Axie Infinity (AXS) price has failed to reclaim the $5 level despite the positive sentiment surrounding the altcoin markets in late September. Historical on-chain data provides insights into how AXS price could perform in the coming weeks.

Axie Infinity is set to execute its next token unlock on October 20. Here’s how key stakeholders in the AXS markets are positioning their trades ahead of the upcoming milestone event.

Crypto Whales Have Started Offloading Axie Infinity Ahead October 20 Token Unlock

Axie Infinity is scheduled to have the largest crypto token unlock event in October 2023, according to a recent Beincrypto report. The much-anticipated event will release 15.13 million AXS (~$69 million) into circulation.

Interestingly, crypto whales holding 100,000 to 1 million AXS have started offloading their balances to front-run the potential inflationary pressure.

The chart below shows that they held a total of 34.66 million AXS in their wallets as of October 2. But barely 3 days later, they are now down to 34.2 million tokens.

This implies they have already sold off 460,000 AXS tokens worth approximately $2.07 million this week. Conspicuously, this mirrors the bearish precedence set during the previous token unlock on July 22, 2023.

The chart shows how the whales had sold 1.85 million AXS between July 5 and July 21. While the crypto market rally after Ripple’s (XRP) infamous victory had papered over the cracks, AXS price still sank by 26% within 30-days of the July 22 token unlock.

Notably, the upcoming $70 million token unlock event is four times larger than the previous one. Hence, other stakeholders in the Axie Infinity ecosystem will likely join the bearish action in the coming weeks.

Read More: 9 Best Crypto Futures Trading Platforms in 2023

Speculative Traders are Closing Their AXS Positions Rapidly

In confirmation of the bearish outlook, AXS Futures traders have been spotted closing their positions rapidly this week.

Derivatives data analytics platform Coinalyze reports that AXS Open Interest stood at $50.4 million on September 15. That figure has since dropped by a staggering 49% to hit 26 million million on October 5.

This implies Axie Infinity has $46 million in capital outflows in the perpetual futures markets within the last three weeks.

Open Interest values the total outstanding derivatives contracts for an asset across recognized trading platforms. Strategic investors often interpret such a sharp downtrend in Open Interest as a bearish signal.

It indicates that existing AXS traders are closing their positions faster than those bringing in fresh capital.

In summary, if the speculative traders and whale investors’ historically bearish trends persist, it’s only a matter of time before AXS price drops to new lows.

AXS Price Prediction: Losing the $4 Support Could Catalyze Larger Losses

From an on-chain perspective, the October 20 token unlock will likely drive Axie Infinity price into a downswing toward $4.

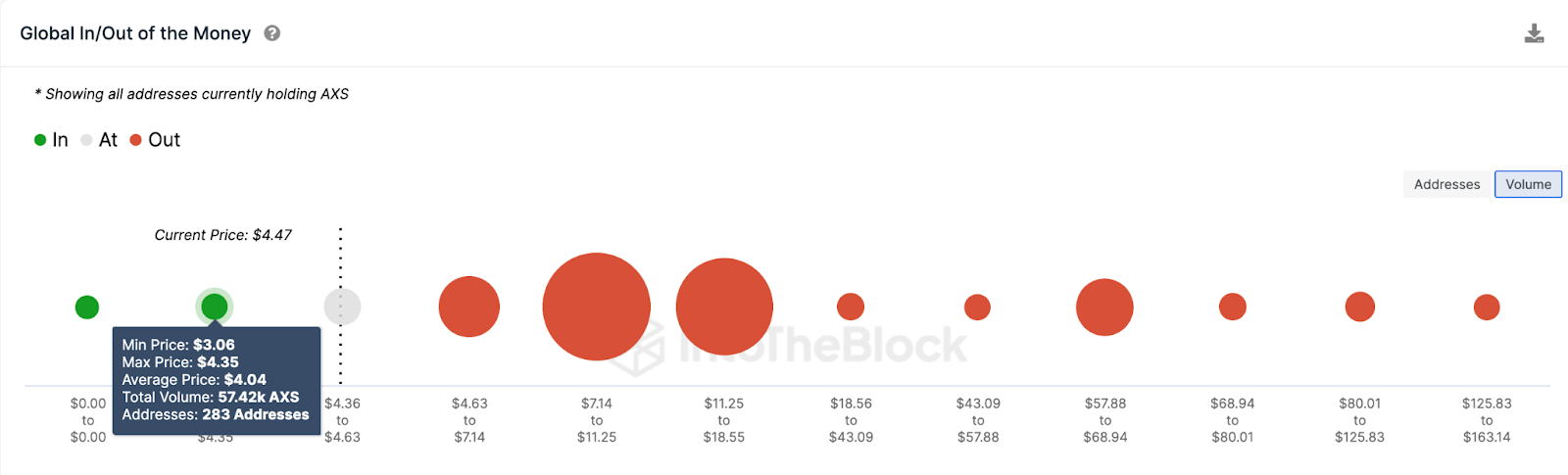

The Global In/Out of the Money (GIOM) chart, which depicts the entry price distribution of current AXS holders, also buttresses this bearish prediction. It shows that if AXS loses vital support at $4, it could catalyze historic losses.

As seen below, 283 addresses purchased 57,420 AXS at an average price of $4.04. Considering this is the last major support line, they will likely make frantic efforts to HODL.

But if the whales keep selling and the $4 support caves, AXS price could edge closer to zero.

Alternatively, the bulls could invalidate that bearish narrative if Axie Infinity’s price can reclaim $7. But that currently appears implausible, as 12,110 addresses had bought 27.8 million AXS at the average price of $6.

If they sell to avoid the inflationary impact of the upcoming token unlock, AXS price will likely retrace.

But if that resistance level caves, Axie Infinity could rally toward the $7 range.

beincrypto.com

beincrypto.com