Over the last 7 days, the Sandbox (SAND) price has stagnated at $0.30. A critical on-chain indicator suggests that holders are bracing for more bearish trading activity.

Sandbox (SAND) price has consolidated around the $0.30 support territory. The last time SAND broke above this level was in July 2021. Despite last-ditch efforts from whale investors, Sandbox’s price looks set for another bearish downswing.

Whales are Making Last-ditch Efforts to Prop Up SAND Price

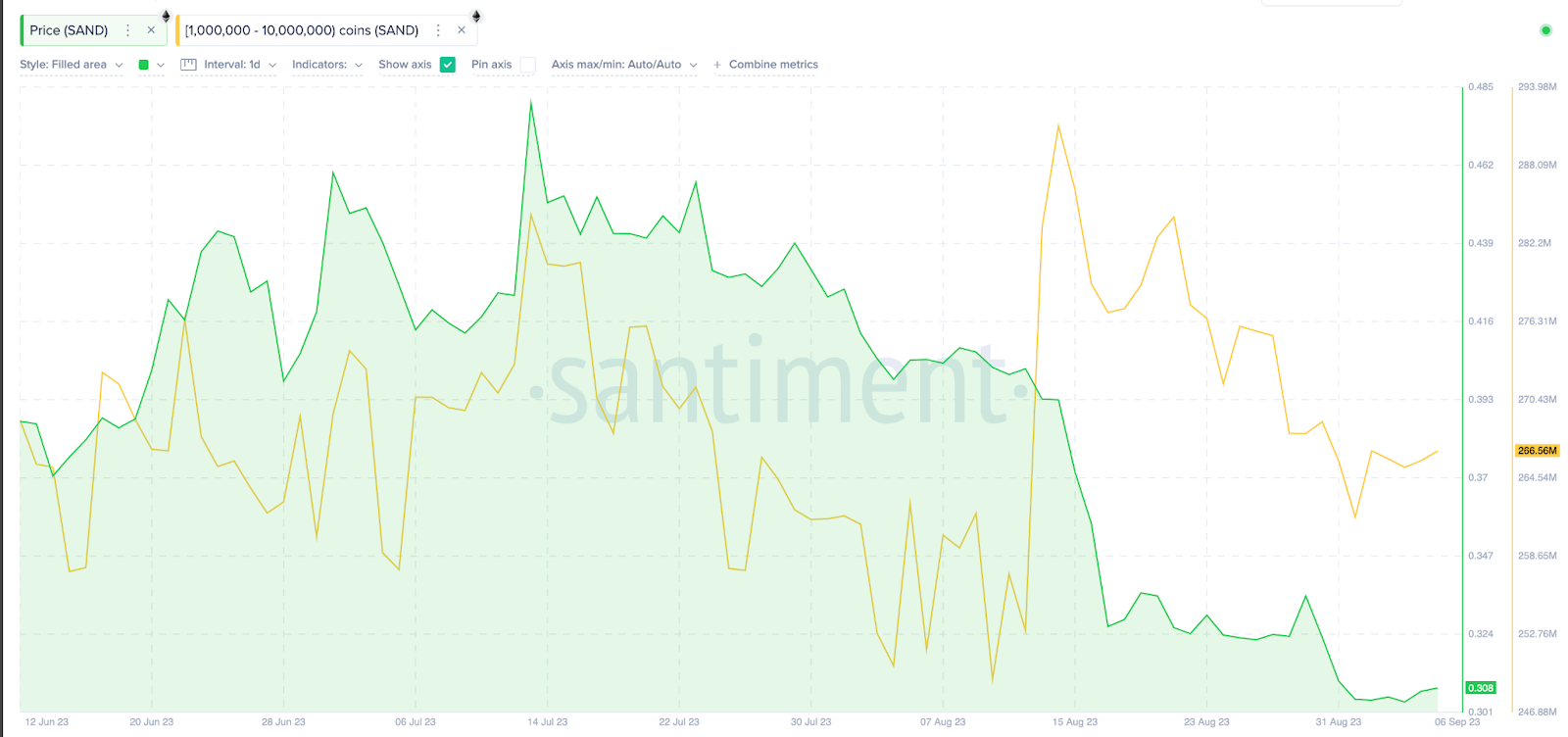

Over the past week, a group of whale investors holding 1 million to 10 million SAND tokens have made visible efforts to prevent a reversal below $0.30.

According to data from Santiment, the whales halted their two-week-long selling frenzy to accumulate 5 million tokens within the first six days of September.

As depicted below, the whales held 261.6 million tokens in their cumulative balances as of August 31. But as prices wobbled below $0.31 on September 1, they started buying again, bringing their balances toward 266.6 million SAND on September 6.

Tracking real-time changes in whales’ wallet balances provides insights into their current trading activity. When large institutional holders increase their balances during a price slump, it suggests they are trying to apply bullish pressure to defend their positions.

However, another key on-chain indicator suggests that the bearish pressure surrounding Sandbox could intensify in the coming days.

Read More: 9 Best Crypto Demo Accounts For Trading

After a Week of Price Stagnation, Exchange Reserves are Mounting

Sandbox holders appear to be bracing for more sell action in the coming days. The CryptoQuant chart below vividly illustrates a considerable increase in SAND deposits to exchange wallet addresses.

Between September 3 and September 6, Sandbox investors moved 14 million SAND tokens into exchanges. This comes after nearly a month of consistent withdrawals.

Exchange Reserves tracks real-time changes in the total balances that investors currently hold in recognized crypto exchange wallets. Typically, when exchange deposits increase, it suggests that holders are looking to sell or swap for other assets.

In fact, the chart above shows that significant Exchange inflows on August 10 preceded the recent SAND price dip. And now, over the last three days, SAND holders have deposited $4.2 million worth of SAND tokens.

This highlights another potential sell action, which could intensify the bearish pressure on the SAND price in the coming days.

Trouble in the Metaverse: 99% of Play-to-Earn Investors Now Counting Their Losses

SAND Price Prediction: Freefall to $0.10?

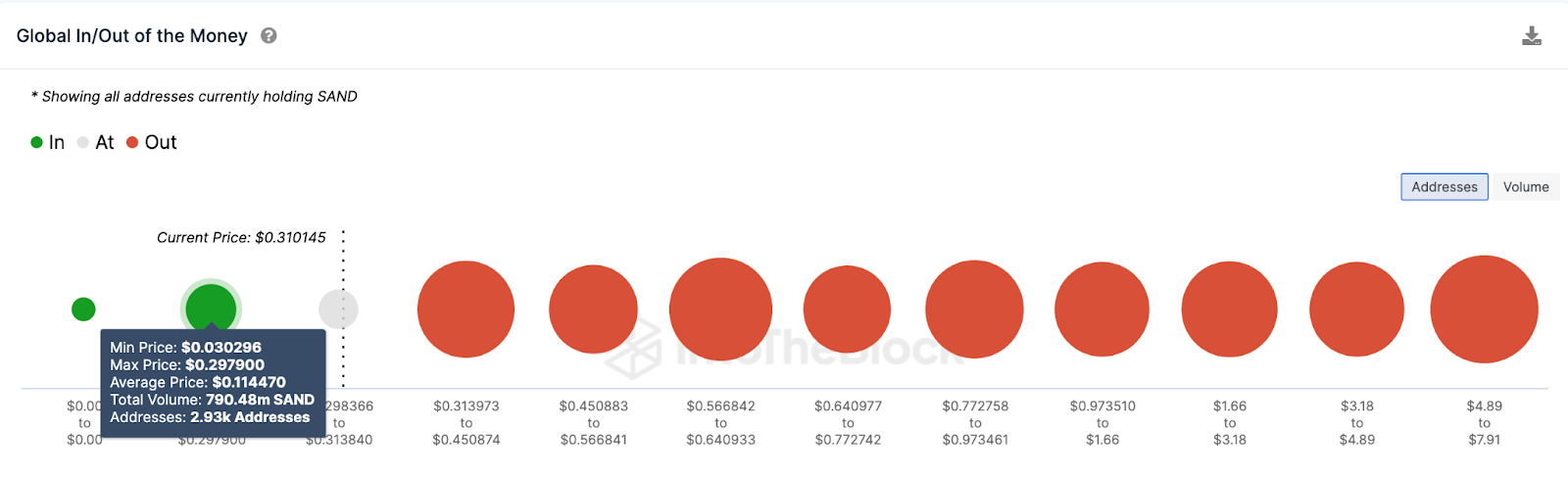

With 98% of Sandbox investors holding a loss, the bears could firmly seize control if the SAND price dips below $0.30.

The Global In/Out of the Money (GIOM) data, which shows the price distribution of the current SAND holders, also validates this prediction.

As seen in the chart below, 976 holders bought 20 million SAND at the minimum price of $0.29. The next significant support could be as low as $0.11 if they cannot keep the bears at bay.

Conversely, if the negative sentiment in the altcoin markets subsides, the bulls could increase toward $0.60. However, 22.19 million addresses bought 380 million SAND tokens at the maximum price of $0.45. They could slow the rally if they close their positions early.

But if that resistance level does not hold, the Sandbox price rally could hit $0.60.

8 Best P2P Crypto Exchanges You Need To Know About in 2023

beincrypto.com

beincrypto.com