- Cosmos price has broken out from a descending trendline, hinting at a possible rally north.

- ATOM could make one retest above the trendline before a possible 45% run to $17.19.

- The bullish thesis will be invalidated if the price breaks and closes below the $8.40 level.

Cosmos (ATOM) price is trading with a bullish bias, which has seen the cryptocurrency vindicate itself from underneath the confines of a descending trendline. This is a bullish sign, hinting at a strong rally depending on how bulls play their hand.

Cosmos eyes a possible 45% run

Cosmos (ATOM) price could rally 45% to the $17.19 resistance level after breaking out from a descending trendline.

Based on the outlook of the Relative Strength Index (RSI), momentum is still rising, which coupled with the green histogram bars of the Awesome Oscillator (AO) indicator in the positive territory, indicative of the presence of the bulls in the ATOM market, increases the odds for an extension north.

Increased buying pressure could see Cosmos price overcome the immediate barrier at $13.16, possibly flipping it into a support floor before spring boarding above it to the forecasted target. In a highly bullish case, the gains could stretch an arm higher, clearing the $17.90 to tag the $20.00 psychological level, which was last tested in May 2022.

ATOM/USDT 1-week chart

On-chain metrics underpin Cosmos price bullish outlook

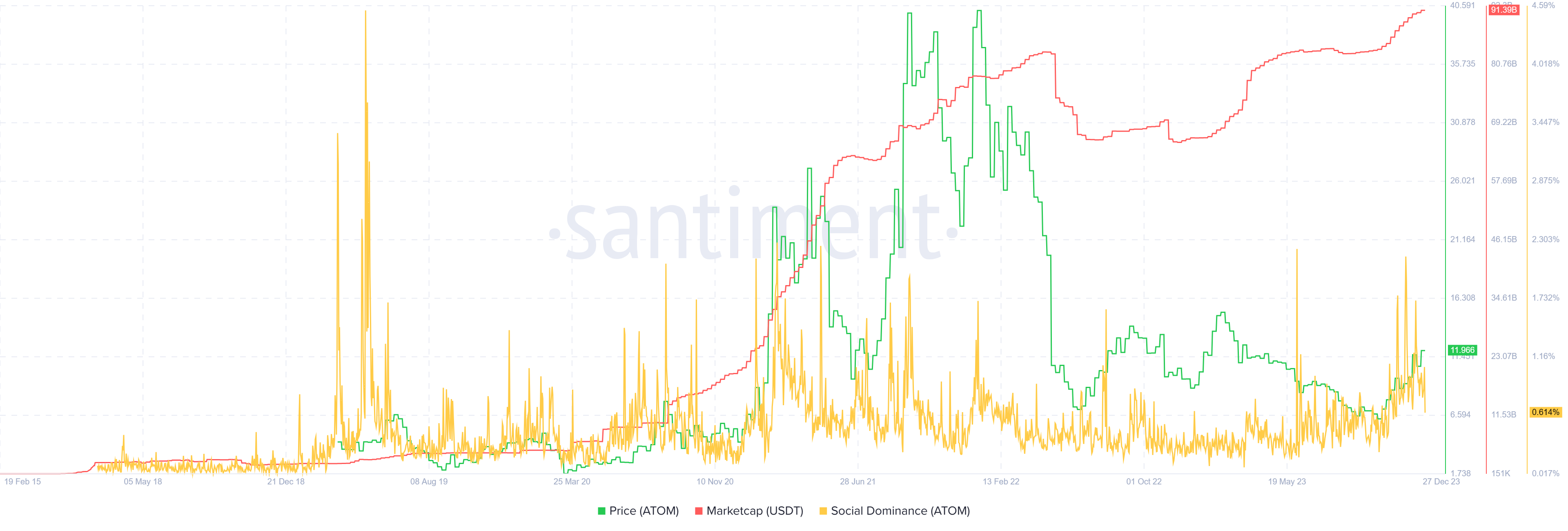

Santiment’s Tether (USDT) market capitalization metric is rising, recording 91.39 billion at press time, which points to fresh capital flowing into the ATOM market.

Additionally, the social dominance metric is also registering a significant climb, moving from 0.24% to 0.61% at the time of writing. With the metric indicating a steady rise in the number of ATOM mentions on crypto-related social media, it adds credence to the bullish thesis.

ATOM Santiment: USDT market capitalization, social dominance

On the flip side, if the $13.16 barrier holds as a resistance, Cosmos price could face a rejection, sending ATOM market value under the descending trendline. While losing the $10.00 psychological level would be concerning, the bullish outlook would only be invalidated once the price records a weekly candlestick close under the $8.40 level. This would constitute a 30% drop below current levels.

fxstreet.com

fxstreet.com