Bitcoin went through another roller coaster yesterday when the US SEC Twitter account was informed that the agency had approved a spot ETF, which later turned out to be fake news due to the compromise of said account.

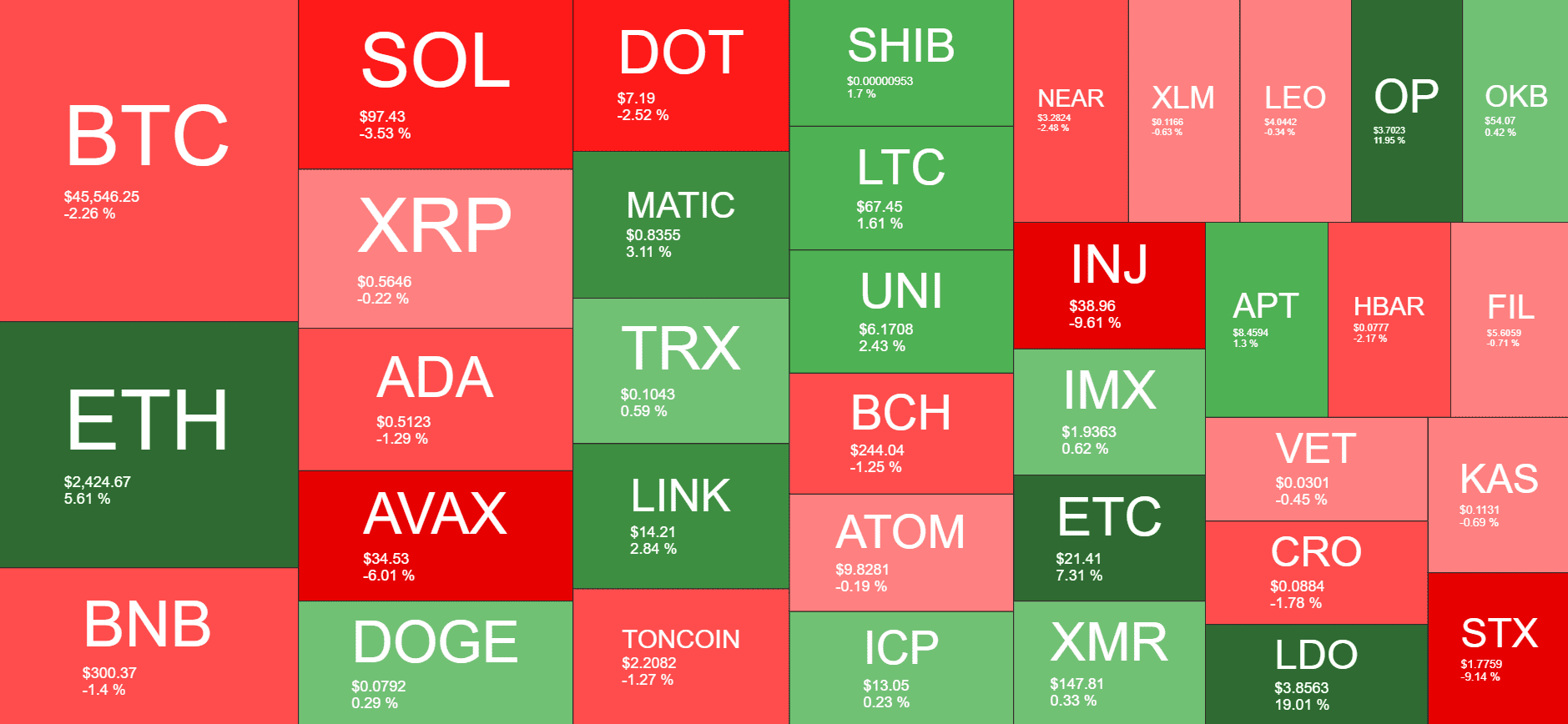

Interestingly, while most altcoins are with losses today, ETH has gone on the offensive and sits above $2,400 after a 5% daily increase.

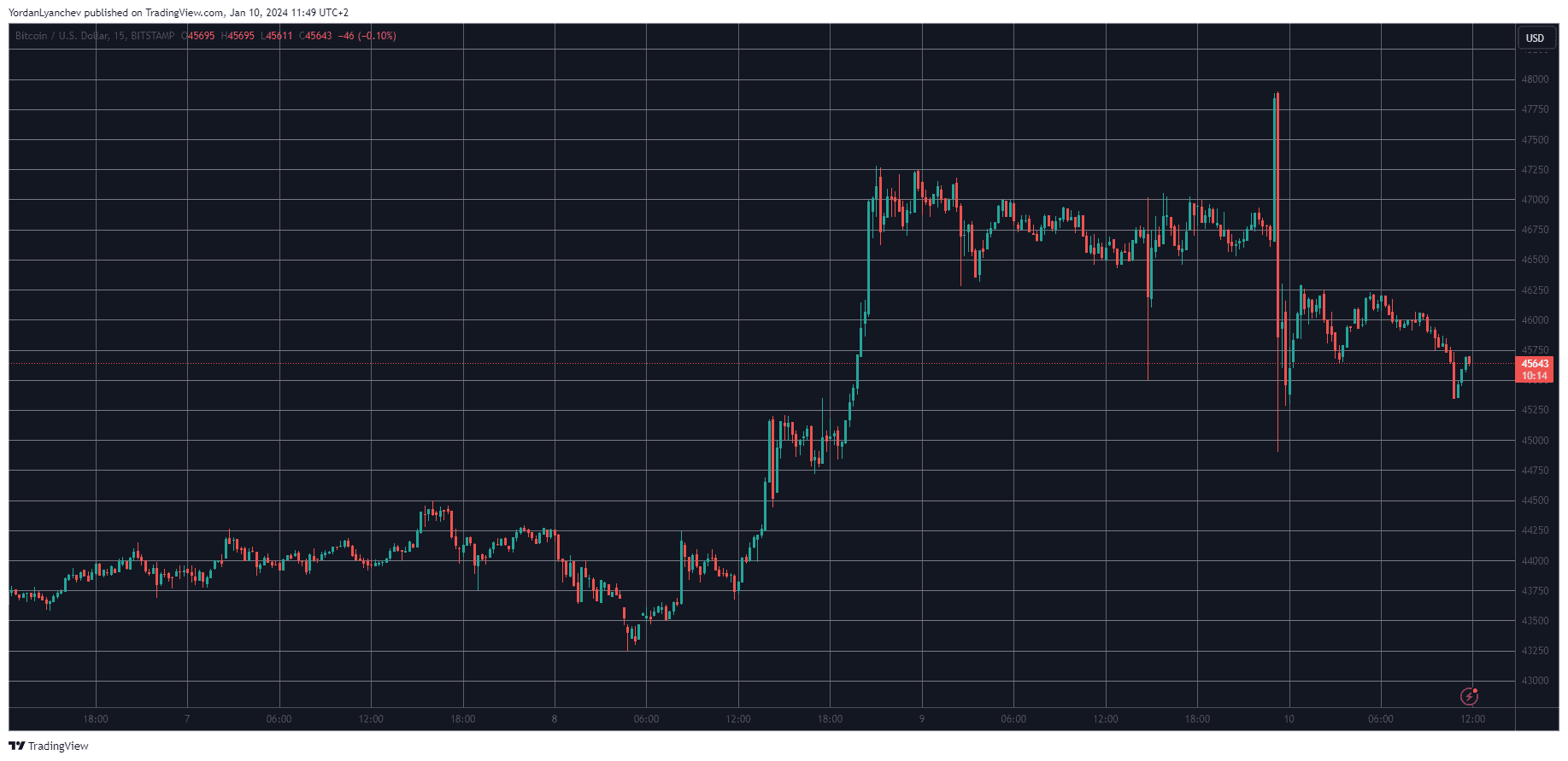

BTC’s Insane 24 Hours

With the deadlines for many of the applications currently reviewed by the SEC inching closer, the topic of spot Bitcoin ETFs continue to impact the entire market daily.

After the pump and dump at the start of the year, in which BTC saw price movements of $3,000 to $5,000 in hours, the asset jumped higher yesterday and spiked above $47,000 once again.

Then came more news on the ETF front, as the SEC published a tweet indicating that the agency had greenlighted all pending applications. This sent BTC flying immediately, but the news was refuted minutes later, as the Commission’s X account was hacked.

As expected, the price of the cryptocurrency slumped just as hard. In USD terms, BTC went from $46,700 to $48,000, before dumping to $45,000 in minutes, leaving millions in liquidations.

As of now, Bitcoin has calmed at around $45,500. Its market capitalization has declined to under $900 billion, and its dominance over the alts is down to 52.4%.

ETH-Related Assets on the Run

Most of the larger-cap alts are slightly in the red today. This adverse trend is led by Avalanche (-6%) and Solana (-3.5%). As a result, AVAX is below $35 now, while SOL has lost the $100 mark.

In contrast, Ethereum stands with a notable 5.5% increase. ETH has been among the underperformers lately, but has gained the most from the larger-cap alts now. Consequently, ETH now sits above $2,400.

Other Ethereum-related assets, such as ETC, OP, and LDO have recorded impressive gains as well. ETC is up by 7%, OP by 12, while LDO has soared by nearly 20% do $3.85.

The total crypto market cap has declined slightly since yesterday, but still stands above $1.7 trillion on CMC.

cryptopotato.com

cryptopotato.com