Bitcoin price analysis

Bears and bulls have struggled for dominance this week, with several cryptos posting losses while others gained. Bitcoin (BTC) has seen some bear activity this week, recording a weekly decrease of 0.13% as Bitcoin price at $25.84K. Bitcoin has a current market cap of $503.4B as the trading volume stood at $5.7B as of press time.

Volatility on Bitcoin price for the week has been relatively stable as the Bollinger bands move closer to each other. However, BTC’s relative strength indicator is moving below its average line, indicating a bear dominance still on BTC as the MACD indicator hovers in the red zone, showing the effects of bears over the week on Bitcoin price.

Ethereum price analysis

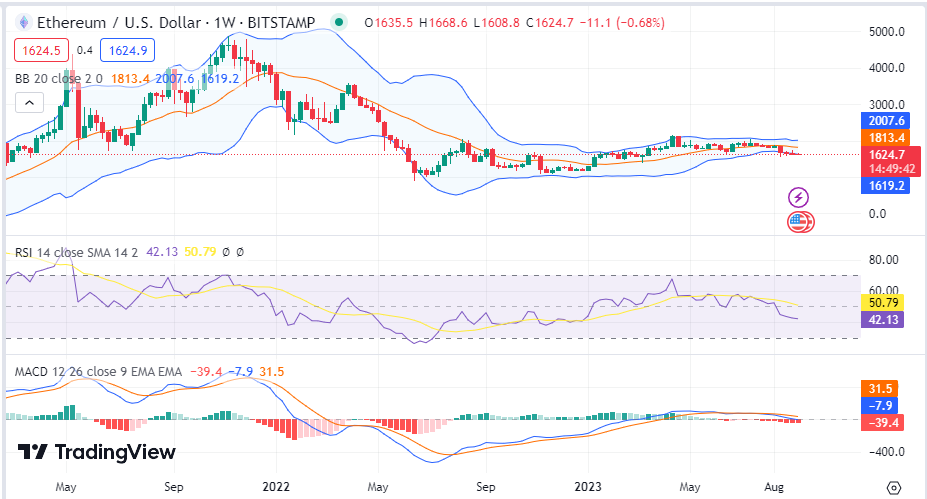

Ethereum (ETH) has also seen bear activity as the asset’s weekly drop now stand’s at 0.47% as Ethereum price stands at $1,624. Ethereum has a current market cap of $195.3B, as the trading volume now stands at $2.4B.

Volatility levels on Ethereum price have also been low over the week as the Bollinger bands now move at a relatively close distance. In contrast, the RSI indicator moves below its average line, showing bear activity on Ethereum as bulls and bears struggle for dominance as the MACD moves in the red zone.

Render price analysis

Render (RNDR) has also seen bull activity as the asset’s weekly rise now stand’s at 10.22% as Render price stands at $1.48. RNDR has a current market cap of $549M, as the trading volume now stands at $20.9B.

Volatility levels on Render price have been stable over the week as the Bollinger bands maintained a close distance. The RSI indicator is still below its average line, showing bear activity on Ethereum as bulls push for a cross-over above the average line.

Rocket Pool price analysis

Rocket Pool (RPL) has also seen bull activity as the asset’s weekly gain now stand’s at 6.5% as Rocket Pool price stands at $23.07. RPL has a current market cap of $454M, as the trading volume now stands at $3.3M.

Volatility levels on Rocket Pool price have been high over the week as the Bollinger bands maintained a far distance from each other. The RSI indicator is, however, still below its average line, showing some bear activity on Rocket Pool price as bulls push for a cross-over above the average line.

Stellar price analysis

Stellar (XLM) has also seen bull activity over the past seven days as the asset’s weekly gain now stand’s at 16.6% as Stellar price stands at $0.1326. RPL has a current market cap of $3.6B, as the trading volume now stands at $134M.

Volatility levels on Stellar price have been high over the week as the Bollinger bands maintained a close distance from each other. The RSI indicator i above its average line, showing bull activity on stellar price.