- Avalanche (AVAX) leads among cryptocurrencies with a 17% increase, while Helium (HNT) is up 42%.

- Bitcoin stabilizes at $44,000, driving interest in altcoins; analysts predict an imminent ‘altcoin season’.

The recent surge of growth in the cryptocurrency market has captured the attention of the financial world, marking a milestone in the evolution of digital assets. With Bitcoin leading this phenomenon with an impressive 15% increase in just 72 hours, its value stabilized around $44,000 on Wednesday. This rally has not only benefited Bitcoin, but has also fueled a significant boom in other cryptocurrencies, especially the so-called ‘altcoins’.

Among the biggest beneficiaries is Avalanche’s AVAX token, which posted a 17% increase on Wednesday, making it a leader among cryptocurrencies with a market value of more than $1 billion. This increase follows a near doubling of its price in November, demonstrating the robustness and growing appeal of these alternatives to Bitcoin.

Tradingview: AVAXUSD_2023-12-07_07-28-35

Avalanche (AVAX) has shown an impressive performance in the market, posting a 16.91% gain, trading at $26.65. This advance leads AVAX to increase its monthly earnings by more than 110%, with trading volume up 52%, reaching $1.1 billion.

The introduction of Ordinals in Avalanche has been a key factor in this trend

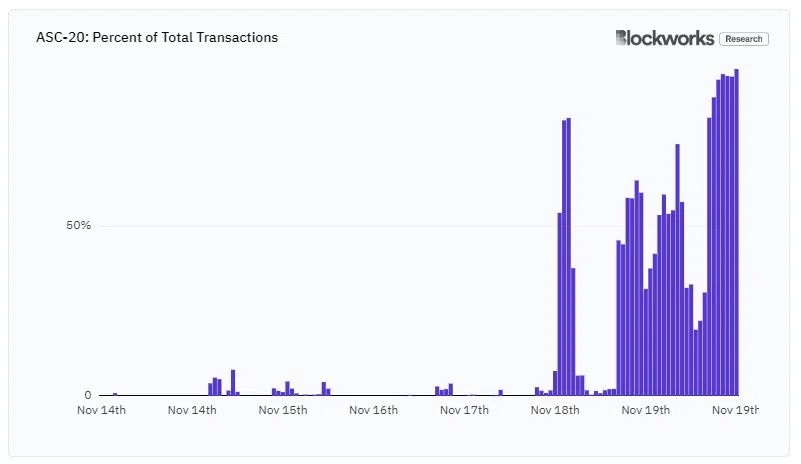

The adoption of Ordinals has played a key role, significantly increasing transaction volume. Recent data shows that the minting of Ordinals accounted for approximately 96% of total transactions in the last week, generating an increase in network fees and demand for AVAX.

Avalanche ordinals activity. Source: X/@smyyguy

In November, Layer-1 platforms like Avalanche posted a 167% month-over-month increase in transaction volume, reaching $2.73 billion.

Another major movement in the market is led by Helium, a crypto connectivity project that migrated from its own blockchain to Solana’s last year. Helium saw a 42% increase after announcing the launch of a cell phone plan in the U.S. with unlimited data, texts and calls for just $20 a month, a proposition that has resonated strongly with the market.

Tradingview: HNTUSD_2023-12-07_07-42-36

‘Memecoins’, such as dogecoin (DOGE), have also seen a rally, up 11% in the last 24 hours, surpassing $0.10 for the first time since April. This phenomenon highlights the interest and speculation around these less conventional digital assets.

Tradingview: DOGEUSDT_2023-12-07_07-45-18

Craig Erlam, senior analyst at OANDA, attributes this Bitcoin rally to the anticipation generated by the possible approval of a Bitcoin ETF, in addition to expectations of lower interest rates. However, Erlam emphasizes that the main driving force behind this rise is the anticipation of the ETF.

Source: X: Craig Erlam

It is suggested that with this, the onset of an ‘altcoins season’ could be approaching, a market cycle where a significant number of cryptoassets other than BTC show superior growth rates. Market share of altcoins has risen sharply since October, reaching 67% lastweek.

This view is shared by crypto analyst @Mags, who predicted parabolic growth in November. These predictions have been borne out with several altcoins reaching their highest valuations since November 2022, including Luna Classic (LUNC) and other coins such as Energi and Blur, which have reported impressive growth in the past week.

#Bitcoin is about to print the first ever Golden Cross on a weekly chart

Historically, $BTC has not broken below the 200 WMA in any bear market, except for this one.

Recommended for you

• Dogecoin’s Whale Moves: $13.3 Million Transferred Amid Price Surge• Ripple-Backed Inheriti to Launch on XRP Ledger: A Decentralized Inheritance Game-Changer• Everlodge The New Crypto That Reinventing The Real Estate Market Pumps 15x, Surges Past Pepe Coin and IOTAWe also witnessed the first ever D e a t h Cross back in Feb 2023.

Later, price reclaimed the 200 MA and is… pic.twitter.com/F9vmBpaRe2

— Mags (@thescalpingpro) December 7, 2023

So, the outlook offers a fascinating glimpse into a transforming financial future, where cryptocurrencies are positioning themselves as a disruptive and revolutionary force. The speed with which these digital currencies are gaining traction and value underscores the importance of considering cryptocurrencies as an integral part of modern investment strategies. However, it also raises questions about regulation, stability and security in this rapidly evolving market.

With the steady rise of cryptocurrencies and their increasing acceptance, 2023 is shaping up to be a key year for the consolidation of these digital currencies in the global financial landscape. The financial community and investors alike remain vigilant, waiting to see how this exciting and dynamic sector will develop in the coming months.