As the cryptocurrency industry continues its sideways trading trend, it might be a good opportunity for investors to accumulate their favorite cryptocurrencies while the prices are relatively low, but not all digital assets represent equally good investments at every point in time.

With this in mind, Finbold has analyzed the crypto sector, taking into account charts, price activity, recent developments (or lack thereof), and various other indicators to arrive at the list of several crypto assets that might not be a good idea to invest in at this particular moment.

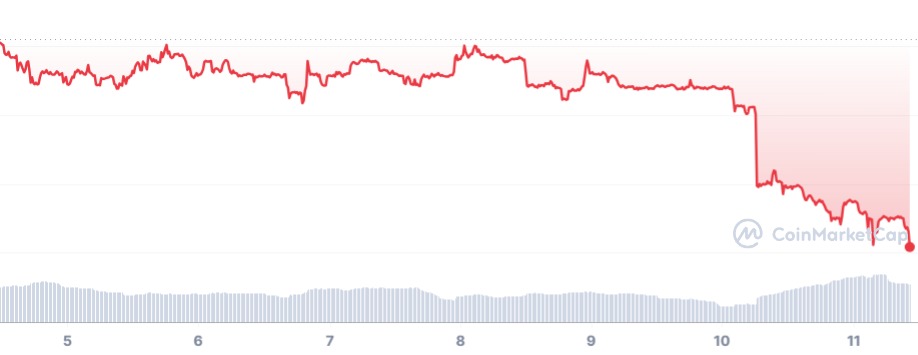

Pepe (PEPE)

Despite making a grand entrance into the crypto market, the massive popularity of meme cryptocurrency Pepe (PEPE) has failed to help it retain its initial momentum, raising concerns among crypto traders about its future, particularly as new meme coins enter the market and threaten its dominance.

Indeed, Pepe is currently trading at the price of $0.0000006877, indicating a loss of 5.32% on the day, 15.84% across the previous week, and 44.82% in the last month, according to the latest data retrieved from crypto analytics platform CoinMarketCapon September 11.

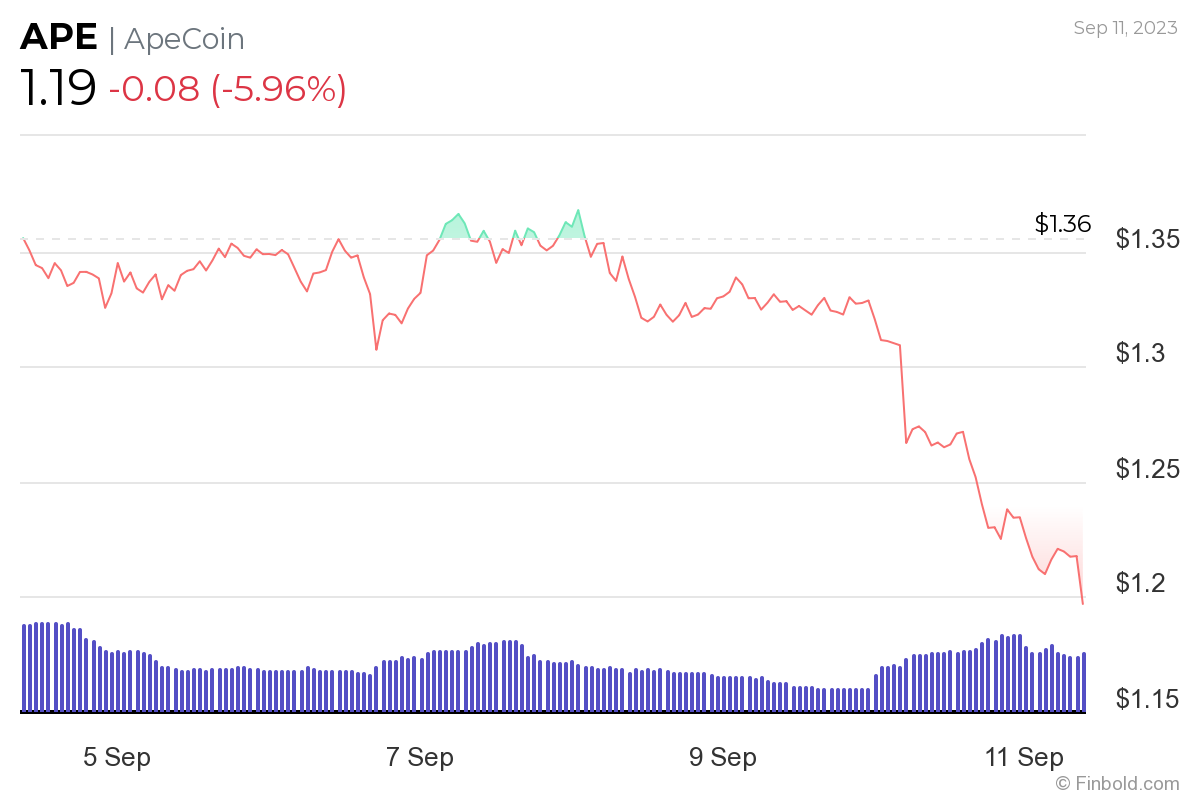

ApeCoin (APE)

Another crypto sensation, the governance and utility token used within the non-fungible token (NFT) ecosystem Bored Ape Yacht Club, ApeCoin (APE), has joined PEPE on the underdog list after falling to its support level and facing resistance there under the prevailing bear dominance.

As such, it was at press time changing hands at $1.1915, down 5.96% in the last 24 hours, dropping 11.92% across the previous seven days, as well as continuing the 40.29% decline on its monthly chart, according to the most recent crypto price trends.

Gala (GALA)

At the same time, Gala (GALA), the core utility token for the Web3 game development and NFT platform Gala Games, has been struggling as well, despite the growing activity on the network and an explosive start to 2023 that has seen it rallying $0.006 in January.

Specifically, its price at the time of publication stood well below the important $0.02 price level – at $0.0146, demonstrating a decline of 3.08% on the day, adding up to the negative price change of 13.61% across the week and a 37.3% loss in the last 30 days, indicating a difficult period for GALA.

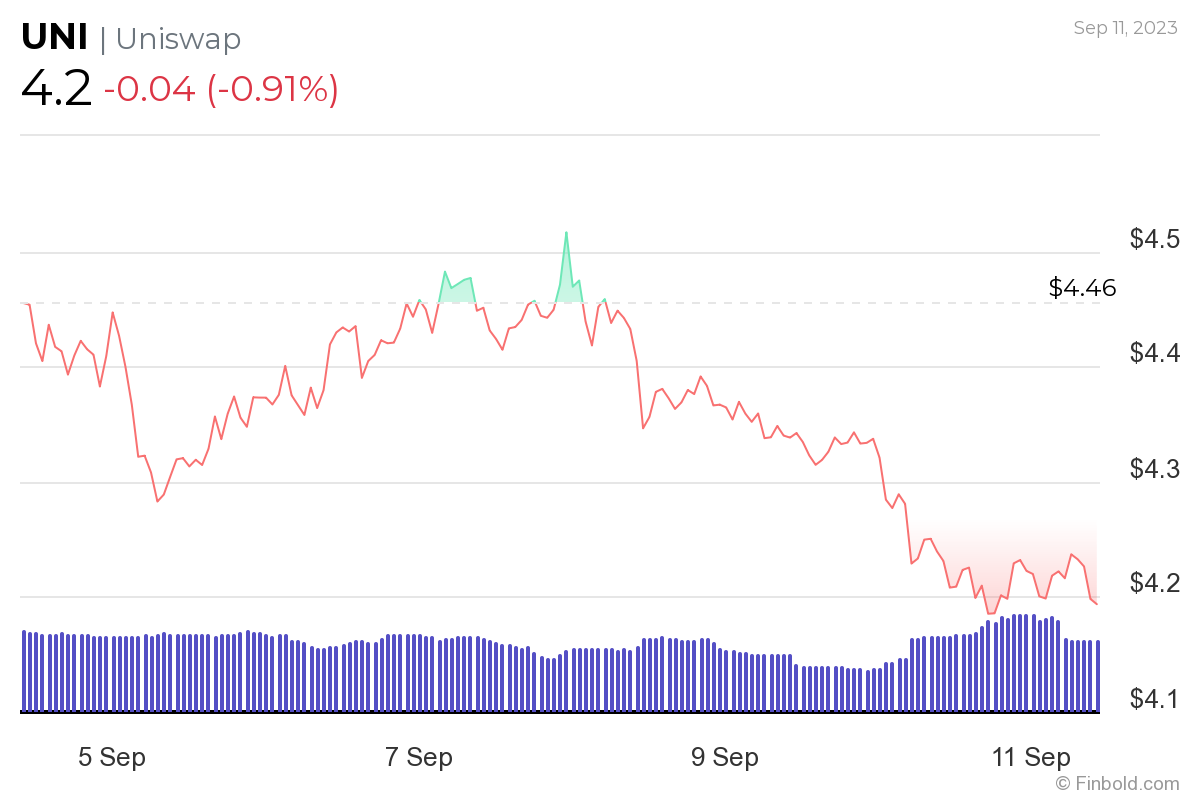

Uniswap (UNI)

Meanwhile, the governance token of the popular protocol facilitating automated trading decentralized finance (DeFi) tokens, Uniswap (UNI), has continued to accumulate declines on zoomed-out charts under recent legal woes, despite the Southern District of New York dismissing a class action lawsuit against Uniswap.

This has been reflected in price fluctuations for UNI in recent months, resulting in a marginal loss of 0.91% on its 24-hour chart but more significant declines of 5.82% across the past seven days and 31.45% in the last month, currently trading at $4.194, as the latest charts indicate.

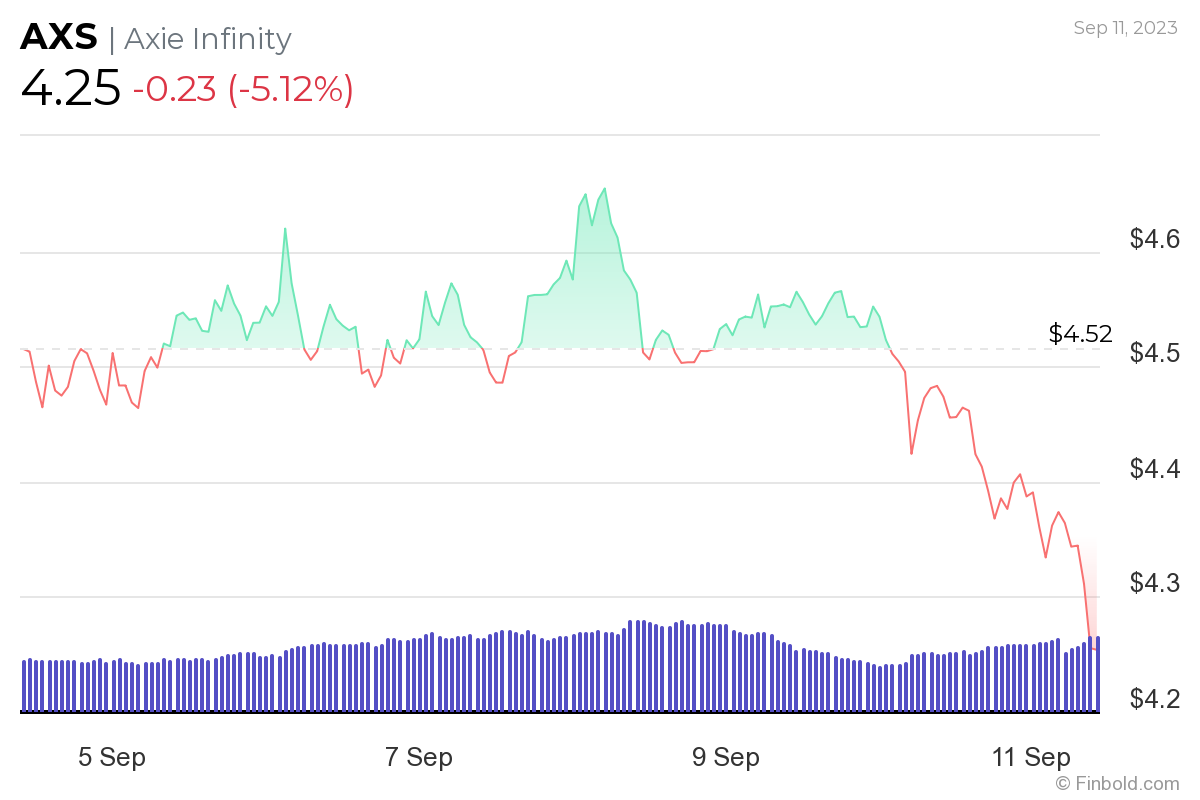

Axie Infinity (AXS)

As for the native token for the Axie Infinity (AXS) ecosystem and the central mechanism for running the play-to-earn Axie Infinity game, it has been facing problems as well, with 100% of AXS addresses in the red, according to the recent information retrieved from the blockchain analytics platform IntoTheBlock.

Although its price has witnessed a few spikes into the green over the last week, it nonetheless records a loss of 5.12% in the past 24 hours, dropping 5.96% across the previous seven days, as well as plummeting 29.12% over the last month, as the charts show.

Conclusion

All things considered, this might not be the best time to invest in the above cryptocurrencies. However, things could easily change in the future, particularly in the still relatively uncertain sector such as this one, which is why it is important to do one’s own research before dedicating any significant amount of money to any crypto asset.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com