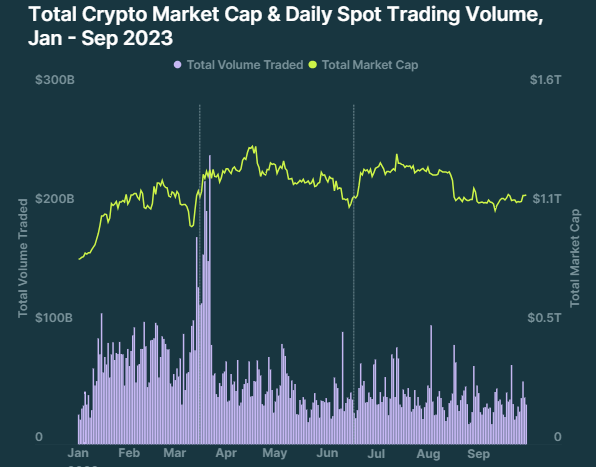

In the latest 2023 Q3 report by CoinGecko, the cryptocurrency market experienced significant fluctuations and setbacks, prompting both controlled and decentralized exchanges to grapple with a challenging quarter. The market encountered a sharp decline in mid-August, causing a split in the slow-paced quarter and subsequently leading to a decline in the total value of the market by 10%. Despite this, the market maintained a positive trajectory, boasting a 35% increase compared to the beginning of the year.

The unexpected plunge was triggered by Bitcoin’s staggering drop from approximately $29,000 to $26,000 in just a day, directly impacting the overall market value of cryptocurrencies, which plummeted from $1.2 trillion to $1.1 trillion. Amidst the market volatility, trading activities on regulated platforms witnessed a substantial 20.2% decline, pointing towards a significant slowdown in trader activities during the summer months.

Stablecoin Sector Faces Setbacks

The stablecoin sector encountered a decline of 3.8% in value, with several significant players experiencing setbacks. Tether (USDT), the largest stablecoin, managed to retain its market share, while other prominent stablecoins, such as USD Coin (USDC) and Binance USD (BUSD) suffered significant losses. However, TrueUSD (TUSD) emerged as an exception, marking a notable 12.8% increase in its market cap, distinguishing itself as the sole gainer among the top five stablecoins.

1/ Our recent report shows that the top 15 stablecoins fell -3.8% or $4.8 billion in market cap in 2023 Q3 and now sits at $121.3 billion.

— CoinGecko (@coingecko) October 26, 2023

Tether’s $USDT market cap remained flat in 2023 Q3; however it saw a 2.6% gain in stablecoin market share. pic.twitter.com/wMGNjdj28k

The report highlights the exponential growth of tokenized T-bills, with a cumulative worth of $665 million, making them a significant contributor to on-chain Real World Asset (RWA) assets. The popularity of tokenized US government bills underscored the increasing reliance on traditional banking systems, with Franklin Templeton dominating the market share, closely followed by Ondo Finance.

NFT Market Sees Decline in Trading Volume

In contrast, the NFT sector witnessed a staggering 55.6% decline in trade volume, indicating a waning interest in NFTs across various chains. Despite Ethereum’s continued dominance in the NFT market, the report suggests a modest increase in Bitcoin’s presence. ImmutableX NFTs, bolstered by the release of the trading card game Gods Unchained, experienced a surge in market share, positioning itself as a notable player in the NFT ecosystem.

The cryptocurrency exchange landscape faced challenges, with the total number of spot trades declining across controlled and decentralized platforms. Binance, a major industry player, grappled with mounting regulatory pressures, leading to a significant drop in its market share from 66% in February to 44% in September. Meanwhile, decentralized exchanges experienced a substantial 31.2% decrease in spot trades, resulting in Sushi, a famous DEX, falling out of the top 10 cryptocurrencies.