Render (RNDR) has been consistently registering notable gains with small losses over the past 60 days while the market has been affected by different factors.

RNDR is up by 3.65% in the past 24 hours and is trading at $1.79 at the time of writing. The asset’s market capitalization rose to roughly $665 million while its 24-hour trading volume has plunged by 9.5%, declining to $36.8 million.

Render’s surge came while the marketwide bullish momentum has been fading away. One of the most important bearish factors is the Israel-Palestine war.

You might also like: Crypto might fluctuate due to Israel-Palestine war, analyst says

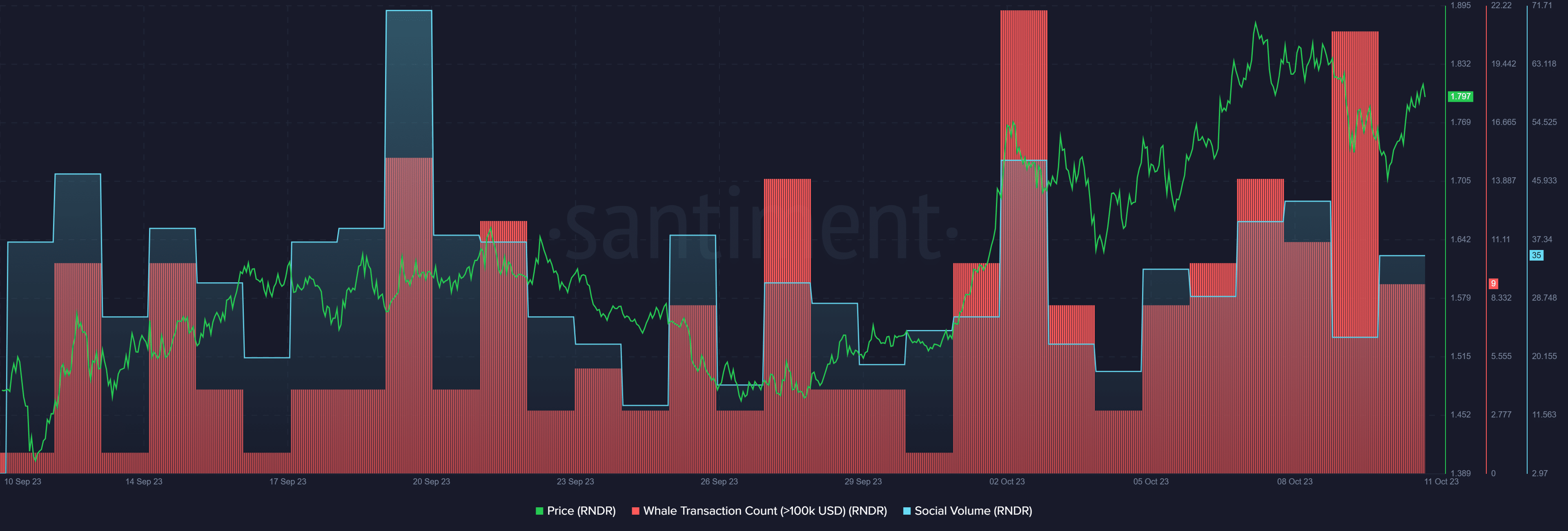

According to data provided by the market intelligence platform Santiment, RNDR’s social volume surged by around 50% over the past day. The hike comes while the asset’s social activity registered a 45% decline on Oct. 9.

On the other hand, per Santiment, the number of whale transactions consisting of at least $100,000 worth of RNDR plunged by 57% over the past 24 hours — falling from 21 transactions on Oct. 10 to only nine at the time of writing. This suggests that smaller investors rather than whales might have triggered the recent uptrend.

Despite the drop in the number of whale transactions, Santiment data still shows a possibility of further incline for the Render token.

Render’s price-daily active addresses (DAA) divergence still hovers in the positive zone. Per Santiment, RNDR’s price DAA divergence is currently 82%. In simple terms, this suggests a “buy signal” since the number of active addresses has increased along with the price.

Read more: RNDR token surges, as Render Network introduces new feature