- 1 The Synthetic network is built on the Ethereum blockchain with synthetic assets.

- 2 The bulls have maintained a grip on the SNX coin price for 2 months.

- 3 The EMAs are far away from the price creating a possible risk of correction.

Synthetix is a protocol built on the Ethereum blockchain that allows for the creation of synthetic assets. These synthetic assets, called “Synths,” are ERC-20 smart contracts that track the performance of an underlying asset, without the need to own the actual asset. Synths can be traded on Kwenta, Synthetix’s decentralized exchange (DEX), and include cryptocurrencies, indexes, inverses, and real-world assets such as gold.

How Does the Synthetix Network Work

The Synthetix Network token (SNX) is used as collateral to issue Synths. Decentralized oracles, which are smart contract-based price discovery protocols, are used to track the prices of the underlying assets that Synths represent.

It allows investors to trade Synths as if they were holding the actual underlying assets, providing exposure to assets that are normally inaccessible to the average investor, like gold and silver, in a quick and efficient manner.

It’s important to note that Synths differ from tokenized commodities, such as Paxos’ PAX Gold (PAXG), which are backed by physical gold bars.

Owning PAXG means that the investor owns the underlying gold and that Paxos holds it for them. In contrast, owning Synthetix’s sXAU only provides exposure to the price of gold, without actual ownership of the underlying asset.

Technical Analysis and Prediction of the SNX Coin Price

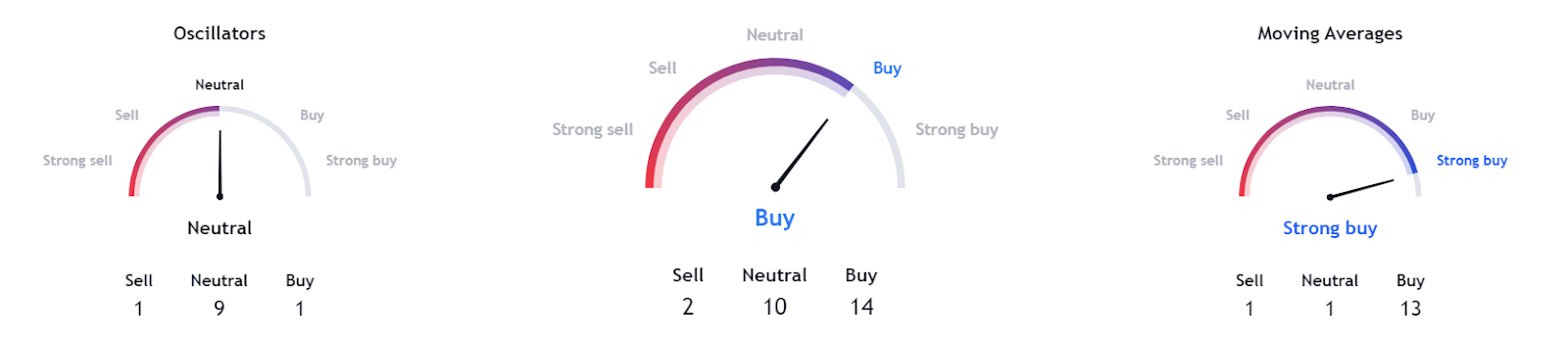

The SNX coin price is rising significantly and it may perform exceptionally well over the next few months. The price of SNX has shown an upward trend by forming higher highs. The bulls have successfully broken the major resistance level of $3.26.

It has resulted in a bullish rally and hitting the year-to-date high, indicating the strength of the bulls. The buying volume has also increased, indicating that some genuine buyers and crypto whales might have taken long positions.

Bullish Sentiment Bearish Sentiment

As a result of this bullish sentiment in the SNX coin, the SNX price has gone far away from the 50-day and 200-day EMAs. Therefore, a minor selloff may trigger at any time from higher levels. The demand zone is at the level of $3.95 and $3.26. Meanwhile, the supply zones are based at $4.306 and $6.16.

However, the bulls can also take support at the 50-day EMA if the bears get a hold of it. In addition to this, the chart pattern of this coin looks highly bullish and no signs of weakness are visible. If the price retraces downward, the investors can have an opportunity to buy on dips.

Conclusion

Synthetix is a protocol on Ethereum that creates synthetic assets called Synths using SNX as collateral. Due to bullish sentiment, the SNX price is far from 50-day and 200-day EMAs, and a minor selloff may occur from higher levels.

Technical Levels

- Support Levels: $3.95 and $3.26

- Resistance Levels: $4.306 $6.16

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading in stocks, cryptos or related indexes comes with a risk of financial loss

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

thecoinrepublic.com

thecoinrepublic.com