Crypto derivatives volume surged, leaving some unbalances behind, which could trigger liquidation events. On that, some cryptocurrencies have seen increased short positions that, if liquidated, would cause a short squeeze.

In the meantime, the cryptocurrency market’s total capitalization has reached a 10-day high of $1.614 trillion, up 1.5% on the day. If the crypto total market cap breaks this month’s highs, high-shorted coins will likely experience short squeezes.

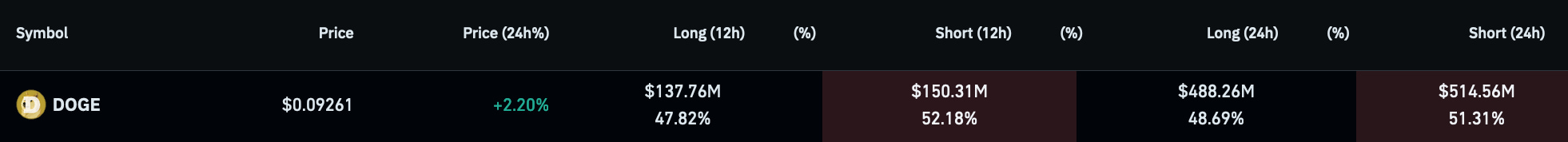

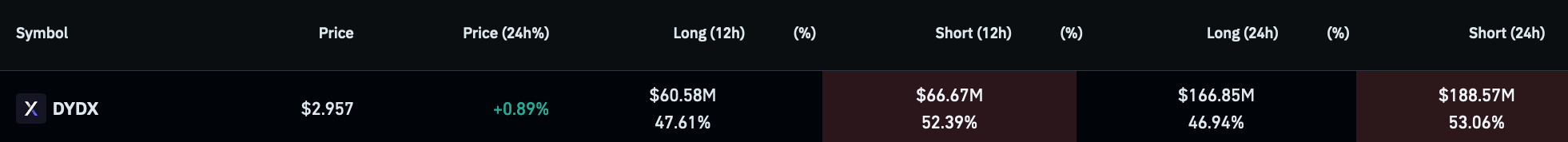

Finbold then retrieved open interest data in the last 12 and 24 hours from CoinGlass’s long/short ratio dashboard. In particular, we spotted Dogecoin (DOGE) and dYdX (DYDX) as two cryptocurrencies with increased short over the long positions.

Short squeeze alert for Dogecoin (DOGE)

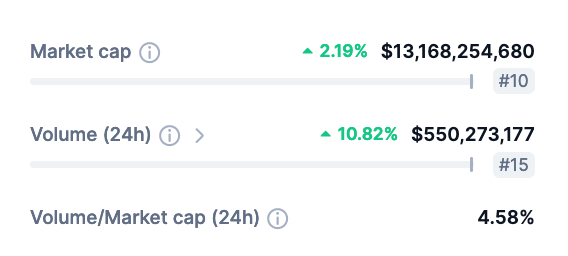

As for DOGE, the leading memecoin is trading at $0.0926 by press time, up 2.2% in the last 24 hours. Notably, Dogecoin has $514.56 million in the 24-hour opened short positions, corresponding to 51.31% of its daily open interest.

This massive U.S. Dollar worth corresponds to almost the same 24-hour spot exchange volume of $550.27 million. Therefore, a short-squeeze liquidation event could have a relevant impact on DOGE’s price.

DYDX is being shorted on December 21

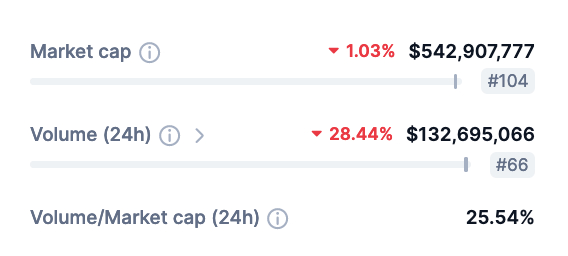

Meanwhile, DYDX has seen $188.57 million (53.06%) in shorts opened on December 21, trading at $2.957.

Interestingly, the decentralized exchange token has only $132.69 million in 24-hour volume. This means a larger amount of short positions for what is currently trading on multiple markets, according to CoinMarketCap.

However, a short squeeze still needs a market pivot from bearish to bullish in order to happen. DYDX has been through meaningful changes and token migration in the past few days, also experiencing a massive token unlock for over 80% of its circulating supply. Such an inflation could have impacted cryptocurrency investors’ perception of the digital asset’s value.

All things considered, there are no guarantees that such an event will happen with these cryptocurrencies. Traders must do their own research and consider complimentary data to make profitable financial decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com