After a sudden dip that erased some of the gains that cryptocurrencies made over the previous months, the market is recovering, and one among those that are healing the quickest is Terra Classic (LUNC).

In light of the prevailing conditions, Finbold sought assistance from CoinCodex to leverage its AI-driven machine-learning algorithms for analyzing the anticipated price of LUNC by the end of the month.

These algorithms assess dynamic market conditions and meticulously examine pertinent indicators to predict the probability of the cryptocurrency gaining value by the end of January.

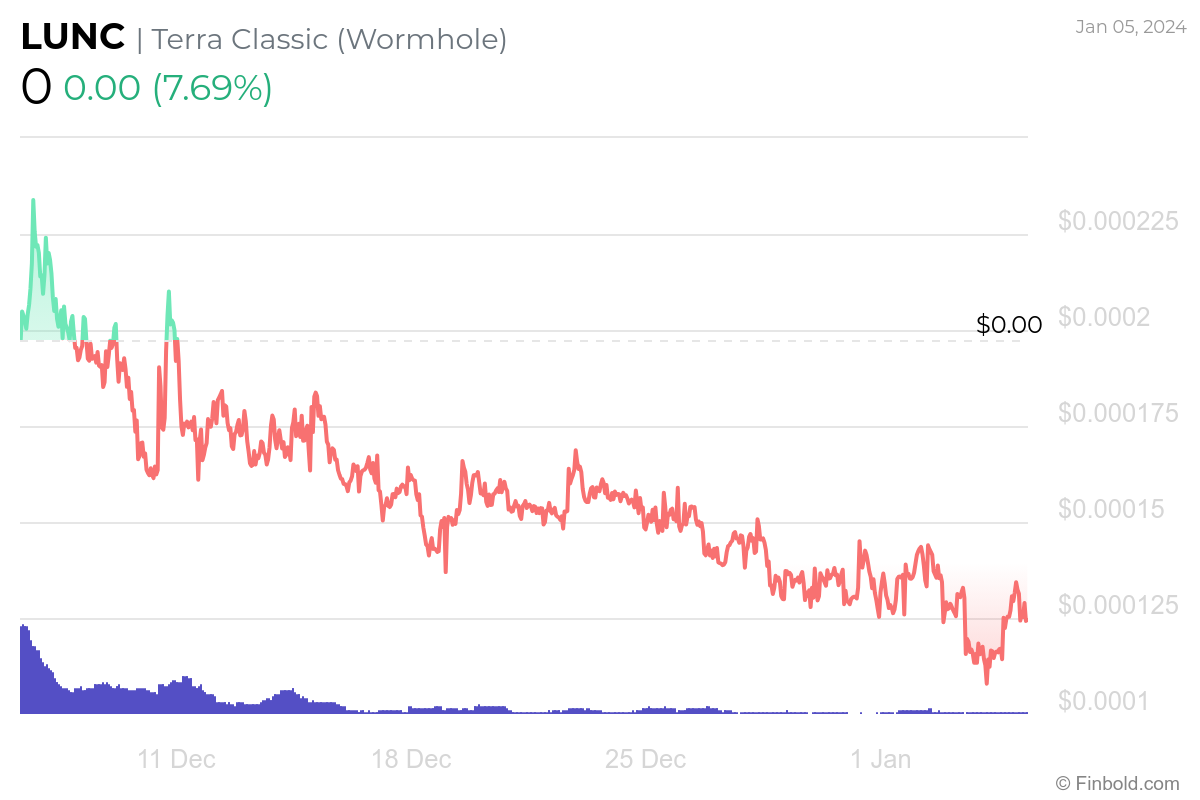

According to the algorithms, the projected price for LUNC is expected to increase to $0.000150 by January 31, reflecting a 14.50% rise from its present level of $0.000131 as of the time of writing.

Analysts predictions

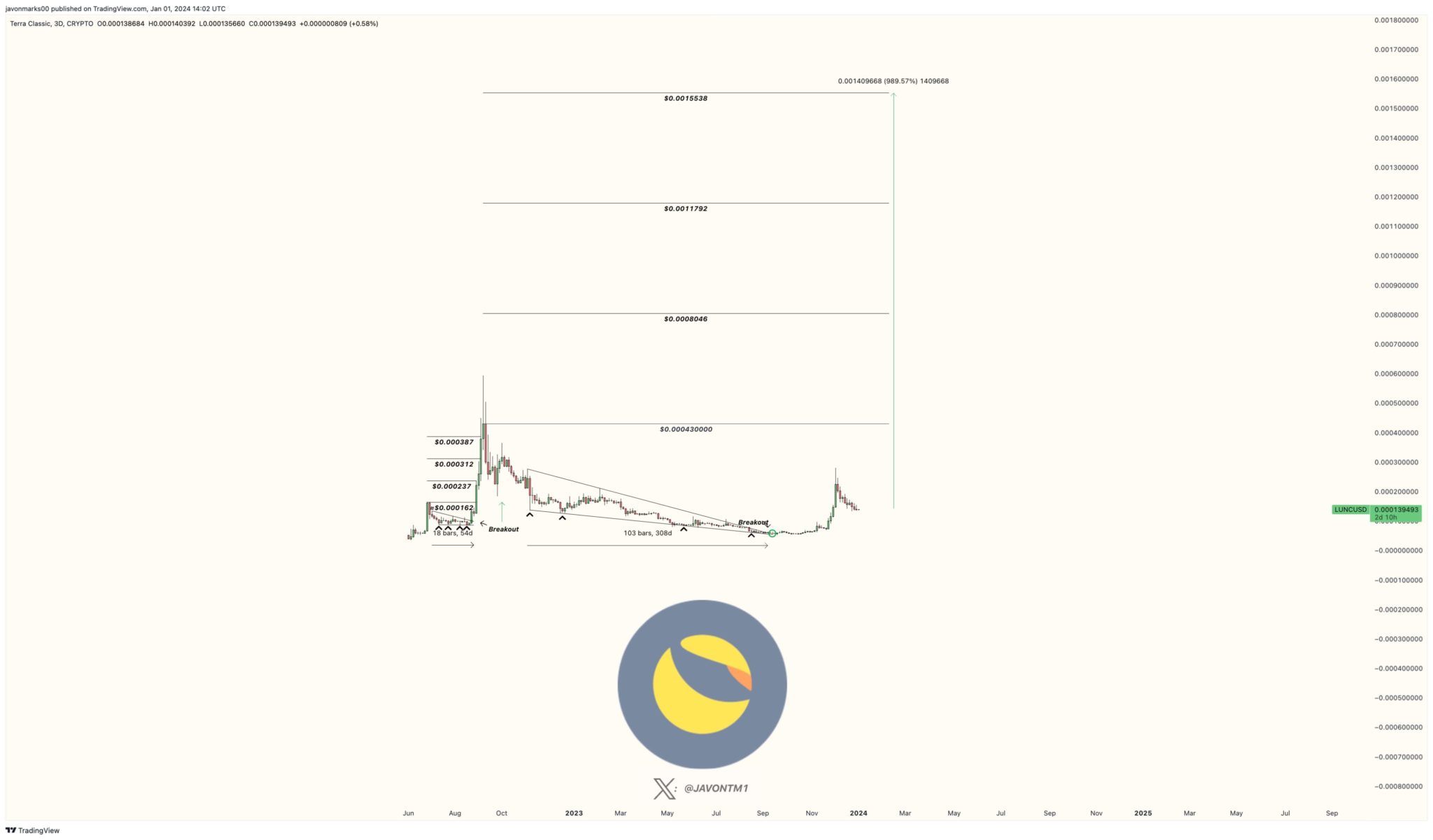

The lower timeframes of LUNC are currently indicating a sustained bullish trend, suggesting the potential for a significant upward movement in the near future. This trend may be signaling a potential tenfold increase from its current levels.

Drawing insights from the previous breakout, there is a possibility of prices experiencing a further increase of over 1008%, reaching levels around $0.001553 and potentially surpassing them, as per crypto analyst Javon Marks X post on January 1.

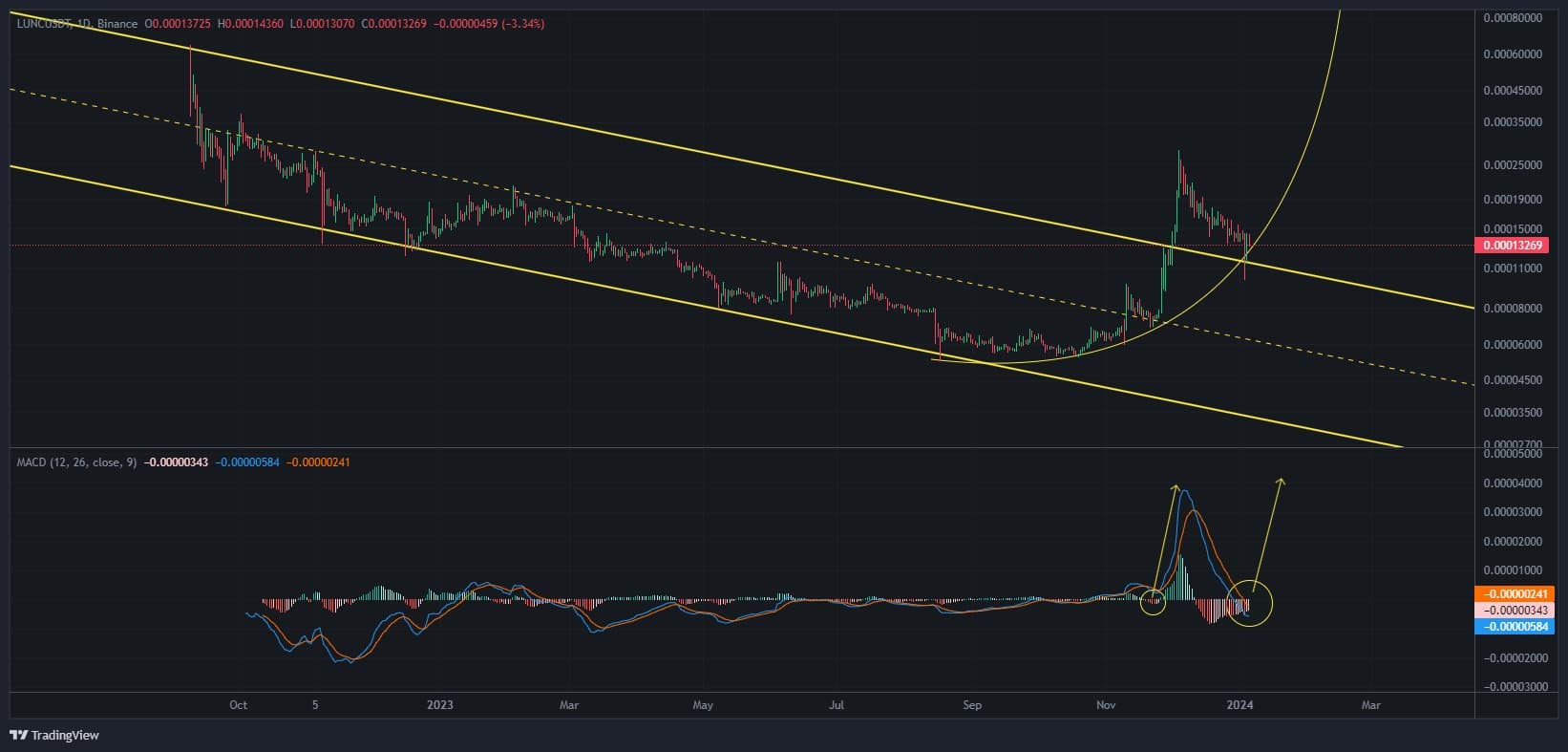

The cryptocurrency has successfully broken free from its previous downward trend and is currently in a consolidation phase, poised for its next developmental stage.

Notably, the MACD indicator’s DIF (Difference) and DEA (Signal) lines have undergone further compression, suggesting an ongoing adjustment in trigger timing to align with the prevailing market conditions, per crypto market analyst Derek’s post on January 5.

LUNC price analysis

At the time of writing, LUNC was trading at $0.000131, reflecting a decline of 7.69% in the last 24 hours, contrary to losses of -8.63% over the preceding week and contrary to a decrease of -35.55% in the past 30 days.

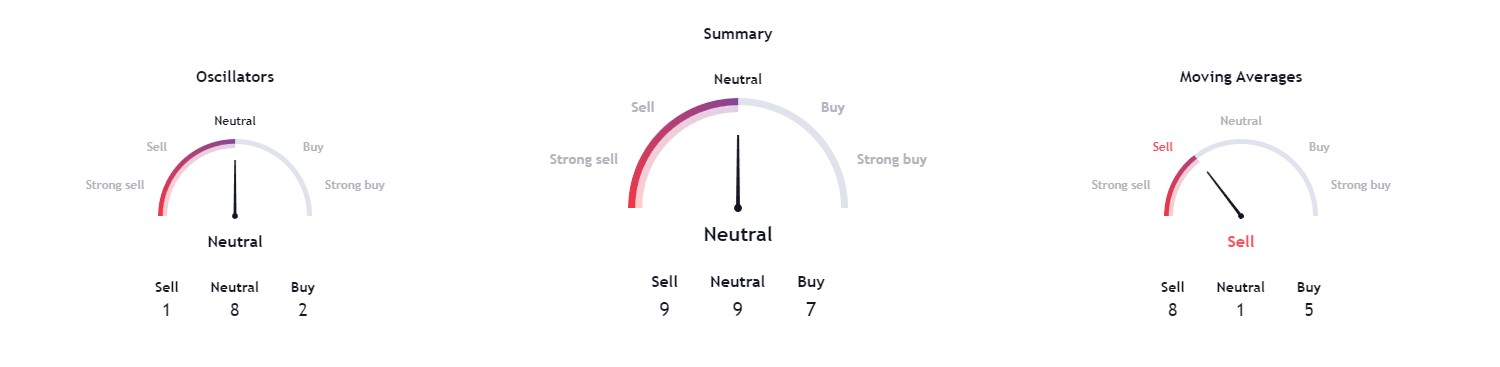

Simultaneously, the technical indicators on TradingView for Terra Classic reflect a sentiment characterized as neutral. A consolidated assessment of these indicators assigns a rating of ‘neutral’ at 9, with moving averages signaling a ‘sell’ at 8. Oscillators are leaning towards a ‘neutral’ rating, recording at 8.

Various elements, including overarching trends in the cryptocurrency market, burning events, and investor support, represent potential influencers that could impact the price trajectory of LUNC in the upcoming days and months.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com