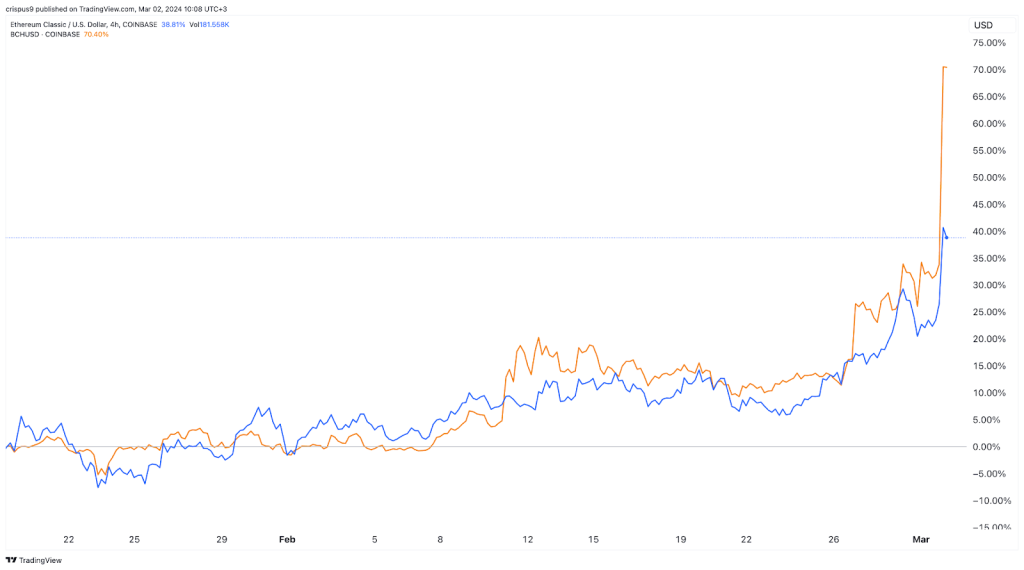

Bitcoin Cash ($BCH) and Ethereum Classic ($ETC) prices spiked this week as the overall mood in the crypto industry continued. $BCH spiked by more than 30% on Saturday and reached its highest point since January 2022. Similarly, $ETC surged to $33.45, its highest level since September 2022.

$BCH vs $ETC price chart

Upcoming Bitcoin Cash halving

The main reason why Bitcoin Cash price continued soaring was because of the upcoming halving, which is set to happen in the next 20 days.

Bitcoin Cash was created as a hard fork of the main Bitcoin. As such, like Litecoin, it retained the features that Bitcoin has, including halving.

Halving is a process where the amount of rewards offered to miners is reduced by half. In this case, $BCH halving is set to happen on March 22nd when it reaches a block height of 840,000. The current block height stands at 835,160 while the block reward stands at 6.25 $BCH. After halving, the reward will move to 3.125.

In most cases, cryptocurrencies tend to rally ahead of halving. For example, Litecoin price jumped sharply ahead of its halving event in August last year. Similarly, Bitcoin has now pumped to over $61,000 ahead of its halving event in April.

The other main reason why the $BCH price is pumping is that it is often seen as a cheaper alternative to invest in $BTC. It is trading at $400 while $BTC has moved to over $62,000. As a result, many traders believe that buying the coin will bring better rewards than investing in Bitcoin. Besides, cryptocurrencies tend to have a close correlation with each other.

Ethereum ETF approval

Meanwhile, the Ethereum Classic price is soaring because of the ongoing crypto rally. In particular, it is being influenced by the performance of Ethereum, which has moved above $3,400 in the past few days.

$ETH’s price action mirrors that of Bitcoin, which surged hard ahead of its spot ETF approval. Now, eight companies, including Blackrock, Franklin Templeton, and VanEck have all applied for a spot Ethereum ETF.

If the ETF is approved, analysts believe it will see robust inflows as Bitcoin recently has. Most importantly, this is happening at a time when Ethereum’s supply has dived sharply.

Therefore, Ethereum Classic price is soaring because it is seen as a better alternative to Ethereum. Like $BCH, which came from $BTC, $ETC came from $ETH through a hard fork in the ecosystem.

Also, many traders believe that $ETC is a cheaper alternative to gain access to $ETH. In this case, $ETC was trading at just $33 while $ETH was trading at over $3,400. As a result, traders believe that investing in $ETC will lead to better results in the long term.

Most importantly, Ethereum Classic is also expected to go a halving event in May. That event will lead to lower rewards to miners, a move that will impact its supply.

The post Here’s why Bitcoin Cash ($BCH) and Ethereum Classic ($ETC) are soaring appeared first on Invezz

invezz.com

invezz.com