In a seismic move between June 5 and 6, 2023, the United States Securities and Exchange Commission (SEC) pursued lawsuits against Binance and Coinbase. This strategic legal offensive reverberated throughout the crypto sector, challenging the established norms.

The heightened regulatory scrutiny initiated intense discourse about classifying specific cryptocurrencies as securities while negatively impacting the prices of many altcoins mentioned in the lawsuits.

Unfurling the SEC’s Stance

At the epicenter of this legal maelstrom, Binance, led by its iconic founder Changpeng Zhao, faces allegations of intermingling billions of users’ funds. The world’s largest crypto exchange by trading volume allegedly breached regulations to accommodate wealthy US traders on its global platform.

SEC Chair Gary Gensler said in a lengthy statement:

“Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law. As alleged, Zhao and Binance misled investors about their risk controls and corrupted trading volumes while actively concealing who was operating the platform, the manipulative trading of its affiliated market maker, and even where and with whom investor funds and crypto assets were custodied. They attempted to evade US securities laws by announcing sham controls that they disregarded behind the scenes so that they could keep high-value US customers on their platforms. The public should beware of investing any of their hard-earned assets with or on these unlawful platforms.”

Read more: 7 Best Binance Alternatives in 2023

Meanwhile, Coinbase confronts accusations of functioning as an unregistered broker. The SEC points fingers at the firm’s prime brokerage, staking, and exchange operations as infringements on securities regulations.

According to Gensler, the SEC alleges that “Coinbase, despite being subject to the securities laws,” blended several functions that are typically separate in the securities markets. These alleged actions might have stripped investors of vital safeguards such as “rulebooks that prevent fraud” and other critical protections.

Additionally, Gensler mentions that Coinbase “never registered its staking-as-a-service program as required by the securities laws.”

Read more: Coinbase vs. Robinhood: Which Is the Best Crypto Platform?

The resolute actions against these two behemoths have ignited widespread speculation. Is the SEC aiming to curtail the growing influence of crypto exchanges, creating a power vacuum for Wall Street?

Identifying Cryptos as Securities

A standout aspect of the SEC’s lawsuits is explicitly naming 19 cryptocurrencies as securities. Binance found itself in the spotlight for trading tokens like Cosmos ($ATOM), Binance Coin ($BNB), Binance USD (BUSD), and COTI (COTI), among others.

At the same time, Coinbase drew scrutiny for facilitating trades in Chiliz ($CHZ), Near ($NEAR), Flow ($FLOW), Internet Computer ($ICP), Voyager Token (VGX), Dash ($DASH), Nexo ($NEXO), and a host of others. Notably, Ethereum (ETH) was conspicuously absent from these lists.

Read more: 46 Cryptos Deemed Securities by the SEC: Consequences of Trading Them

Simultaneously, a cross-section of tokens like Solana ($SOL), Cardano ($ADA), Polygon (MATIC), Filecoin ($FIL), The Sandbox ($SAND), Decentraland ($MANA), Algorand ($ALGO), and Axie Infinity ($AXS) appeared as contentious points for both exchanges.

The implication of such a classification is profound. If these tokens garner the tag of securities, it may lead to their delisting from US exchanges, throttling trade avenues, and presenting enormous regulatory roadblocks for developers and crypto enthusiasts.

A Ripple of Hope in the Storm

However, it is pivotal to note that not all crypto tokens named in legal proceedings endure a bleak fate. An illustrative example is the recent ruling in the SEC vs. Ripple saga by Judge Analisa Torres.

“Defendants’ motion for summary judgment is GRANTED as to the Programmatic Sales, the Other Distributions, and Larsen’s and Garlinghouse’s sales, and DENIED as to the Institutional Sales,” court documents read.

Here, Ripple’s transactions of $XRP on public exchanges were deemed exempt from being classified as investment contracts. This landmark judgment was met with euphoria across the crypto industry.

Read more: Why a $1896 Target for Ripple’s $XRP Is an Outrageous Lie

Gemini co-founder Cameron Winklevoss lauded the decision as a “watershed moment” that reshapes the SEC’s authority over digital assets.

“The sale of $XRP on exchanges is not a security. Which means the sales of all cryptos on exchanges are not securities and SEC and Gary Gensler have no jurisdiction over them,” said Winklevoss.

Yet, for the myriad of tokens listed in the Binance and Coinbase lawsuits, their future remains uncertain, especially after the sell-off that most of these altcoins have experienced.

Cryptos Labeled Securities Underperform

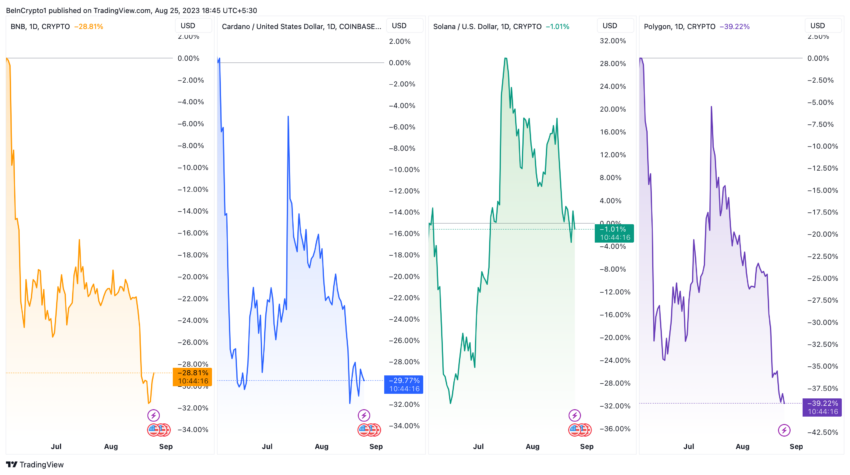

Since early June, the 19 cryptocurrencies identified as securities in the SEC’s lawsuits against Binance and Coinbase have experienced notable declines.

For example, $BNB, $ADA, and MATIC have witnessed a decrease in their market valuations by 28.8%, 29.8%, and 32.2%, respectively. In contrast, Solana’s $SOL token has demonstrated resilience, with a minimal 1.0% dip as of this writing.

Other altcoins, including Cosmos, Internet Computer, Filecoin, and Near Protocol, have undergone even more pronounced corrections. Specifically, $ATOM has decreased by 32.4% since June 5, while $ICP, $FIL, and $NEAR have seen declines of 26.3%, 33.7%, and 26.1% respectively.

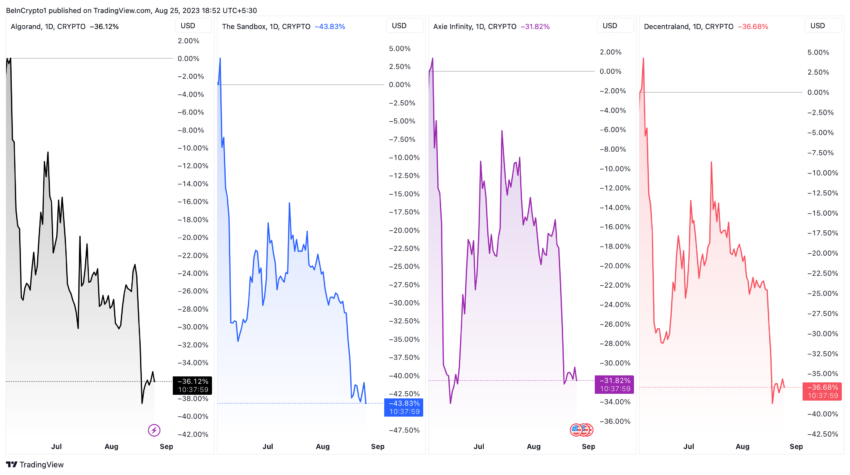

Similarly, the wider crypto market has shown little mercy to Algorand and metaverse tokens like The Sandbox, Axie Infinity, and Decentraland. $ALGO has seen a drop of 36.1%, $SAND by 43.8%, $AXS by 31.8%, and $MANA has plummeted by 36.7%.

Flow, Nexo, Chiliz, and Dash have also faced substantial downturns. In particular, $FLOW, $CHZ, $NEXO, and $DASH have declined by 37.5%, 39.8%, 11.8%, and 40.8% respectively.

Finally, COTI and Voyager Token, the last two altcoins identified as securities in the lawsuits, have not been spared either. Their respective native tokens, COTI and VGX, have fallen by 43.9% and 19.6%.

The importance of clear and consistent regulatory frameworks becomes evident as the line blurs between traditional finance and the emerging cryptocurrency market. While some cryptocurrencies have managed to weather the storm, many face uncertain futures.

beincrypto.com

beincrypto.com