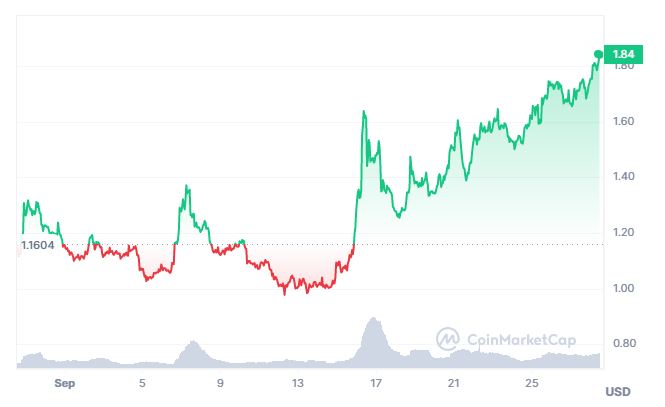

Worldcoin’s native token, Worldcoin ($WLD), has been making significant waves in the cryptocurrency market, demonstrating an impressive 80% surge in value over the past two weeks. On September 13, the $WLD token was trading at around $1, compared to its price of $1.84 at the time of writing (September 28).

This remarkable performance has piqued the interest of both seasoned cryptocurrency enthusiasts and industry experts alike against the backdrop of a worldwide regulatory backlash that culminated with a ban in Kenya. But what factors are driving this surge, and what does it mean for the Worldcoin project?

Worldcoin ($WLD) price analysis

When Worldcoin made its debut in the cryptocurrency market in July 2023, it quickly gained attention and became listed across various exchanges. On its first trading day, the token’s price surged to an impressive high of $5.290 before settling at $2.161. While this level of volatility is common in the crypto world, particularly for new and highly anticipated projects, the token dropped further below $1 following the backlash of various regulatory bodies around the world.

Over the following months, $WLD maintained a relatively stable trajectory, fluctuating between $2.525 and $0.972. However, in its recent performance, the token has encountered a mid-term resistance point set at $1.724. Currently, it hovers at around $1.726, drawing significant attention as it aims to break through this resistance, potentially paving the way for even higher valuations.

Worldcoin’s expanding popularity in South America

Worldcoin sets itself apart from other cryptocurrencies with its innovative “proof of personhood” mechanism, leveraging biometric iris scanning technology for identity verification.

This unique approach has enabled the project to achieve remarkable milestones, particularly in Chile, where it has garnered the participation of over 1% of the country’s population, or 200,000 Chileans, in receiving Worldcoin’s grant in the form of $WLD tokens.

More than 200K people have verified their World ID in Chile. That’s over 1% of the population.

— Worldcoin (@worldcoin) September 26, 2023

To help meet demand, project contributors at @tfh_technology have recently started operations in Vina del Mar & Concepcion, in addition to Santiago. pic.twitter.com/MN0ztyqmcF

The token’s growing popularity extends beyond Chile’s borders, reaching other Latin American countries that have warmly embraced the project. Notably, in August, Worldcoin disclosed that it had registered over 9,500 Argentines in a single day, equating to one verification every nine seconds. This achievement is particularly remarkable given that there were only four verification stations in Argentina at the time.

However, Worldcoin’s popularity has not been without some hiccups. It faced some regulatory hiccups a few weeks after it was launched in July this year with the main one being in Kenya, where it is still under investigation after almost half a million people scanned their iris to register with the project. In addition to the suspension in Kenya, Worldcoin also faced regulation problems in France, Argentina and the UK.

Increased Binance trading activity

The surge in $WLD’s value can be largely attributed to heightened trading activity on Binance, one of the world’s leading cryptocurrency exchanges.

Analysts have been closely monitoring this trading activity, with Riyad Carey, a distinguished crypto researcher, shining a spotlight on the recent influx of approximately $1 million into Worldcoin ($WLD) on Binance within a mere six-hour window on September 25. This substantial buying spree resulted in a notable 5% boost for the Worldcoin token.

$WLD rallying more than 5% on about $1mn worth of net buying on Binance in the past 6 hours pic.twitter.com/VjEv4S49Kc

— Riyad Carey (@riyad_carey) September 25, 2023

Carey’s observations suggest that a phase of $WLD accumulation may be on the horizon.

While Binance witnessed this surge, other major exchanges, including Uniswap, Bithumb, Bybit, Kucoin, and OKX, did not experience a similar uptick in cumulative volume during the same timeframe. Notably, Binance had seen the most significant drop in $WLD’s cumulative volume over the previous week.

The post Worldcoin ($WLD) explodes, surges 80%: a look at the driving factors appeared first on Invezz.

invezz.com

invezz.com