In the ever-evolving world of cryptocurrencies, Bitcoin (BTC) finds itself locked in a battle for a major breakthrough, trading well below its historic highs of 2021. While this might seem like a subdued phase for crypto enthusiasts, astute investors recognize it as a unique window of opportunity to acquire promising coins at discounted rates.

Having said that, on September 22, Finbold carefully chose 3 cryptocurrencies that are trading below $0.1 that could be worth considering in the next week as they could garner the attention of investors if and when the next bull cycle commences.

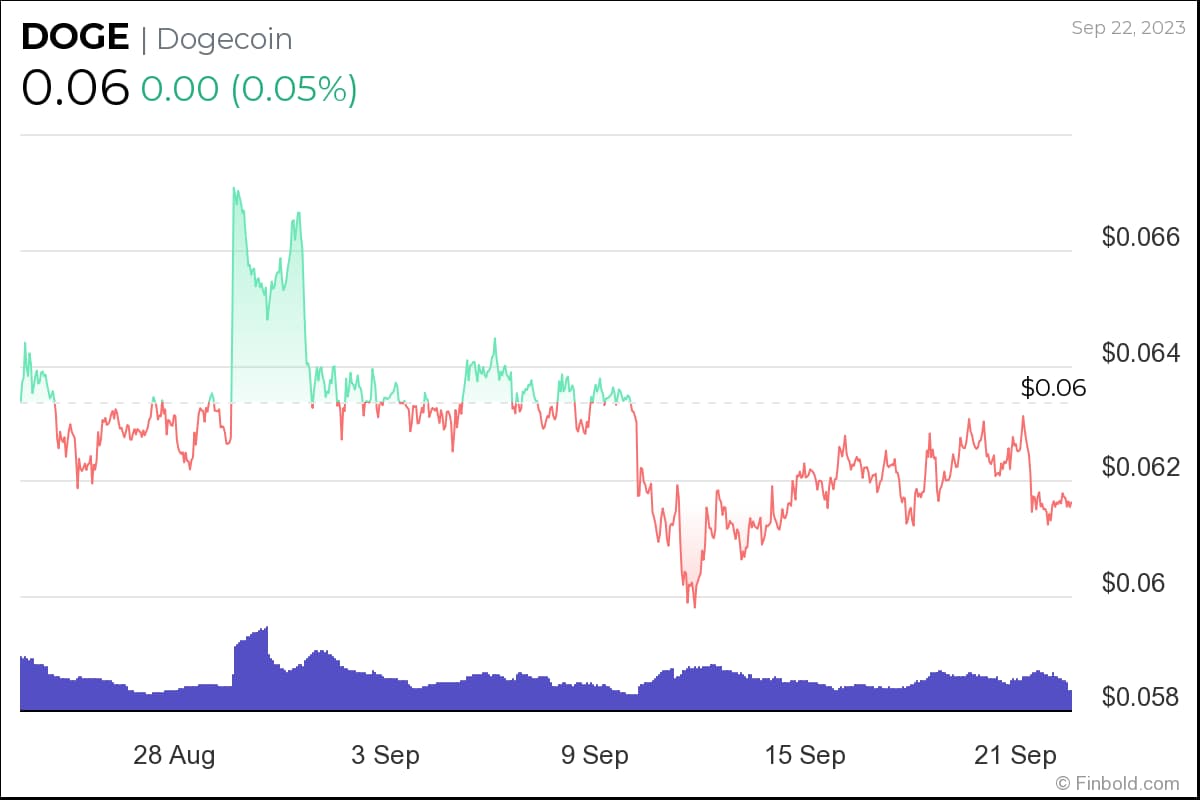

Dogecoin (DOGE)

After achieving fame during the 2021 crypto market rally, Dogecoin (DOGE) remains the favorite and biggest meme coin in the world to this day.

More importantly, the cryptocurrency continues to trade at a favorable entry point significantly below the $0.1 mark even after the market rebounded from its 2022 lows.

This could eventually prove to be a unique opportunity for investors to grab DOGE, particularly when taking into account that the meme-inspired asset could in time become an official payment method at X.com (formerly Twitter), as previous rumors have indicated.

At the time of publication, DOGE was changing hands at $0.06, almost unchanged in the past 24 hours.

The crypto coin fell 0.4% in the past week, and more than 2.3% on the month. Nonetheless, it has outperformed 75% of the top 100 cryptocurrencies in the past year.

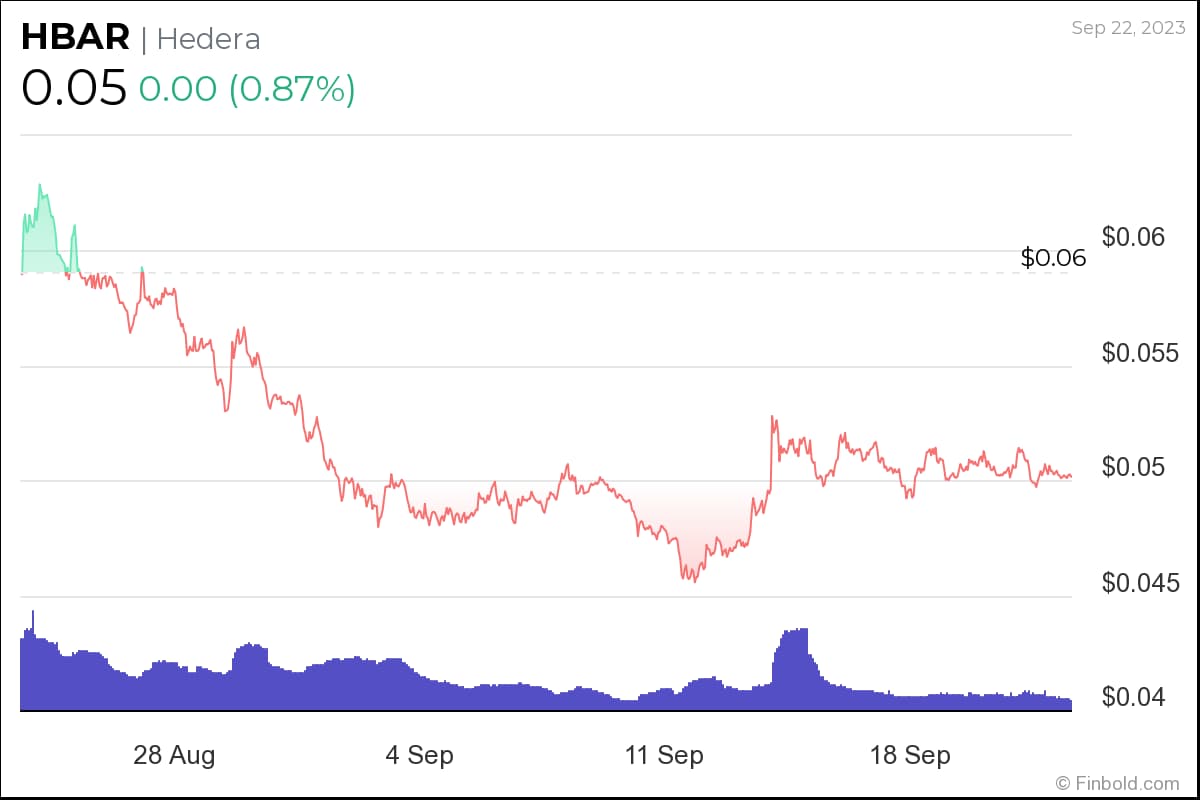

Hedera (HBAR)

Following its noteworthy ascent since the start of 2023, Hedera (HBAR) continues to garner attention among crypto investors, with the token currently being the 30th largest cryptocurrency by market cap.

But HBAR’s rise this year does not come without justification. Notably, Hedera, the blockchain project behind the token, keeps making headway with significant developments and partnerships, such as its recent collaborations with auto giants Kia and Hyundai.

More recently, the blockchain made headlines after announcing it plans to push full speed ahead into the stablecoin market with the unveiling of ‘Hedera ‘Stablecoin Studio’ – “the all-in-one stablecoin configuration, issuance, and management toolkit tailored for web3 platforms, institutional issuers, enterprises, and payment providers alike.”

At press time, HBAR was trading at $0.05, up 0.9% in the past 24 hours. The crypto token gained 0.05% in the past week while losing nearly 15% on the month, outperforming 52% of the top 100% crypto assets in 1 year.

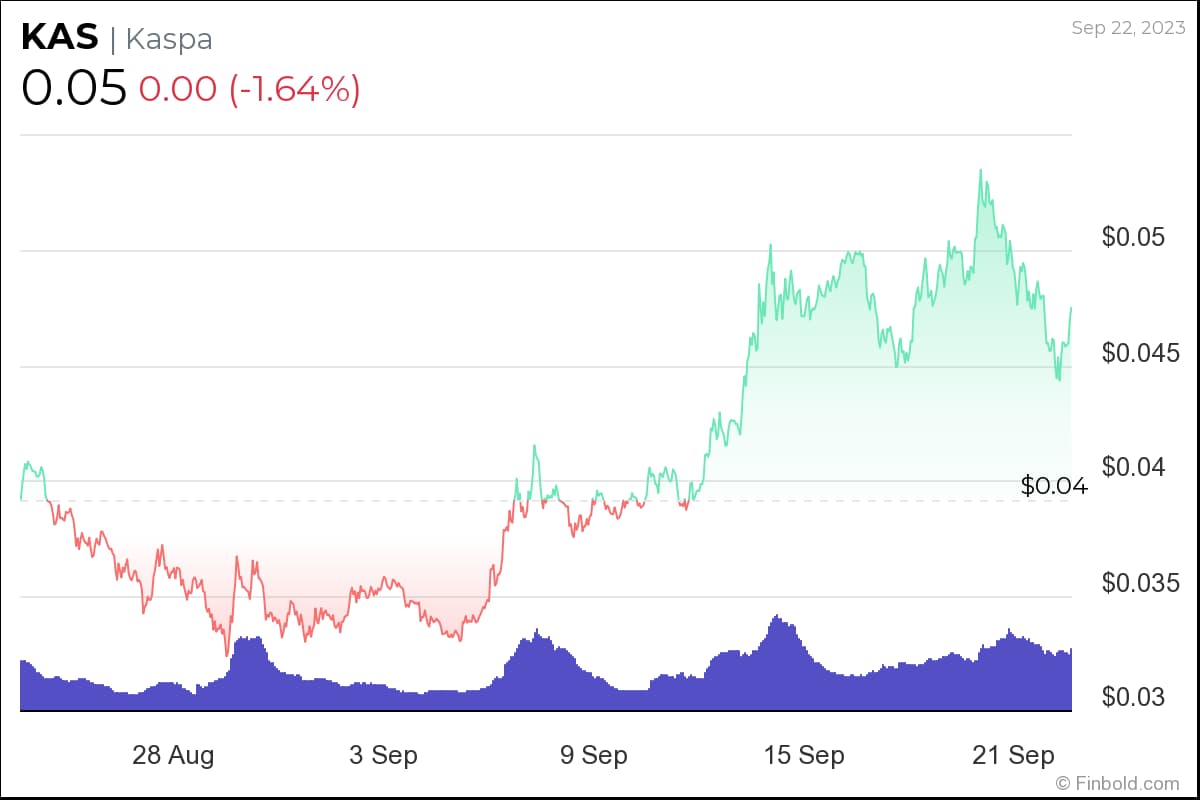

Kaspa (KAS)

Meanwhile, our third pick is Kaspa (KAS) – a blockchain that serves as a decentralized and highly scalable protocol crafted to tackle the shortcomings prevalent in current blockchain networks.

With a focus on achieving elevated throughput, minimal transaction fees, and heightened scalability, it paves the way for streamlined and secure transactions and the execution of smart contracts.

Earlier this week, Kaspa unveiled a significant upgrade to its mempool design, substantially increasing transaction efficiency. Notably, a single node was able to handle 1.4 million transactions during the testing phase, broadly exceeding expectations.

KAS was sitting at $0.05 at the time of writing, down 1.6% on the day. The cryptocurrency fell 1.8% in the past week, though it is up over 11% across the month. The token’s price skyrocketed by a staggering 999% in the last year, outperforming 99% of the top 100 crypto assets during that period, including Bitcoin and Ethereum (ETH).

It’s currently trading above its 200-day simple moving average (MA) and close to its cycle high.

While the cryptocurrencies discussed may currently face pressure, the dynamic nature of the digital asset realm suggests that unexpected breakthroughs remain a possibility. On the other hand, it’s important to remember that crypto assets primarily rely on the overall market sentiment, a key factor to track when entering the market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com