Axie Infinity (AXS) holders have fiercely defended the $4 support level after a major retracement in early September raised concerns that it could edge closer to zero. An in-depth on-chain analysis examines how investors could react to the recent 12% price rebound toward $4.50.

Axie Infinity (AXS) price scored 12% gains over the past week. However, vital on-chain indicators suggest that the leading metaverse is unlikely to reclaim its spot in the top 50 crypto market rankings any time soon.

Axie Infinity Whales Capitalized on the Recent Price Bounce to Sell Their Holdings

On-chain analysis reveals that crypto whales and spot market trades appear unconvinced that AXS could enter a prolonged price rally.

AXS price bounced 12% from $4.08 to $4.50 between September 11 and September 20. But rather than ape in, on-chain data shows that the Axie Infinity whales capitalized on the rally to sell their holdings.

According to data compiled by Santiment, crypto whales holding 100,000 to 10 million AXS tokens held a cumulative balance of 83.28 million when AXS price hit a 2023 bottom of $4.08 on September 11.

As the AXS price increased, the whales have sold 760,000 AXS tokens, bringing their balance to 82.52 as of September 20.

With Axie Infinity’s price currently hovering around $4.50, it means the whales have sold tokens worth $3.4 million within the past week. By depleting their balances by such a large margin, the institutional investors on the Axie Infinity network appear unconvinced of AXS’ recovery prospects.

When large institutional investors start selling off a token during a rally, it dampens the confidence across the ecosystem. Hence, the AXS price could retraced again in the coming days if the whales do not get on board.

Bearish Traders Have Regained Control Of the Market

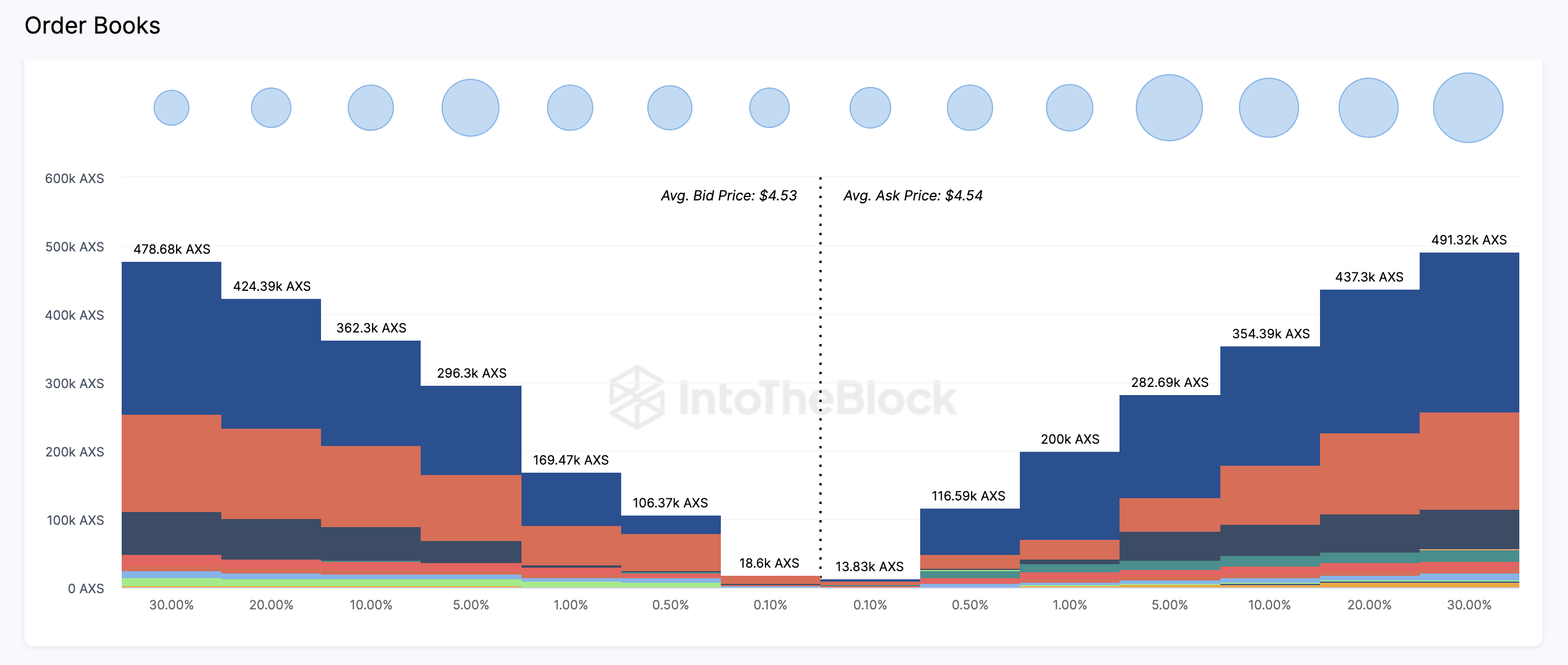

According to Exchange order books, many strategic traders have mounted a considerably high sell-wall, which could put AXS in danger of another price correction.

As seen below, crypto traders have placed active orders to sell 1.9 million AXS tokens around the current prices. Meanwhile, the buyers have only placed purchased orders for 1.8 million AXS.

The Exchange On-chain Market Depth chart depicts the volume of active orders that AXS traders have placed across recognized crypto exchanges.

The chart above depicts that after the double-digit price bounce, the current market supply for AXS still exceeds demand by 100,00 tokens. This is a vital signal that the AXS token may struggle to find sufficient demand to propel the price recovery further.

AXS Price Prediction: Another Potential Downswing Toward $3

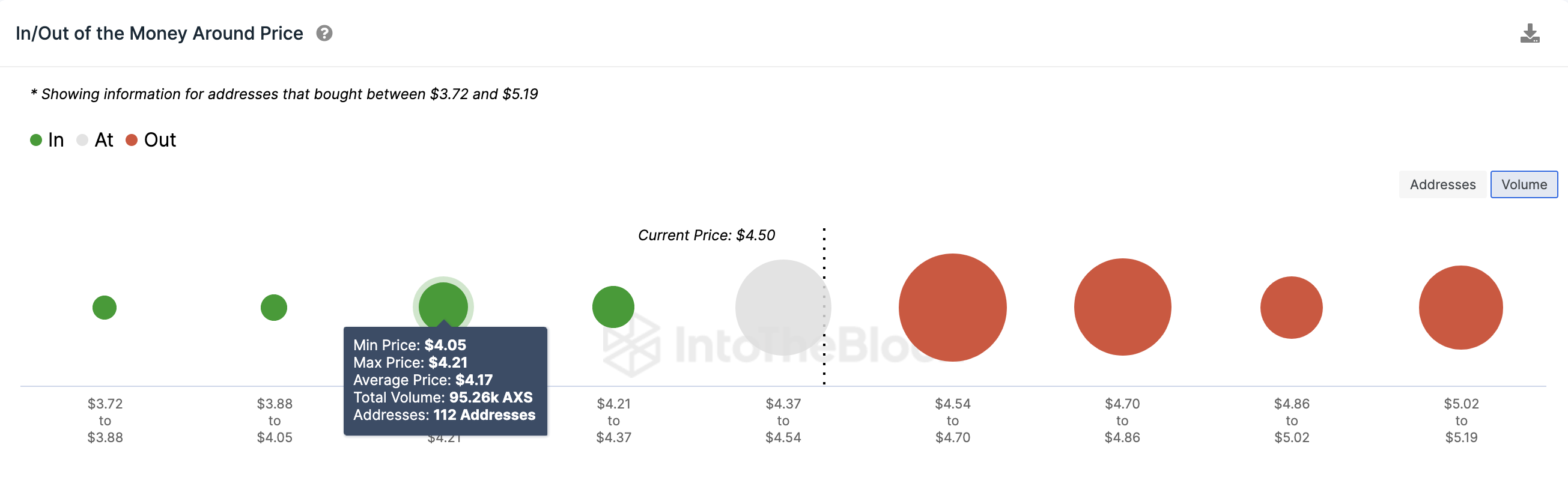

While the bulls have mounted a spirited effort to defend the $4 support, on-chain indicators suggest another bearish reversal toward $3 in the coming days. The In/Out of Money Around Price data, which outlines the purchase price distribution of the current AXS investors, also depicts this.

It highlights that 112 investors had bought 95,260 AXS tokens at the minimum price of $4. If that support level holds, AXS could enter another mild price recovery.

But if the whale investors maintain their bearish disposition, Axie Infinity’s price could edge closer to $3 as predicted.

Yet, if the troubling sentiment surrounding Axie Infinity subsides, the bulls could potentially trigger a major recovery mission toward $7.

However, 359 addresses had bought 1.16 million AXS at the minimum price of $4.70. And if they chose to close their positions as the whales did last week, Axie Infinity’s price could retrace again.

But if that resistance level gives way, AXS price could reclaim $5 and begin to edge closer to $7.

beincrypto.com

beincrypto.com