Ordinals (ORDI) price rallied by more than 90% to hit a new 4-month peak of $10.40 on Tuesday, November 7. Will the Binance listing spark a prolonged ORDI price rally?

On Tuesday, crypto investors piled millions in fresh capital inflow on the Bitcoin Ordinals native ORDI token ahead of its listing on the Binance exchange. Here’s how the ORDI price could react in the days ahead.

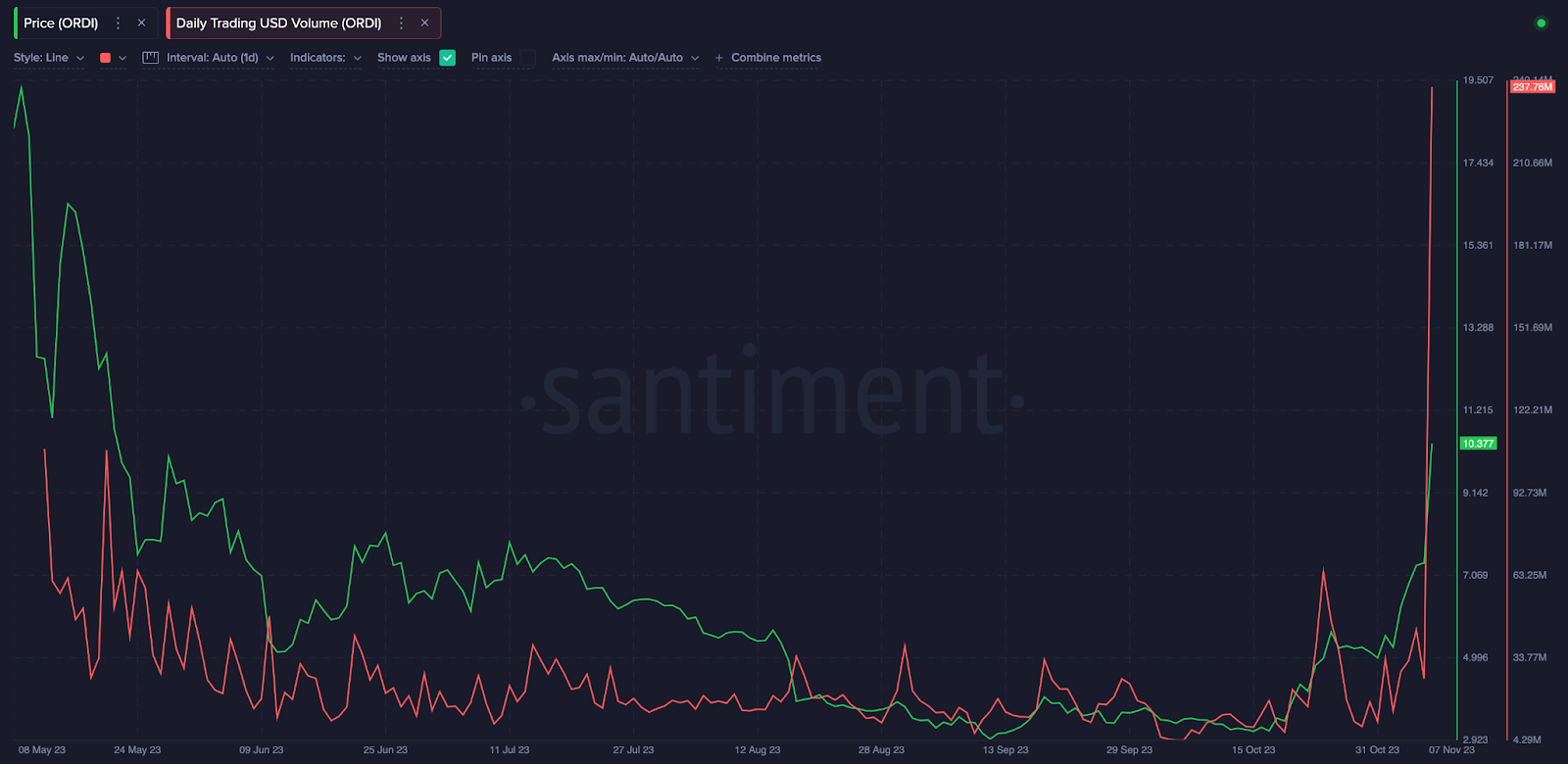

Binance Listing Sends ORDI Trading Volume to All-time High of $237 Million

Ordinals protocol allows users to store light-weight such as text, pictures, audio and video, etc. These inscriptions allow NFTs and other BRC-20 compatible file formats to be traded on the Bitcoin blockchain.

In a statement released today, Binance announced it would start offering spot trading pairs — ORDI/BTC, ORDI/USDT, and ORDI/TRY.

Meanwhile, withdrawal options for ORDI are billed to open at 6:30 a.m. UTC on November 8. The largest exchange in the world by trading volume also plans to list ORDI as a new borrowable asset with a new ORDI/USDT Isolated Margin pair.

Within 24 hours of the news, the ORDI price rose 71% from $7 to $11.90 — a new high since May. However, a closer look at on-chain data shows a clearer view of how investors piled fresh capital inflows into the market.

According to Santiment, ORDI’s Daily Trading Volume crossed the $235 million market, up from 26 million the previous day. This implies that ORDI’s trading volume has grown by over $200 million within the last 24 hours.

The Daily Trading Volume metric measures the dollar value of all trades and token transfers involving a particular digital asset on a given day. An increase in trading volume is a bullish signal. It indicates improved market liquidity and investor interest in the underlying asset.

However, the timing suggests that much of the capital inflows in the last few days could be from speculators’ front-running gains from the Binance listing. It remains to be seen if the new market entrants will stick around for the long haul.

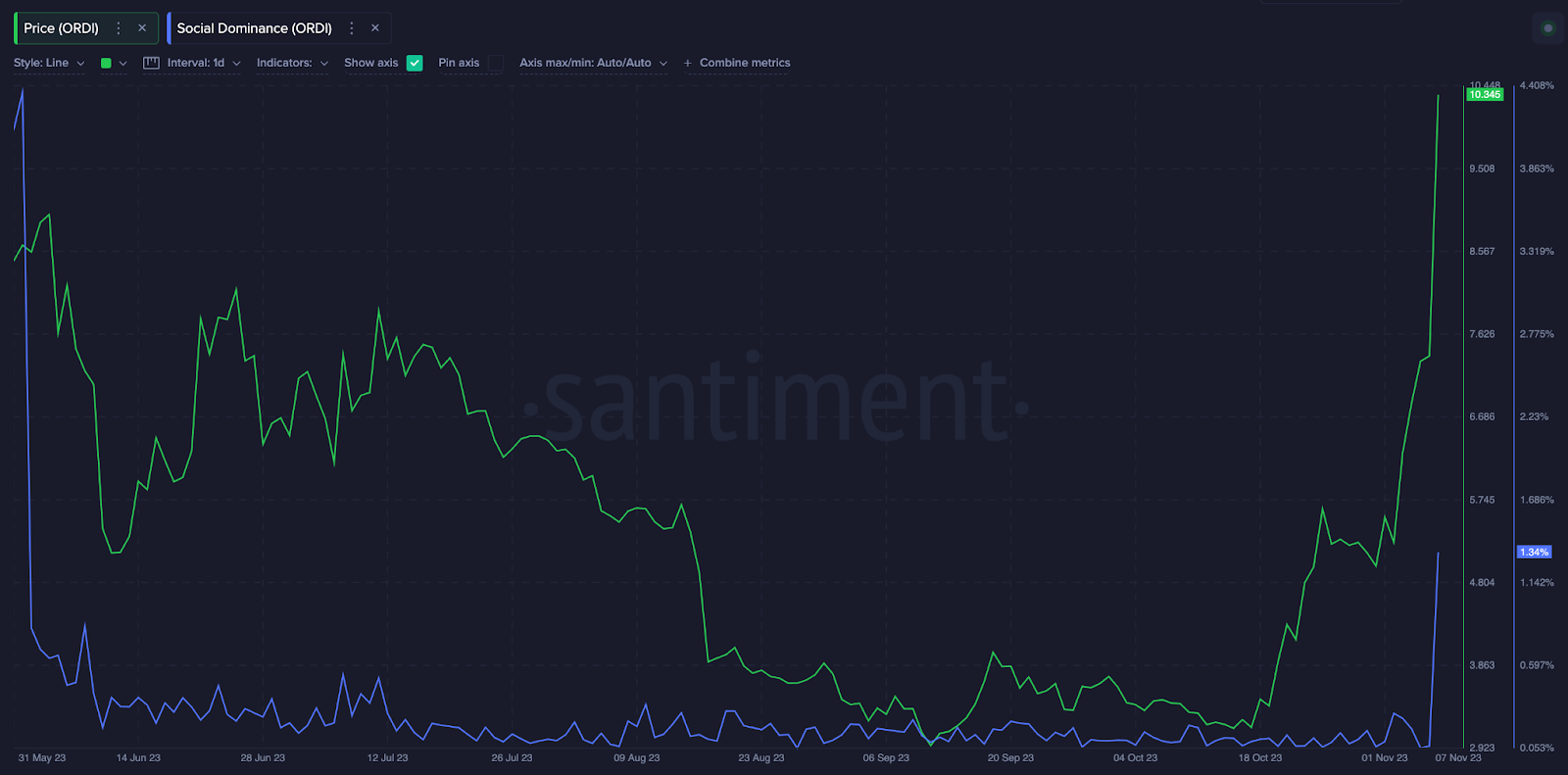

Social Media Hype Around Ordinals is Approaching Euphoric Peaks

Following the Binance listing, media mentions of Ordinals have gone through the roof. As seen in the Santiment chart below, ORDI Social Dominance hit a 4-month peak of 1.34% on November 7.

The Social Dominance metric represents the percentage share of media mentions a blockchain community pulls compared to the 50 most relevant crypto projects.

An increase in social dominance during a rally often indicates the market is approaching euphoric highs.

Considering ORDI’s Social Dominance has not been this high in 4 months, strategic investors could consider this perfect timing to exit and book profits. If this thesis holds, an ORDI price correction could be imminent.

ORDI Price Correction: Possible Retracement Toward $10

Before the Binance listing, the prevailing sentiment surrounding the Ordinals markets was predominantly bullish. However, the $200 million increase in Trading Volume in a single day puts the ORDI price at risk of major swings.

The Relative Strength Index (RSI) trending at 88.27 confirms that Ordinals is now trading in overbought territories. Hence, the next major price swing is increasingly likely to be downward.

The Parabolic SAR highlights that the $5.25 is a major potential reversal point. But given the bullish momentum in the broader crypto markets, the bulls will defend that area and see ORDI price consolidate around $7 rather than enter a prolonged down swing.

On the upside, the bulls could further extend their gains ORDI price can surpass the $15 mark. However, the bears will likely mount a significant resistance sell-wall around the $14.

But if the bulls can scale that historically significant sell zone, the price rally could edge closer to $15.

beincrypto.com

beincrypto.com