Bitcoin ($BTC) is up 65% in 21 days and has set a new all-time high ($ATH) of $67,000. After that, it has been consolidating around $60,000 for the last 2 weeks. Such price action of the largest cryptocurrency provides potentially ideal conditions to initiate altcoin season.

In this article, BeInCrypto takes a look at some technical arguments for the hypothesis of an upcoming altcoin season. The total altcoin capitalization is breaking through the all-time high, and its fractal corresponds to the analogous structure from the 2017-2018 bull market. Additionally, Bitcoin’s dominance is dropping, and many top altcoins are breaking out of their multi-month consolidation or just breaking through their all-time highs.

Altcoin cap ready to explode

The chart of total altcoin market capitalization (TOTAL2) is on the verge of its all-time high of $1.49 trillion, set on 12 May 2021 (yellow line). The second time this level was almost reached was on 7 September. Moreover, the chart seems to respect the rising support line (blue), which has been in place since the bottom at $608 billion on 20 July.

Cryptocurrency trader @Parabolic_Matt pointed out on Twitter that technical indicators on the weekly time frame also look bullish. In his opinion, the chart has created an ascending triangle formation. It also resembles a cup-and-handle pattern with a technical target at $2.63 trillion. Measured from today’s altcoin market valuation, this would be a 58% rise.

In addition, the weekly RSI has just broken out above the descending long-term trendline (red circle), which was in place since February 15, 2021. This is also a bullish signal that offers a chance for a strong altcoin season in the coming weeks. @Parabolic_Matt concludes:

“The $ALT Coin market cap looks like it’s about to EXPLODE! (…) November may bring #ALTSEASON.”

Another argument in favor of altcoin season is provided on Twitter by another crypto market analyst @TechDev_52. In a 2-week time frame, he compared the fractal of total market capitalization from the turn of 2017-2018 and today.

In his opinion, the structures show similarities, which are confirmed by the 2-week RSI. In his opinion, the RSI of altcoin capitalization is following a 3-step bull market pattern. The first two peaks (red and blue) were reached earlier this year, while the last one (yellow) is ahead and is expected to happen in early 2022. According to the analyst, this could take TOTAL2 to values in the $5-7 trillion range.

Will Bitcoin’s dominance decline?

Another way to look for arguments for a possible altcoin season is to look at the chart of Bitcoin dominance (BTCD). We see a 20% increase in BTCD between September 10 and October 19. However, Bitcoin’s dominance has been declining since then.

Moreover, BTCD failed to form a higher high relative to the 49% level reached on July 30, 2021 (red circles). This is a bearish signal that may indicate a continuation of the decline in Bitcoin’s dominance, which has continued since the beginning of 2021. Long-term support is found at the 39.5% and 35.5% levels.

Additional analysis of BTCD in relation to the Bitcoin price was recently done on YouTube by crypto market commentator Kevin Svenson. He highlighted 3 moments in 2021 that initiated a decline in BTCD. Each time they were correlated with a consolidation of the $BTC price after a violent surge.

In the chart below, we see the $BTC price spikes (green arrows) and the subsequent consolidation (red circles). The beginning of this repetitive process occurred on 14 January, 31 March and 10 August. At the same time, on the bottom chart of BTCD, we see that these moments initiated a sharp decline (red arrows).

Current market conditions are very reminiscent of all previous periods. Bitcoin has completed a surge, set a new $ATH at $67,000 and is currently consolidating. In contrast, Bitcoin’s dominance has started a decline. If it continues, it will certainly lead to an altcoin season.

The end of a long-term consolidation

The final argument in favor of an upcoming altcoin season are the charts of the major altcoins. Many of these have just broken out from long-term consolidation and validated previous resistance as support. Others, on the other hand, have already recently broken through their $ATH and are continuing their rally.

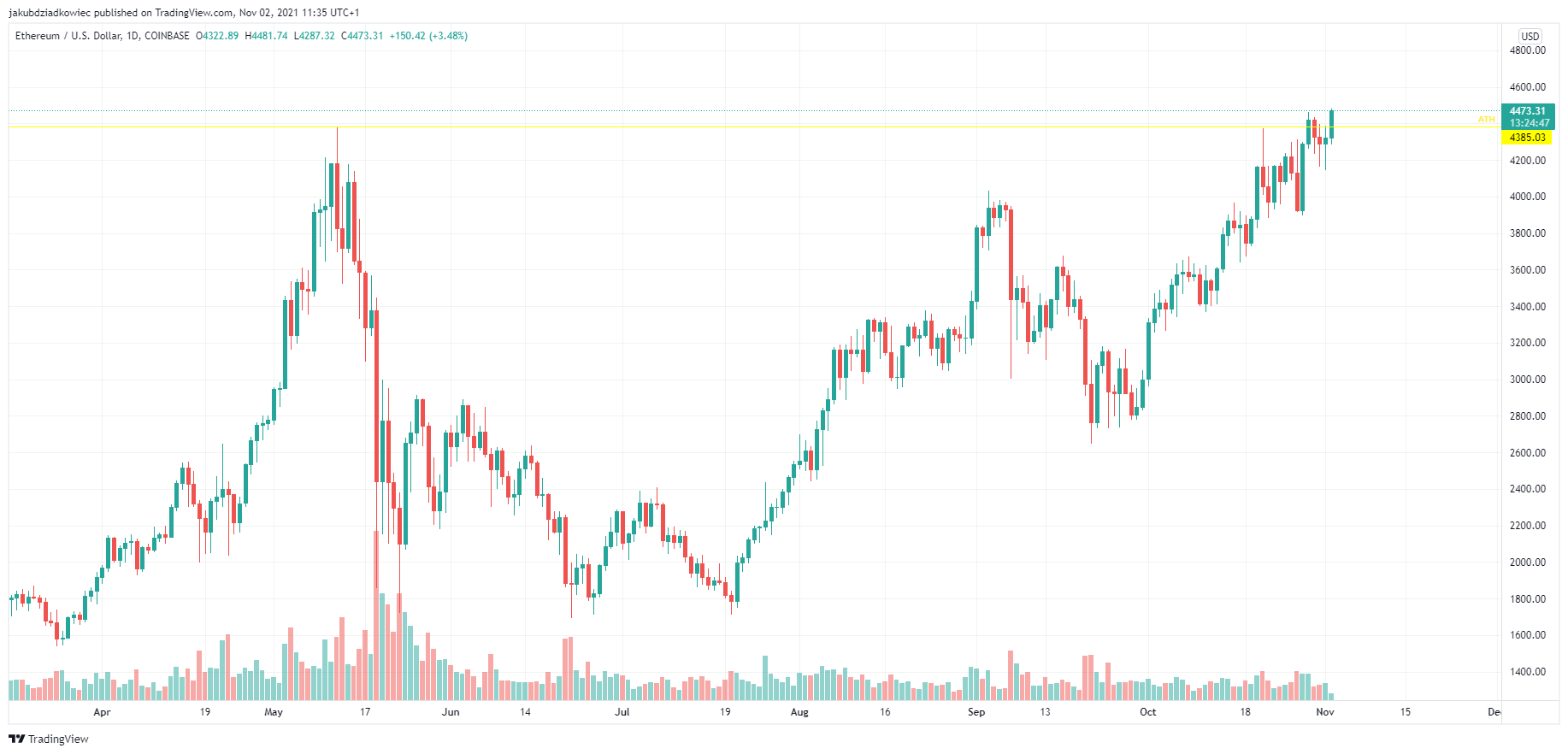

The main determinant of the altcoin market’s condition is Ethereum ($ETH). The second cryptocurrency by market capitalization just broke through its historical $ATH of $4384 reached on May 12, 2021 (yellow line) and continues its upward movement.

We observe a similar situation on the charts of Polkadot (DOT) or Solana (SOL). Meanwhile, such TOP 20 cryptocurrencies as Binance Coin (BNB), Polygon (MATIC) or Chainlink ($LINK) are in the process of breaking out of long-term consolidation patterns.

$LINK, for example, broke out above the resistance area in the $29-30 range and simultaneously closed above the long-term falling resistance line (blue). Once these levels are validated as support, the altcoin is ready to continue the uptrend and attempt to break through the important resistance area at $35. If successful, $LINK will not have many resistance levels before the $ATH at $53.

beincrypto.com

beincrypto.com