After an underwhelming performance in the second half of July, the OKX exchanged-issued OKB token price entered August with a bang. Can the bulls capitalize on the recent wave of positive media spotlight to hit a new all-time high?

Over the past week, the OKB token has climbed up the crypto top gainers’ chart with a 14% price rally. On-chain data analysis examines the likelihood of the OKX exchange native token reaching a new all-time high.

Why is OKB Price Rising?

OKB token began to rally around August 4 after OKX exchange’s investment arm announced a $1 million Series A stake in Moonbox, a Hong Kong-based AI/Web 3 startup.

On August 7, the team issued another well-received statement confirming that OKX would headline the next TOKEN 2049 blockchain conference. Within 24 hours of the announcement, the native OKB token witnessed a significant spike in new users.

How did these factors propel OKB to a 14% price upswing, and can holders expect a new all-time high in the coming days?

OKB Has Witnessed a Significant Increase in New Users

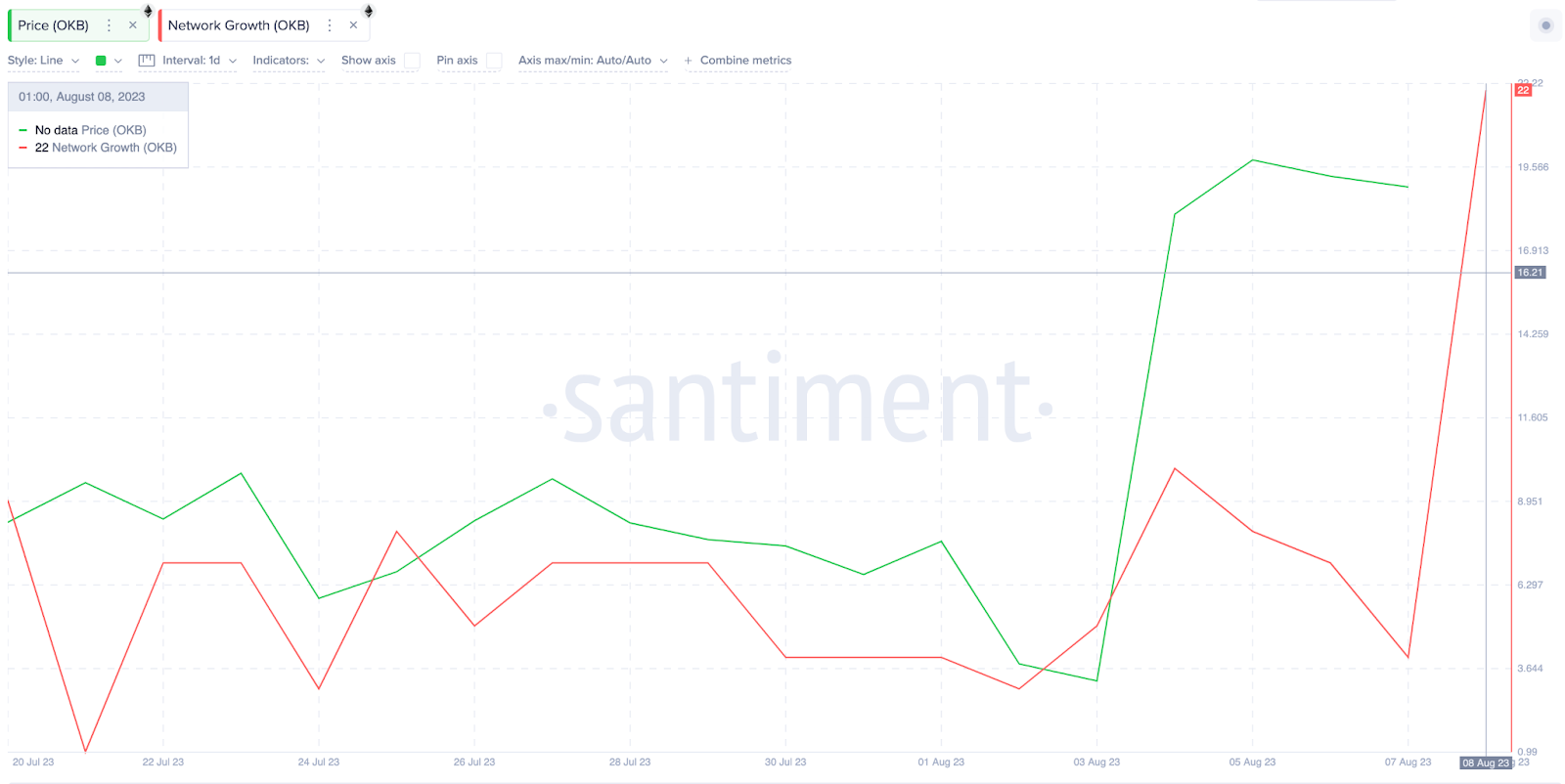

On-chain data suggests that the recent positive media updates have attracted new users to the OKB ecosystem. According to Santiment, OKB had a low Network Growth score of 3 on August 2.

But following the Token 2049 sponsorship announcement on August 7, OKB Network Growth has now increased by 630% to reach a score of 22.

Network Growth measures the rate at which new users adopt a cryptocurrency by aggregating the number of new wallet addresses created daily.

The 630% Network Growth spike observed above underlines the growing demand that the OKB token has experienced this week.

If new users continue to adopt OKB at this rate, the bullish momentum could grow and propel the price to a new all-time high.

Are you ready to foresee your crypto profits? Visit us.

Despite the Price Spike, OKB Still Appears Undervalued

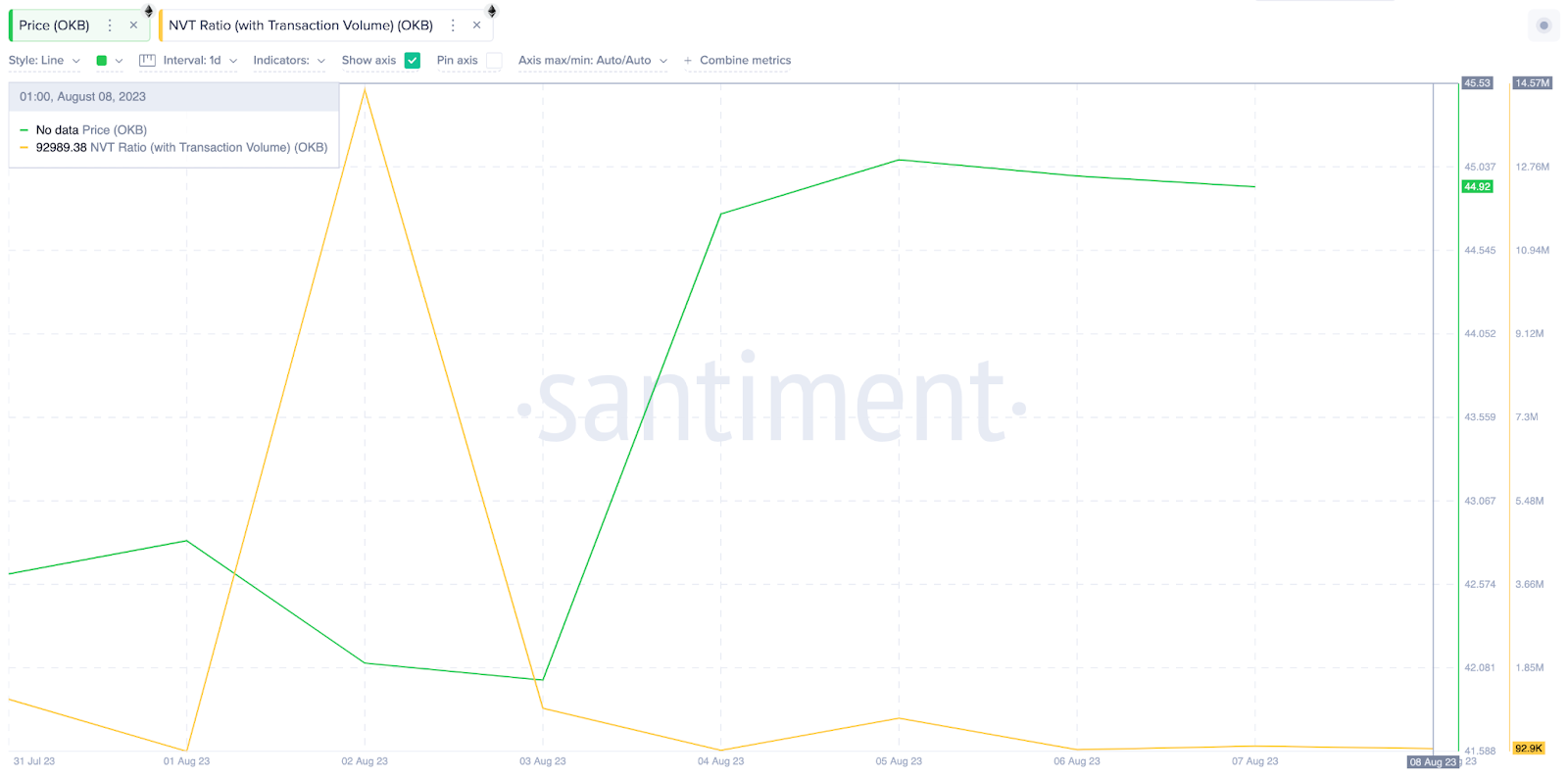

After entering 14% price gains over the past week, OKB still appears to be undervalued. The Network Value to Transaction Volume (NVT) ratio has declined since the Moonbox investment was announced on August 2.

Between August 2, and August 8, OKB witnessed a 94% drop in NVT ratio, from 14.43 million to just about 93,000.

The NVT ratio evaluates the growth in underlying transactional activity on a blockchain network relative to the token price. When it drops, it signals that the token is underbought and could potentially score more gains.

If this analysis holds true, the OKB bulls will like to push beyond the $50 resistance to hit a new all-time high in the coming days.

OKB Price Prediction: A New All-Time High Beckons

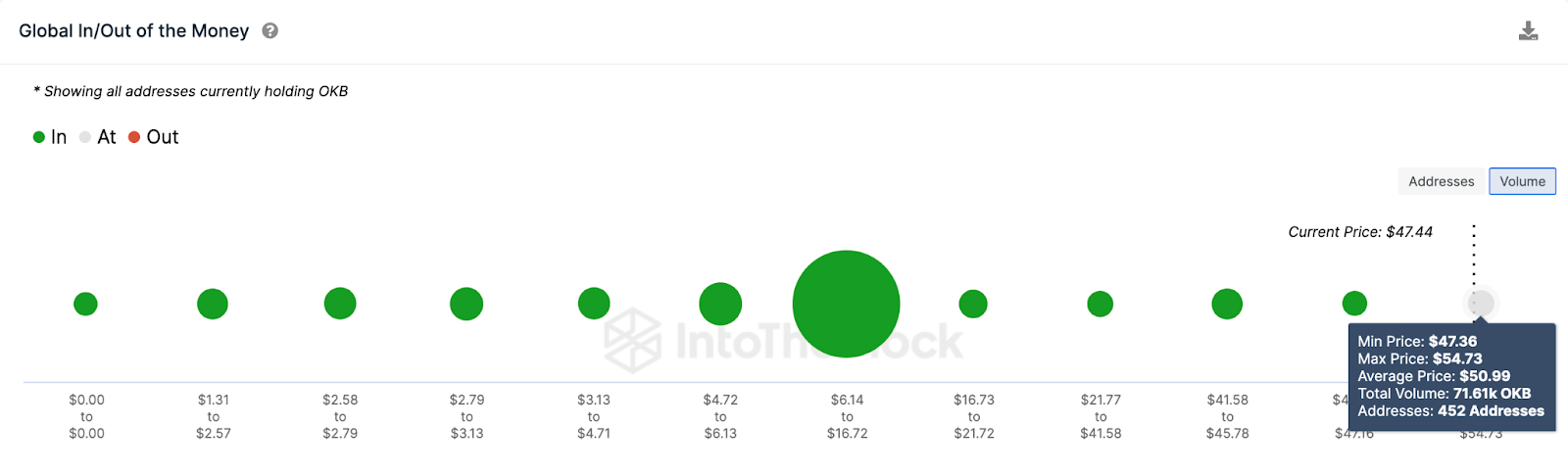

The Global In/Out of Money (GIOM) data shows the purchase price distribution of all current OKB token holders. Currently, it shows that 99% of OKB holders are profitable. Without a significant FUD-inducing market development, they could continue to hold out for more gains.

The $51 territory is the only resistance between the bulls and a new all-time high. As seen below, 452 addresses had bought 71,610 OKB tokens at the average price of $50.99.

If the bulls can sweep past that resistance level, OKB could hit $60 for the first time.

Conversely, the bears could invalidate the optimistic prediction if OKB price drops below the $40 mark. However, 448 addresses that bought 2 million OKB tokens at the average price of $43 can trigger a rebound.

But if that support level does not hold, the OKB price rally could be invalidated and retrace below $40.

beincrypto.com

beincrypto.com