On-chain data from Arkham Intelligence revealed that Chiliz’s (CHZ) purpose for withdrawing $3.5 million from its multi-sig wallet has been identified. On October 9, pseudonymous Chiliz fan Playmaker disclosed that the sports-based blockchain project withdrew the said amount from one of its most secure wallets.

The transfer was the second largest transfer by Chiliz in recent times after a similar withdrawal one month ago. As of October 9, the reason for the withdrawals was largely unknown. However, in a follow-up on the matter, Playmaker got information from Arkham Intelligence that some of the CHZ tokens were sent into the Binance exchange.

𝐎𝐧-𝐂𝐡𝐚𝐢𝐧 𝐔𝐩𝐝𝐚𝐭𝐞 🔎🌶️

— Playmaker (@PLMKR10) October 10, 2023

Looks like @ArkhamIntel identified the addresses to which @Chiliz sent 3.5m $CHZ yesterday

Acc to the labels, $CHZ worth $200k was deposited to Binance via a new deposit address

Great to see such quick updates to your database @ArkhamIntel 🫡 https://t.co/YM981MCuXF pic.twitter.com/yOU8dRG5ep

Although an assessment of Chiliz’s (CHZ) page of X (formerly Twitter) did not give exact details of what the tokens were for, the transfer to Binance is a sign that the tokens may be sold.

CHZ Price Analysis

CoinMarketCap showed that CHZ’s price maintained its hold at $0.05. According to the 4-hour CHZ/USD chart, the token experienced a sharp plunge from $0.060 to $0.056 on October 9.

This decrease was evidently a result of increased selling pressure. While there have been some attempts to push up the price, bears have ensured that CHZ did not cross the $0.056 region. If bulls fail to take charge, CHZ may fall further. In fact, it can drop as low as $0.45 depending on buyers’ or sellers’ presence in the market.

Also, traders may need to consider indicators like the Exponential Moving Average (EMA). This is to assess the potential direction that CHZ may move. At the time of writing, the 9-period EMA (blue) has crossed below the 20 EMA (yellow).

As a way to measure short-term direction, the EMA stance means CHZ is bearish. So, there is a higher chance of another decline than a possible uptick.

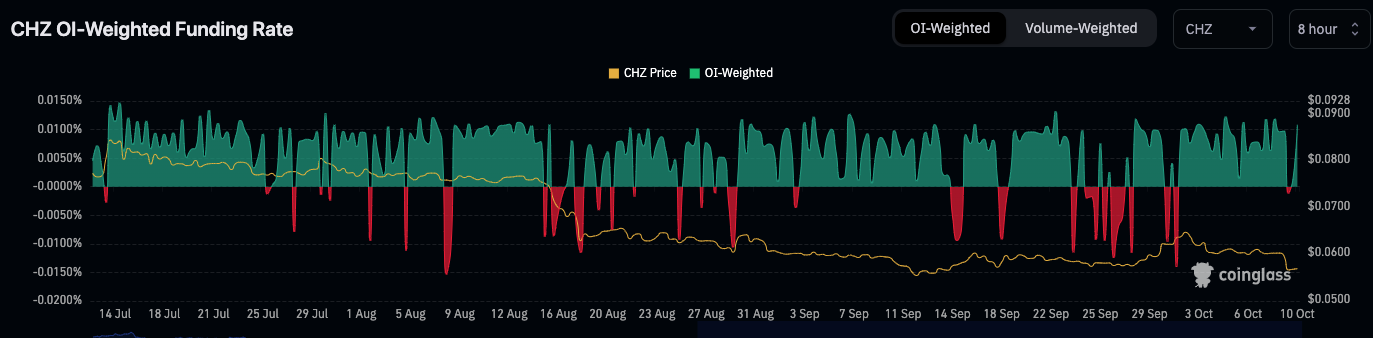

Contrary to expectations, traders seem to be betting on a price increase for CHZ. This assertion was based on the 8-hour funding rate. Funding rates are basically periodic payments paid between longs and shorts in the derivatives market.

A positive funding rate means longs are paying shorts a funding fee to keep their contracts open. Conversely, a negative funding rate implies that short positions are dominant. Based on Coinglasss’ data, CHZ’s weighted funding rate was 0.001%.

From the data above, it was also seen that the average target for CHZ was $0.057. For CHZ to hit $0.5, buying momentum must increase, and there has been a surge in open interest and volume.

General Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com