- 1 The BTC and USD pairs are above major EMAs.

- 2 In the last 24 hours, the long liquidations exceeded the short liquidation.

Chainlink is an ERC-20 token that runs on Ethereum, where developers can create their own tokens and use the Proof-of-Stake consensus method. This means that the nodes that validate the transactions are basically chosen based on the quantity of how many tokens they stake.

LINK/USD & LINK/BTC Weekly Chart Evaluation

The LINK/USD chart demonstrates that the price zoomed from March 2020 generating new peaks and valleys along the way and reaching an all-time high by May 2021. LINK experienced a remarkable 50x increase in price during the previous bull market.

However, it faced a sharp decline as investors took profits and settled at a support level of $15. It then rose again but met strong resistance at $32 and dropped significantly to a new support of $6. After consolidating for about 500 days, it gained momentum and reached $15 again.

Moreover, the chart shows that LINK/BTC achieved an all-time high and a 6x price growth during the last bull cycle from December 2019 to December 2020. However, the price fell as investors cashed out and found support at $0.00045. It then bounced back but faced a strong resistance at $0.00095 and plunged to a new support at $0.00022. After trading in a narrow range for a year, it regained momentum and reached $0.00045 again. Both the pairs displayed a comeback from the key levels after being in a tight range for a prolonged time.

The potential resistance for LINK/BTC is $0.00050 and $0.00060; and for LINK/USD the resistance levels are likely to be around $18 and $21. On the other hand, if the LINK/ USD drops below the immediate support of $12, then it could fall to $7 and LINK/BTC support levels could be $0.00035 and $0.00030.

The RSI demonstrates that in the latest run, the LINK crypto is still in a strong uptrend and has not reached the oversold zone yet. The curve has dipped slightly to 67 for LINK/USD and 63 for LINK/BTC, indicating that the buyers are still in control.

The LINK/USD pair is in a strong uptrend and above all major EMAs. However, the LINK/BTC pair shows a decline from 200-EMA but above major EMA. If the buyers’ pressure rises, the crypto might kickstart another rally and shatter hurdles.

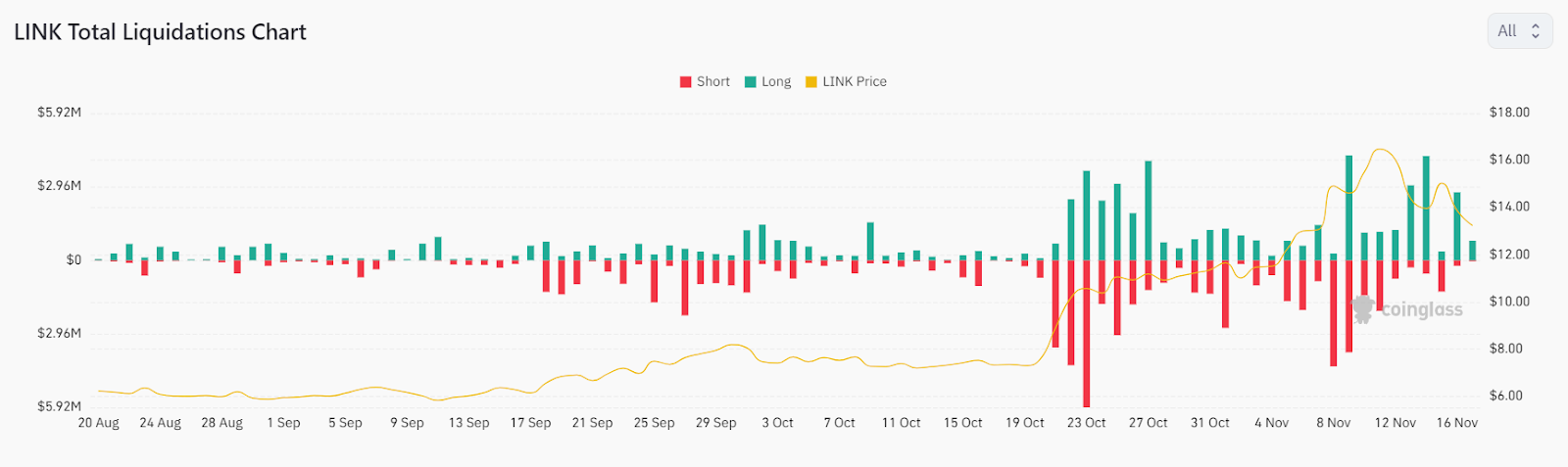

What the LINK Total Liquidations Chart Shows

Per the chart, there were some spikes in liquidations around from October 21st to November n 16th, which highlighted good performance.

In the last 24 hours, the long liquidations were $2.88 million (traders betting on a price surge) and short liquidations were $164.75K (traders betting on a price decrease).

Moreover, the LINK total liquidations chart demonstrates that the short liquidation is decreasing and the long liquidation is surging consistently, meaning that more traders are betting on a price surge.

This will increase the bullish pressure on Chainlink, which, when combined with the pressure to buy, could lead to an increase in price.

Summary

The price trends of LINK/USD and LINK/BTC pairs using the weekly charts, RSI, EMA’s, and total liquidation. This highlights that the crypto is bullish and could continue to surge higher.

Technical Levels

Support Levels: $12 and $7

Resistance Levels: $18 and $21

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com