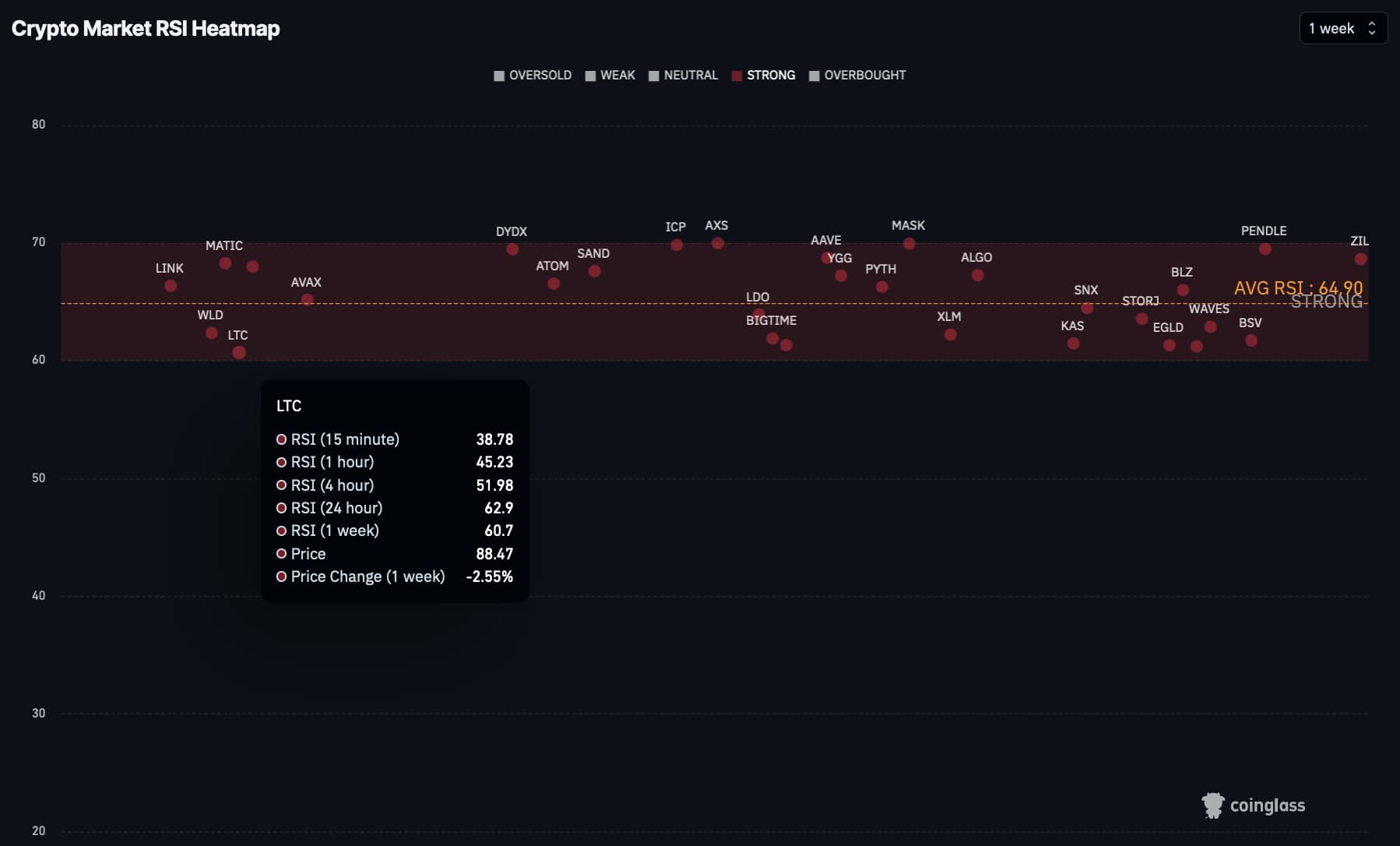

Looking for further insights on a buy signal, Finbold turned to CoinGlass data and spotted two cryptocurrencies with a strong buy signal to navigate the bull market that has already started.

Litecoin (LTC)

First, Litecoin (LTC) shows strong momentum with a 60.7 weekly RSI while remaining below the average 64.9 RSI. This suggests a bullish trend could be picking up steam for LTC as it trades at $88.47.

Notably, Litecoin is one of the leading payment coins in the market, which could benefit from a surging payment narrative.

Moreover, LTC has recently seen 2.55% losses in the last seven days. This shows a neutral or weaker RSI on lower time frames, which investors can use as a buy signal.

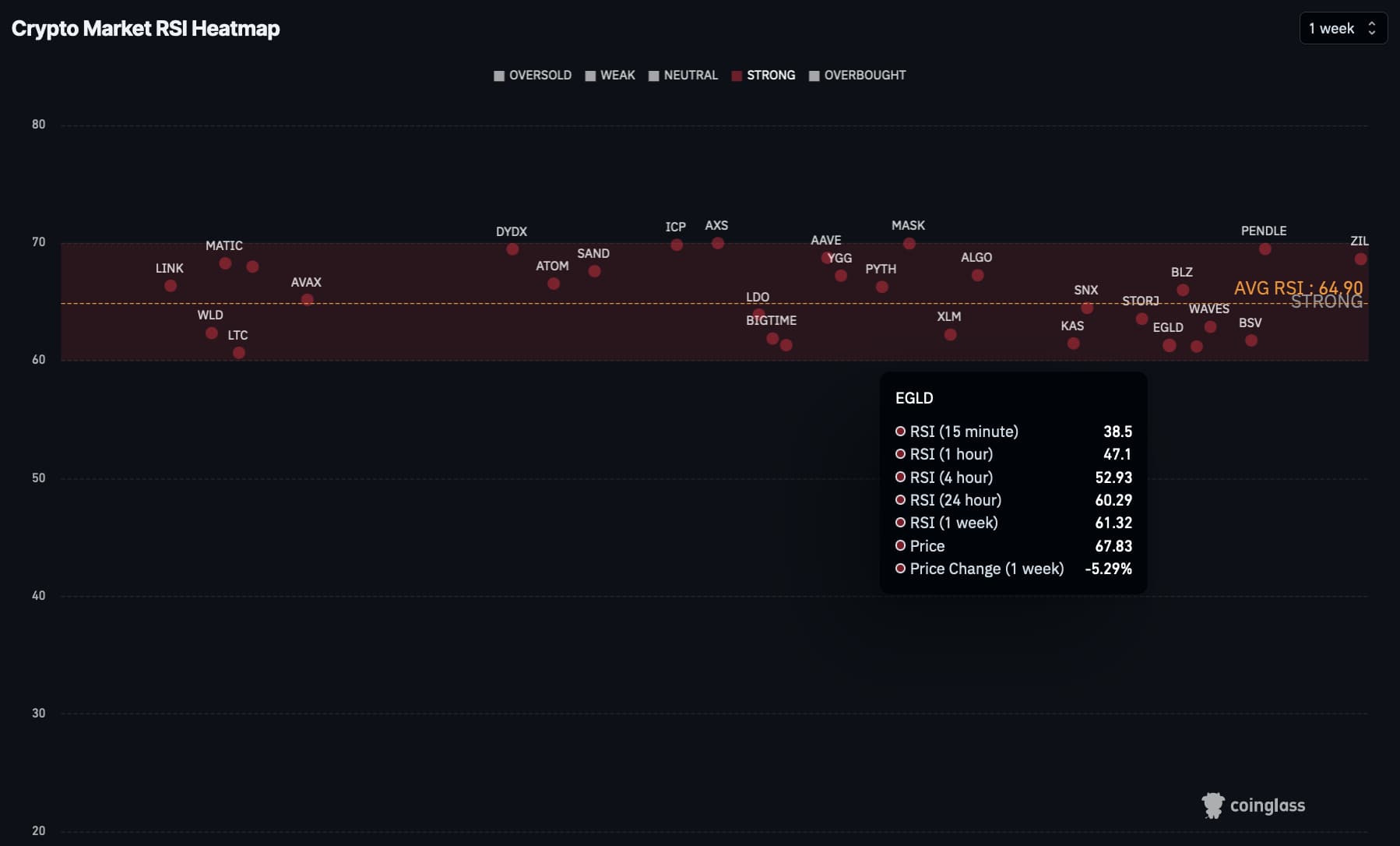

MultiversX (EGLD)

Second, MultiversX (EGLD) is in a similar situation to Litecoin. MultiversX has one of the lowest RSI among the ‘strong’ projects. Essentially, this highlights a higher risk-reward ratio, with more growth potential, while in a bullish trend.

In particular, EGLD has retraced by 5.29% in the week, trading at $67.83 as of writing. Meanwhile, the MultiversX native token shows a strong weekly RSI of 61.32.

Interestingly, MultiversX is the only L1 blockchain with fully implemented and battle-tested sharding.

Nevertheless, cryptocurrency investors should still be cautious despite these cryptocurrencies’ strong buy signals. Further, monitoring their Relative Strength Index is crucial to spot future profit-realization opportunities and an inevitable overbought sell signal.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com