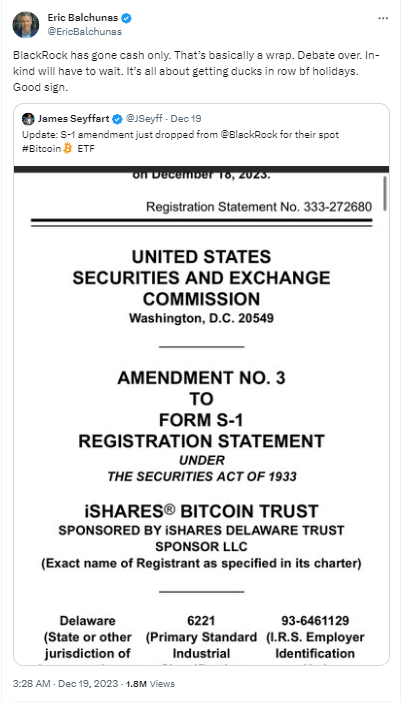

Cryptocurrency enthusiasts eagerly await the approval of a Bitcoin Exchange-Traded Fund (ETF), with discussions among major players intensifying. BlackRock, Nasdaq, and the SEC are at the forefront of these deliberations, aiming to meet federal criteria for Bitcoin price tracking in fund shares. BlackRock, in particular, made significant revisions to its ETF application, opting for a cash-creation methodology for new shares, aligning with industry rivals like ARK Invest and 21Shares.

According to a CNN report, BlackRock’s revised approach raised eyebrows, choosing cash over the traditional “in-kind” method. This shift, though less tax-efficient, mirrors the strategies of other ETF applicants. The looming January 10 deadline adds urgency to the discussion, with Bitcoin ETFs currently on hold.

SEC Concerns and Industry Responses

The SEC, cautious about in-kind redemptions, raised broker-dealer balance sheet concerns, pushing BlackRock to explore alternatives. Despite presenting an alternate in-kind approach in November, regulatory worries persisted, leading to an impasse. Bloomberg ETF analyst Eric Balchunas indicates a standstill, emphasizing patience.

Recent developments, including the SEC’s court defeat against Grayscale, forced a reevaluation of the agency’s stance on spot Bitcoin ETFs. Coinbase, as custodian under BlackRock’s cash model, retains real Bitcoin, offering direct exposure to investors. Balchunas anticipates the approval of multiple ETF applications, signaling a potential shift in the regulatory landscape.

Snap Source | x (Formerly Twitter)

Bloomberg Analyst Weighs in On the ETF Approvals

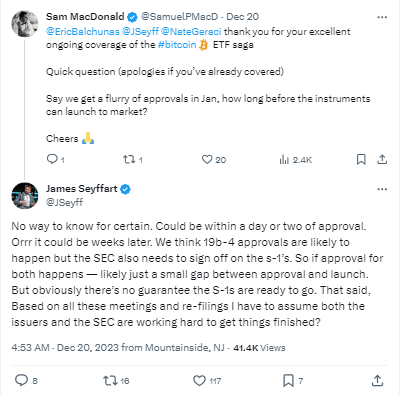

The anticipation surrounding Bitcoin spot ETFs has increased curiosity among Crypto X members, seeking insights into the approval timetable. James Seyffart, a Bloomberg ETF analyst, emphasizes the indispensability of 19b-4 and S-1 registrations for comprehensive consideration in the approval race.

Seyffart anticipates a swift clearance process, estimating a day or two for online trading post 19b-4 approval. While uncertainty looms over the readiness of S-1 files, ongoing conversations between applicants and SEC authorities indicate progress. Meetings with industry giants like Hashdex and BlackRock this week fuel Seyffart’s confidence in resolving technicalities swiftly.

Snap Source | X (Formerly Twitter)

The prolonged demand for a spot Bitcoin ETF in the US, spanning over a decade, positions its potential approval as a pivotal moment for the cryptocurrency market. Notably, the ETF offers institutional investors a streamlined way to participate in Bitcoin, potentially injecting over $100 billion into the market, a force capable of significantly impacting prices.

The ongoing discussions on Bitcoin ETF listing terms, regulatory shifts, and the approval timetable underscore the dynamic nature of the cryptocurrency landscape. As industry players navigate regulatory concerns, the potential approval of a Bitcoin ETF remains a transformative event with far-reaching implications for market participants.

cryptonews.net

cryptonews.net