Uniswap (UNI) price dropped to a weekly low of $5.50 on Wednesday, bringing its August 2023 losses toward the 17% mark. As Uniswap flashes green signals, will it be sufficient to trigger an early price rebound?

As Uniswap (UNI) price declines to new lows this week, on-chain data reveals bullish whales have been buying the dip. Will that buy pressure shore investor confidence across the Uniswap ecosystem?

Uniswap Whale Investors Are Buying the Dip

Uniswap has delivered underwhelming returns in the first half of August 2023. But with losses now approaching the 17% mark, whale investors are now looking to cover their positions.

According to data from Santiment, Whale Transactions involving UNI have increased ten-fold this week.

The chart below shows that Uniswap only recorded 3 Whale Transactions on August 12. Remarkably, it hit 38 and 34 Whale Transactions on August 14 and 15, respectively. This represents a more than 1,000% increase in Whale Transactions this week alone.

Whale Transaction Count sums up the daily number of confirmed UNI transactions exceeding $100,000. This noticeable spike in Whale Transaction count means institutional investors are now making big bets on Uniswap again.

Large transactions provide much-needed market liquidity enabling investors to execute high-volume trades at favorable prices. More importantly, the whale presence also boosts the confidence of retail investors.

Consequently, each of these factors could facilitate a UNI price rebound mission in the coming days.

Empower your investments with UNI price predictions.

UNI is Now Approaching Oversold Territory

The UNI price currently sits precariously below $5.60. The price charts show that UNI lost over 16% of its market value in the first half of August. As losses begin to mount, on-chain data suggests that UNI is now well into the oversold territory.

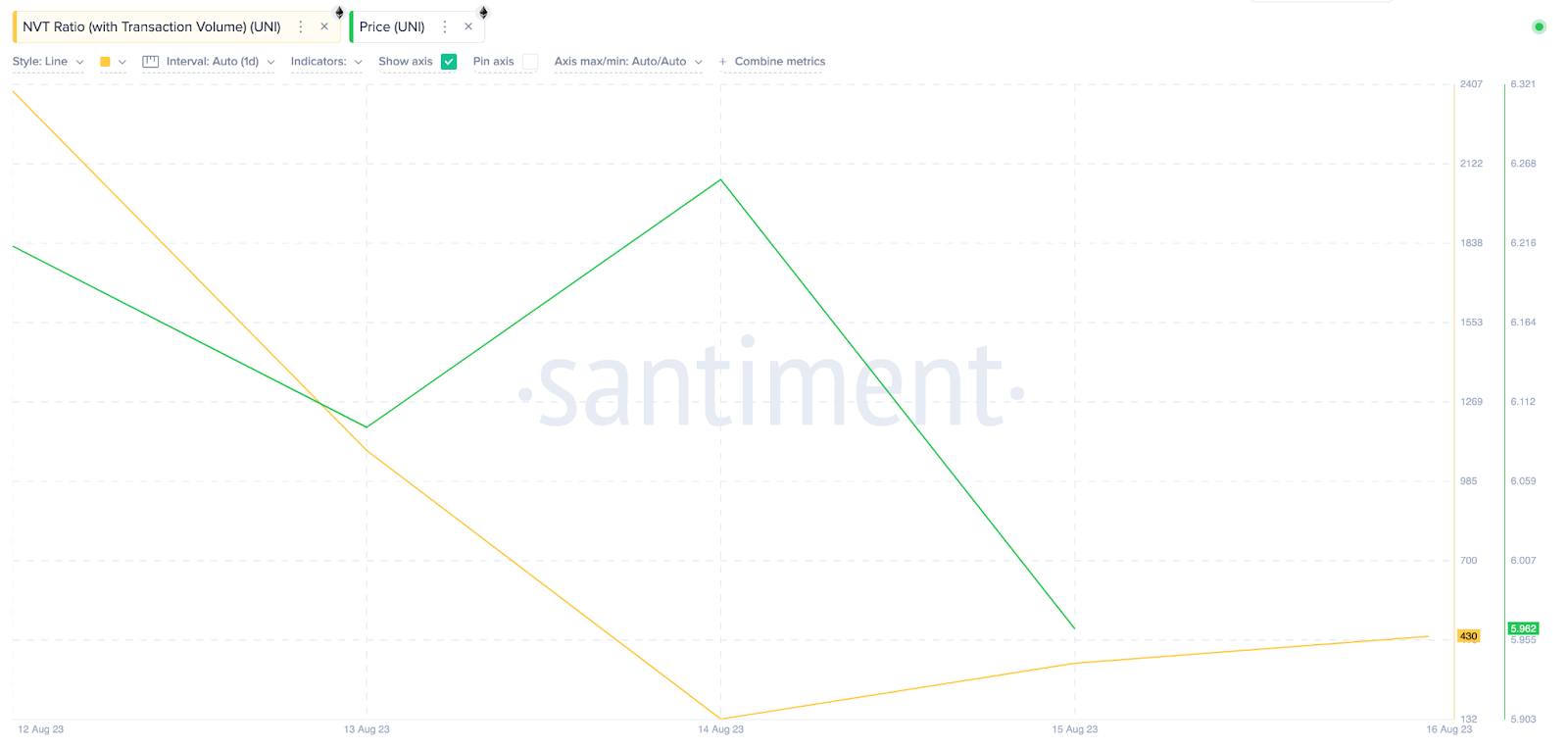

Indicatively, the Network Value to Transaction Volume (NVT) ratio had declined significantly over the past week. Between August 12, and August 16, UNI witnessed a whopping 82% drop in NVT ratio, from 2,383 to just about 403.

The NVT ratio weighs the current market capitalization against the underlying transactional activity. A sharp decline in the NVT ratio means that while market prices are dropping, the network is still experiencing a healthy volume of economic activity on the network.

Typically, this is a bullish signal, suggesting that the current Uniswap transactional activity could spur a price rebound once the sell-pressure subsides.

Check Out the Best Upcoming Airdrops in 2023

UNI Price Prediction: Consolidation Above $5

Drawing inferences from the on-chain indicators analyzed above, the UNI price will likely enter recovery mode in the coming days. As Uniswap flashes vital green signals, the bulls can offer initial support around the $5 range.

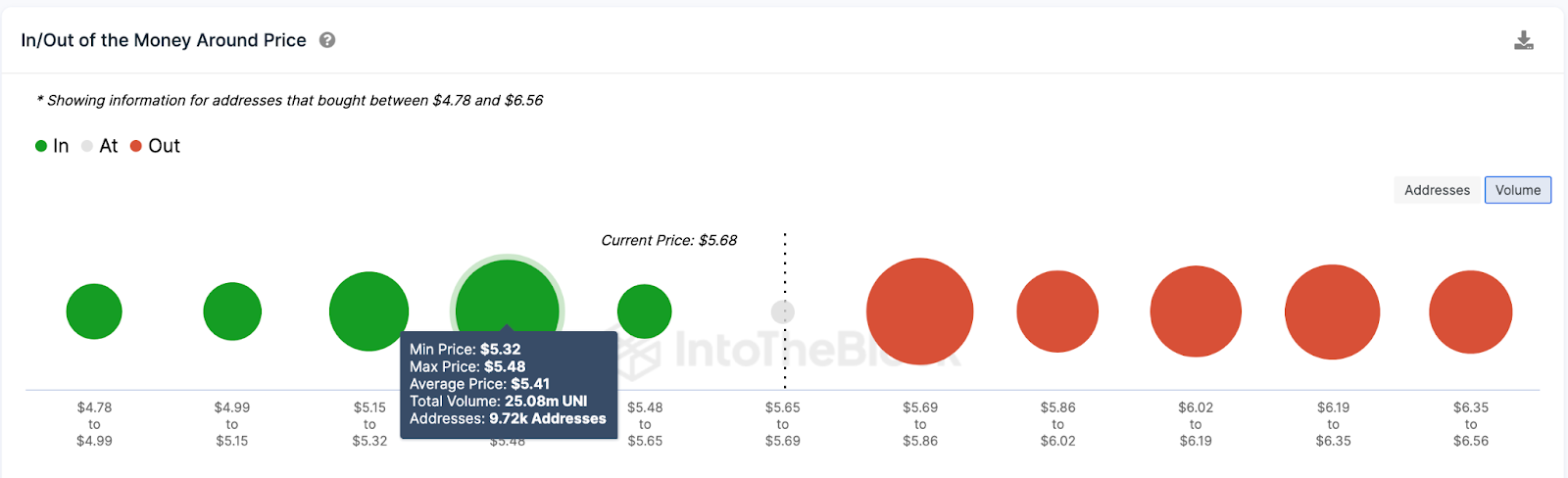

The In/Out of Money Around Price (IOMAP) data, which shows the purchase price distribution of current holders, also supports this optimistic stance.

The chart below shows that 9,720 addresses bought 25 million UNI tokens at an average price of $5.40, which could trigger an early rebound.

However, if that support level cannot hold, the bulls could mount another significant buy-wall at $5.

In contrast, the bulls could trigger an early rebound toward $7. But in that case, the 12,700 holders had bought 18.2 million UNI tokens at an average price of $6.40, which could trigger a pullback.

However, if that resistance level gives way, Uniswap’s price could head toward $7.

beincrypto.com

beincrypto.com