As the year comes to an end, investors and traders are in search of cryptocurrencies that show promising potential. With the next bull cycle expected to start any time between 2024 and 2025, Woo Network (WOO), COTI, Uniswap (UNI), Polygon (MATIC), Band Protocol (BAND), and Vechain (VET) seem to be positioning themselves to maximize their returns in 2024.

All of these altcoins managed to break above key resistance levels on their respective charts over the past three weeks. Furthermore, the price levels on their weekly charts suggest that they have either cleared or are in the process of clearing, a path for their prices to continue to rise in the first quarter of 2024.

WOO Network (WOO)

WOO token’s adoption has been boosted by large investments, including a $12 million backing from Binance Labs. Partnerships with OpenTrade and BITHUMB have also succeeded in expanding the token’s utility, attracting more users. The burn of over 705 million WOO tokens throughout 2023 and collaborations with liquidity providers like Wintermute have strengthened WOO’s value and liquidity as well.

The past week has seen WOO overcome two major resistance levels. In the last 7 days, the cryptocurrency broke above $0.30 and $0.37. However, it has pulled back slightly to retest the $0.37 mark at press time. Should the cryptocurrency close this week’s candle above $0.37, it may continue to rise to $0.46 in the first quarter of 2024.

Conversely, a weekly candle close below $0.37 may lead to a temporary correction. In this more bearish scenario, WOO could fall to $0.30 and possibly reach $0.2390 if the selling pressure persists.

Nevertheless, a long-term positive price channel has emerged on the cryptocurrency chart. Therefore, a correction in the coming weeks may just be a liquidity-building move before another leg up.

COTI (COTI)

COTI announced its plans for a V2 upgrade with the intention of establishing itself as a privacy-focused Ethereum layer-2 solution. So far, COTI plans for their devnet release to take place in Q2 of 2024. It seems like the main priority of the upgrade will be to enhance privacy in the Web3 ecosystem, while still being transparent.

Introducing COTI V2: a Privacy-Centric Ethereum L2

— COTI Foundation (@COTInetwork) December 13, 2023

In the biggest upgrade of our infrastructure to date, we're building an Ethereum L2 and using a new technology that’s 10x faster + lighter than ZK solutions.

Details on how to get involved at the end of the thread👇

🧵

[1/13] pic.twitter.com/jqYYYKKsxD![]()

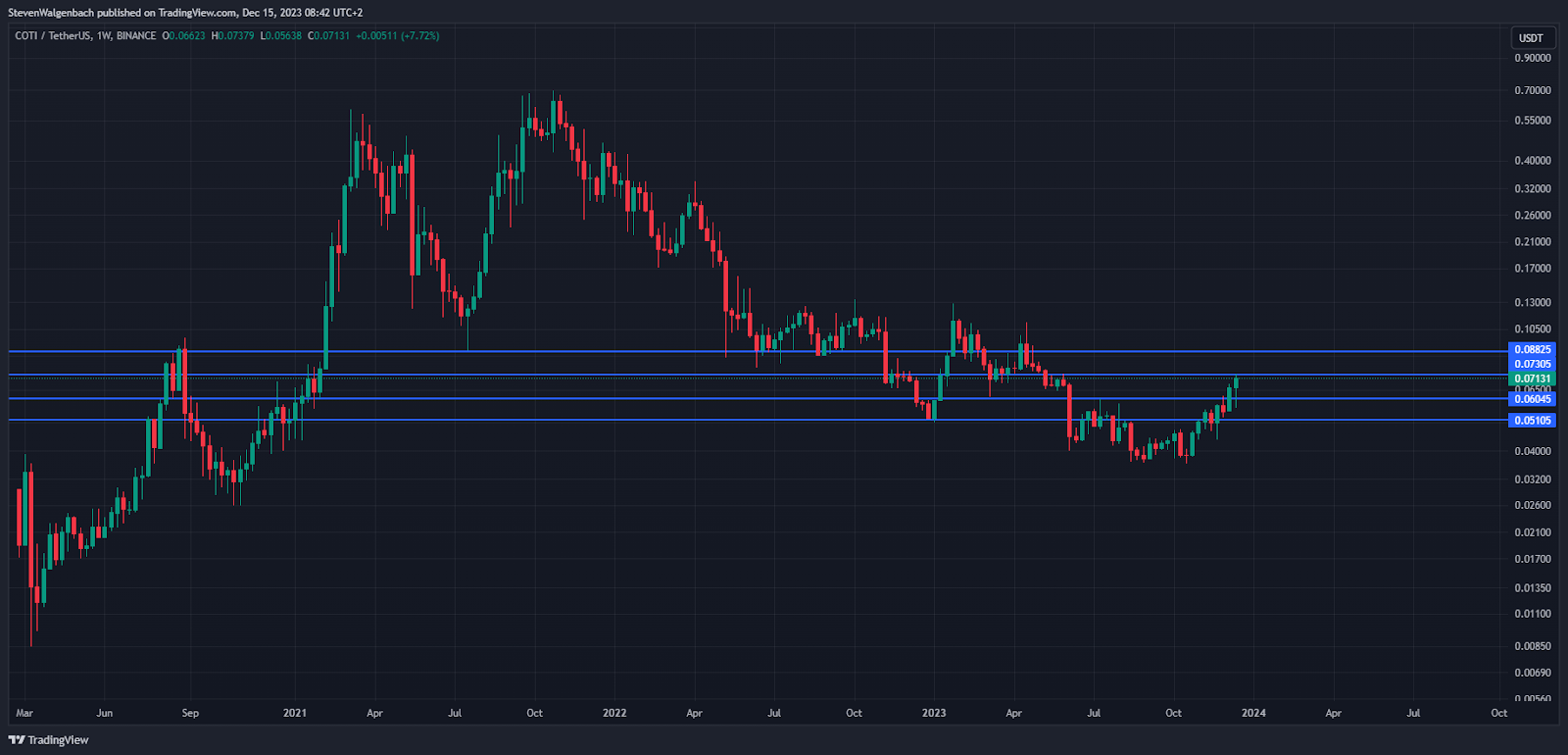

COTI was attempting to flip the resistance level at $0.07305 into support. Should the cryptocurrency close this week’s candle above this price point, it may have the foundation needed to continue rising in the following few weeks. This could lead to the altcoin soaring to as high as $0.08825.

However, a rejection from the $0.07305 resistance level this week may open up the risk of COTI’s price undergoing a correction to the immediate support level. This may result in the altcoin falling to $0.06045 in the next few weeks. Continued sell pressure may then force the cryptocurrency’s value down to as low as $0.05105 towards the first quarter of 2024.

Uniswap (UNI)

The month of November was a good month in general for the cryptocurrency market. However, a few tokens stood out above the rest in terms of gains, and one of these tokens was UNI. UNI was ranked as the third-highest gainer in November after its price surged by over 43%.

Uniswap also generated at least $1 million from its new fee structure in November. The average income from commission per day was about $44,000.

UNI has been in a consolidation phase between $6.060 and $6.715 over the past 3 weeks. It attempted to break out of this range last week, but bears were quick to bring the altcoin’s price back down to within the channel.

There is a significant amount of buy pressure for UNI, as evident by the wick underneath this week’s candle. This suggests that traders may soon attempt to force the altcoin’s price above the $6.715 barrier. A weekly candle close above this threshold may open up an opportunity for UNI to rise to $8.035 in the following few weeks.

This bullish thesis may not validate if UNI closes a weekly candle below $6.060. In this scenario, UNI may fall to $5.445 in the medium term.

Polygon (MATIC)

Chainlink has made its data feeds available to developers using Polygon’s Layer-2 zero-knowledge rollup. This functionality is set to unlock the deployment of several significant DeFi protocols on Polygon zkEVM early in 2024.

Chainlink Data Feeds are now live on @0xPolygon zkEVM.

— Chainlink (@chainlink) December 14, 2023

Polygon zkEVM developers can now securely build advanced #DeFi apps that combine reliable price data with lightning-fast execution.

Dive in ⬇️https://t.co/wHA0RKR5Kv![]()

Similar to UNI, a wick underneath this week’s candle signaled the presence of strong buy pressure for MATIC. If this bullish pressure continues, MATIC may be able to break above $0.9540 in the next three weeks. This may then give the altcoin the support needed to continue rising toward $1.0685 in the medium term.

Traders and investors will want to note, however, that MATIC broke below the $0.8335 support earlier this week. As a result, there is the possibility that MATIC will close this week’s candle below this mark. This could then invalidate the bullish thesis and may lead to MATIC undergoing a strong correction to $0.7190 in the following couple of weeks.

Band Protocol (BAND)

At the start of December, Band Protocol announced its intention to establish an integration with the XRP Ledger (XRPL). This strategic decision positions Band Protocol as the primary oracle provider for both XRPL’s mainnet and its Ethereum Virtual Machine (EVM) sidechain.

1/🚀Band Protocol proudly announces its upcoming integration as the primary oracle provider for #XRPLedger mainnet & EVM side-chain, marking a monumental advancement in the #XRPL's decentralized evolution!

— Band Protocol (@BandProtocol) December 1, 2023

👉Details: https://t.co/r7rRpVrPZP

🧵Discover the impact below👇

.$BAND pic.twitter.com/27zJlxZwjP![]()

BAND was resting on the key support level at $1.690 after it was rejected from the $1.928 resistance earlier this week. If the cryptocurrency can close this week’s candle above $1.690, traders may identify this as a swing long trade entry. The potential buy volume could subsequently elevate BAND to $2.170 in the following few weeks.

This bullish thesis will likely be invalidated if BAND closes this week’s candle below $1.690. In this bearish scenario, the cryptocurrency’s value could be at risk of dropping to $1.490.

VeChain (VET)

VET was able to surpass 900K holders earlier in December, which was a more than 50% gain since October. In fact, 57,000 holders were added in a single week, suggesting that VET has caught the attention of traders as they are actively accumulating the altcoin.

VET has been in a positive sequence over the past 3 weeks. This bullish move resulted in the altcoin flipping the resistance levels at $0.02245 and $0.02540 into support. At press time, it seemed as if the cryptocurrency was on track to flip the barrier at $0.02395 into support as well.

A weekly candle close above this threshold this week may clear a path for VET to continue ascending into the new year. This may lead to it rising to as high as $0.03495 in the coming few weeks.

On the other hand, closing this week’s candle below $0.02935 may trigger a wave of profit-taking by traders. The potential sell volume may pull VET down to the $0.02540 level in the medium term. In an extremely bearish scenario, VET could even revisit the aforementioned $0.02245 mark.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com