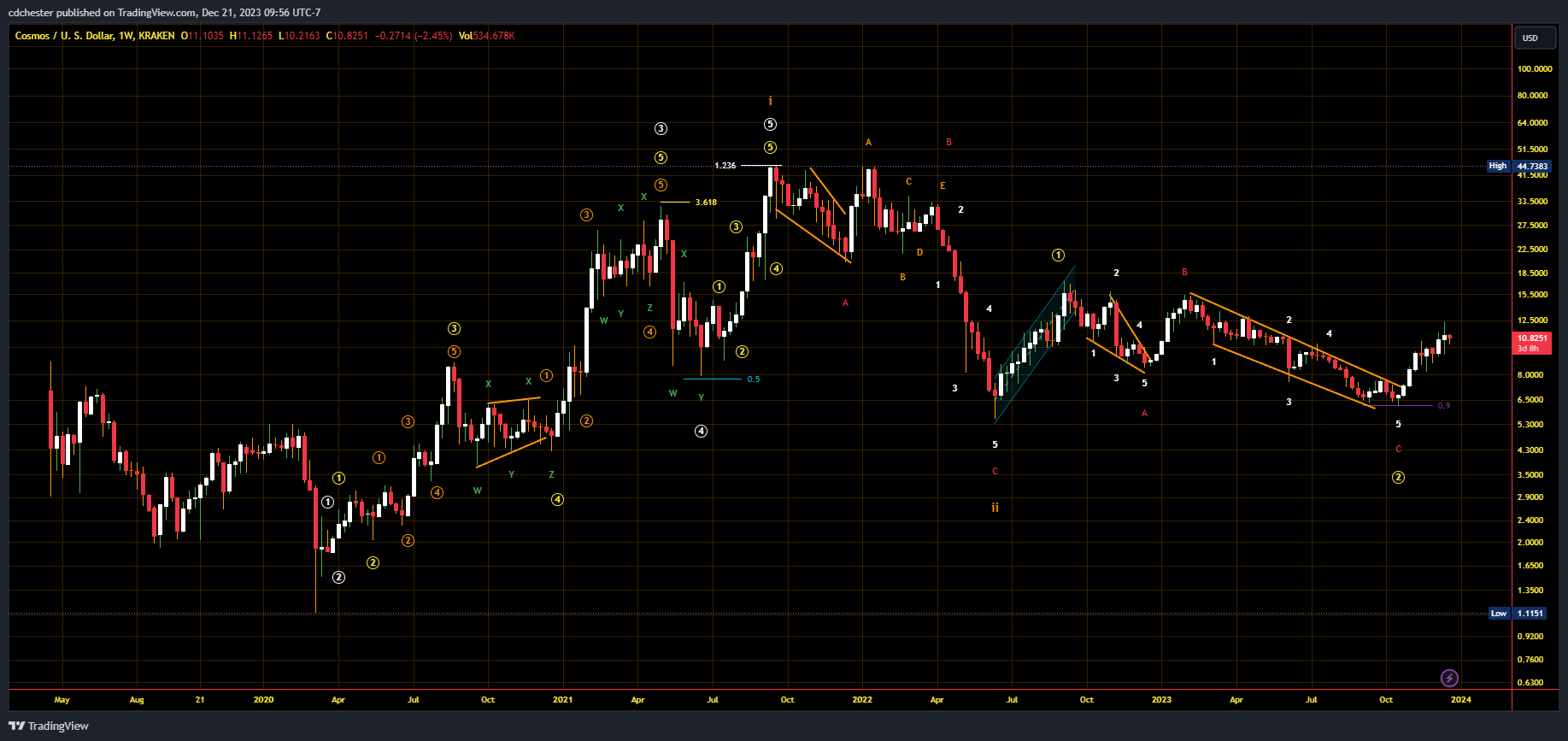

Cosmos ($ATOM) is the coin that powers the entire Cosmos ecosystem. It consists of a variety of projects from different spheres such as finance, decentralized exchanges (DEX), and cloud computing. The earliest price data I can find for $ATOM is from Kraken, starting in April 2019. Using this price data, the remainder of the article represents my best efforts to apply Elliott Wave Theory (EWT) to isolate its placement in market structures. I will assume that you have some knowledge of EWT to understand the terms, but I have also included a small glossary at the bottom for reference.

EWT Summary

Cosmos Price Data from Kraken | Source: ATOMUSD on tradingview.com.

Exploring Further

EWT uses ratios to create price targets. The main target being the 1.618 LFE, however there are the minimum, lower, and much higher LFE’s to watch out for. For $ATOM we first need to find the beta multiple to scale the targets off of. This is accomplished by taking Wave 1 and dividing it by Wave 0. In this case for the Cycle Wave Degree it’s approximately 40.12. Then we raise this multiple to various numbers defined by EWT to create a table of targets. In order below are the LFE Price Targets:

0.618 – $54.26

1 – $222.3

1.236 – $531.3

1.618 – $2,176.84

If we are looking for the typical price box then it’s: $531.3 – $2,176.84.

However, due to the nature of the next estimated bull run only the Intermediate Degree Wave 3 of the Cycle Wave 3 should play out. The next bull run is estimated by many traders and institutions to peak around late 2024 to early 2026. Benner Cycle Theory also puts a market peak around 2026. You can see the full layout for Benner’s Cycle Theory here. As such, the Intermediate Wave 1 and 2 are: $17.2656 and $6.17. The beta multiple for the Intermediate Degree is approximately 3.116. Then as we did for the Cycle Wave Degree the relevant typical price box is: $25.14 – $38.81. The higher price boxes are all above the ATH for $ATOM. The current price action for $ATOM is overwhelmingly bullish, so the higher price boxes are definitely a possibility.

Conclusion

Given the next bull run peak for crypto is likely late 2024 to early 2026 the relevant LFEs to use for $ATOM are at the Intermediate Wave Degree . The typical price targets for the Intermediate Degree Wave 3 are $25.14 – $38.81. The price as I write is $11.3 so the next peak is a rough 2 to 3.5x from here. If the Wave 3 is heavily extended and possibly goes to the 2.618 or 3.618 LFE then a new ATH is possible. That would mean a minimum of a 4x from here to the next peak. The Primary Wave 1 of Cycle Wave 3 is likely due in late 2026 to 2030 using Fibonacci Time Ratios.

Glossary

Elliott Wave Theory (EWT)

“A theory in technical analysis that attributes wave-like price patterns, identified at various scales, to trader psychology and investor sentiment.”

Source: “Elliott Wave Theory: What It Is and How to Use It” by James Chen (2023)

Logarithmic Fibonacci Retracement (LFR)

A measured correction at certain Fibonacci ratios on a semi-log scale.

Logarithmic Fibonacci Extensions (LFE)

A measured rally at certain Fibonacci ratios on a semi-log scale.

Supplemental Reading

“Elliott Wave Principle – Key To Market Behavior” by Frost & Prechter (2022)

“Visual Guide to Elliott Wave Trading” by Gorman & Kennedy (2013)

“How to Calculate Logarithmic Retracements and Extensions” by C. D. Chester (2023)

newsbtc.com

newsbtc.com