VET, the coin that powers the smart contract blockchain VeChain, has seen remarkable growth in the last week, pushing its price to a new yearly high of $0.38.

According to data from CoinMarketCap, in the last week, the altcoin’s price rallied by 12%. During the same period, its market capitalization rose from $2.41 billion to $2.69 billion, causing it to replace Cronos (CRO) as the 35th largest crypto asset in terms of market cap.

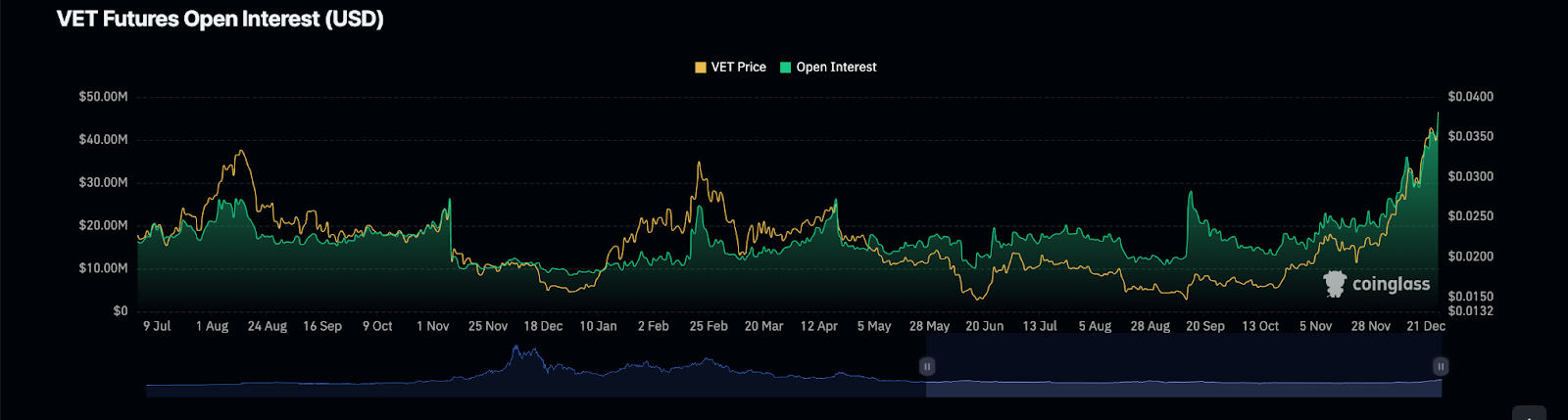

VET Logs Rise in Open Interest

In the coin’s futures market, open interest has risen steadily since December 1. At $46.05 million, VET’s futures open interest was spotted at a high last observed in April 2022, data from Coinglass showed.

For context, the coin’s open interest was less than $20 million when the month started, showing that it has grown by 142% in the past 25 days.

When an asset’s open interest grows in this manner, it means that the market is seeing more participants who are opening up more trading positions.

VET’s funding rates across exchanges have remained positive during the same period. This showed that most traders who have since opened trading positions have placed their bets in favor of a price rally.

No Cause to Worry

VET’s price movements observed on the 24-hour chart showed the presence of significant bullish sentiment, which could help sustain the price growth.

The first indication of this was the 50-day moving average, which has been positioned above the 200-day moving average after initiating a golden cross in November. When this crossover occurs, it means that there is an increase in buying pressure and positive momentum in the market.

Also, key momentum indicators have trended upward since 11 December, showing that coin accumulation has surged. At press time, VET’s Relative Strength Index (RSI) was 70.81, while its Money Flow Index (MFI) was 88.04.

At these values, these indicators showed that VET accumulation significantly exceeded distribution.

However, it is key to note that these RSI and MFI values hint at the possibility of a price correction. Buyers’ exhaustion is common at these high levels, so caution is advised.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com