While July started bullishly for the cryptocurrency market, the second portion of the month was bearish. This is especially evident in the total market capitalization decrease ensuing after the July 13 yearly high.

While there is hope that a bullish reversal will begin in August, these four bearish cryptos have a negative outlook, indicating that the worst is yet to come.

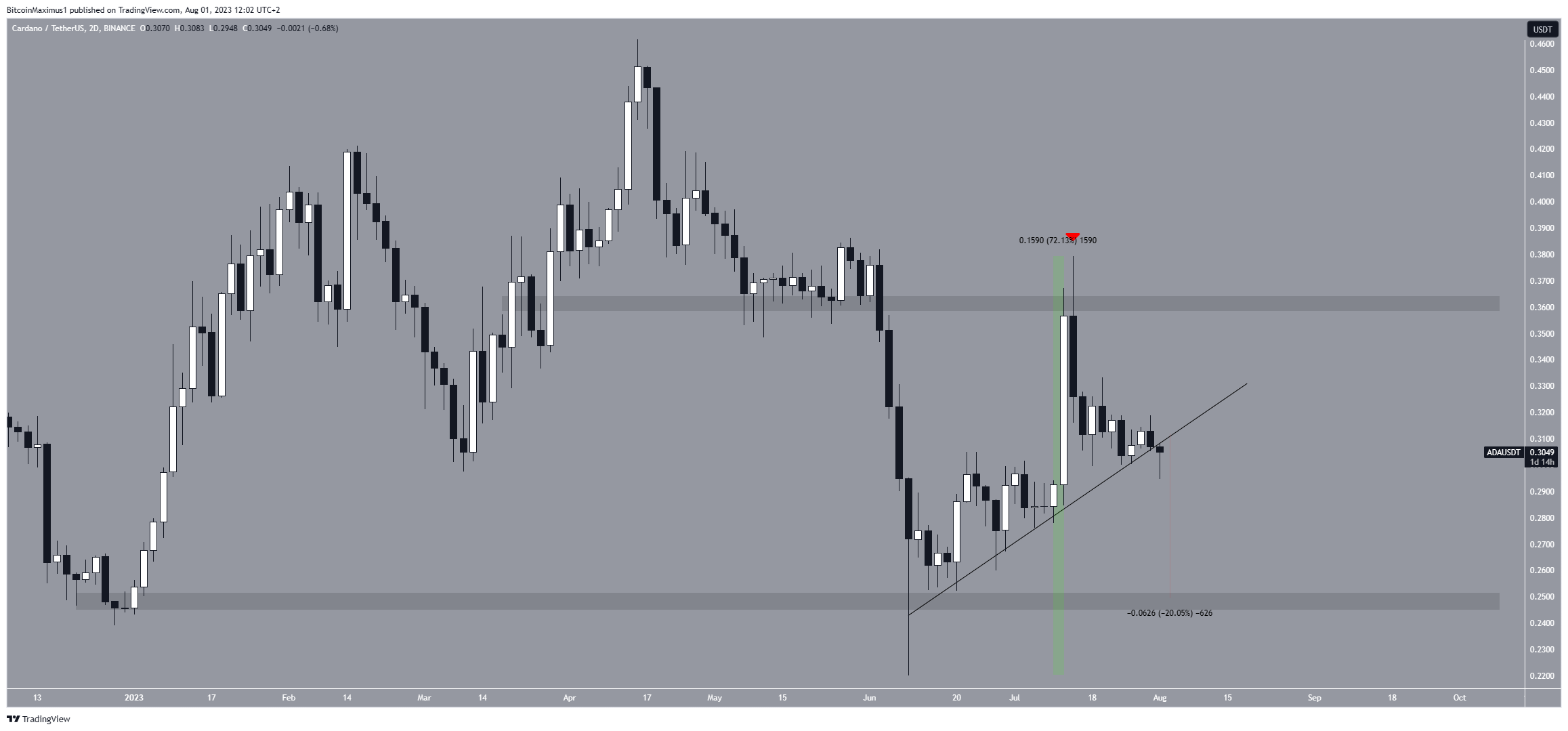

Cardano (ADA) Fall Could Accelerate Due to Lost Support

The Cardano (ADA) price has followed an ascending support line since its yearly low of $0.22 on June 10. The increase was swift and culminated with a high of $0.38 on July 14. This amounted to an upward movement of 72% measuring from the yearly low.

However, the bearish crypto has fallen since. The decrease was catalyzed by a rejection from the $0.36 horizontal resistance area (red icon), which created a long upper wick.

Your crypto compass is here. Navigate with us:

The reason why the rejection is crucial is that it caused a breakdown from the ascending support line on August 1.

If the decrease continues, the next closest support is at $0.25, a drop of 13% measuring from the current price of $0.29. Since this is the final support area before $0.15, a breakdown from it could accelerate the rate of decrease even further.

However, it is worth mentioning that Cardano’s latest upgrade Mithril is a significant improvement in efficiency. Cardano’s founder Charles Hoskinson stated that Mithril will greatly improve performance.

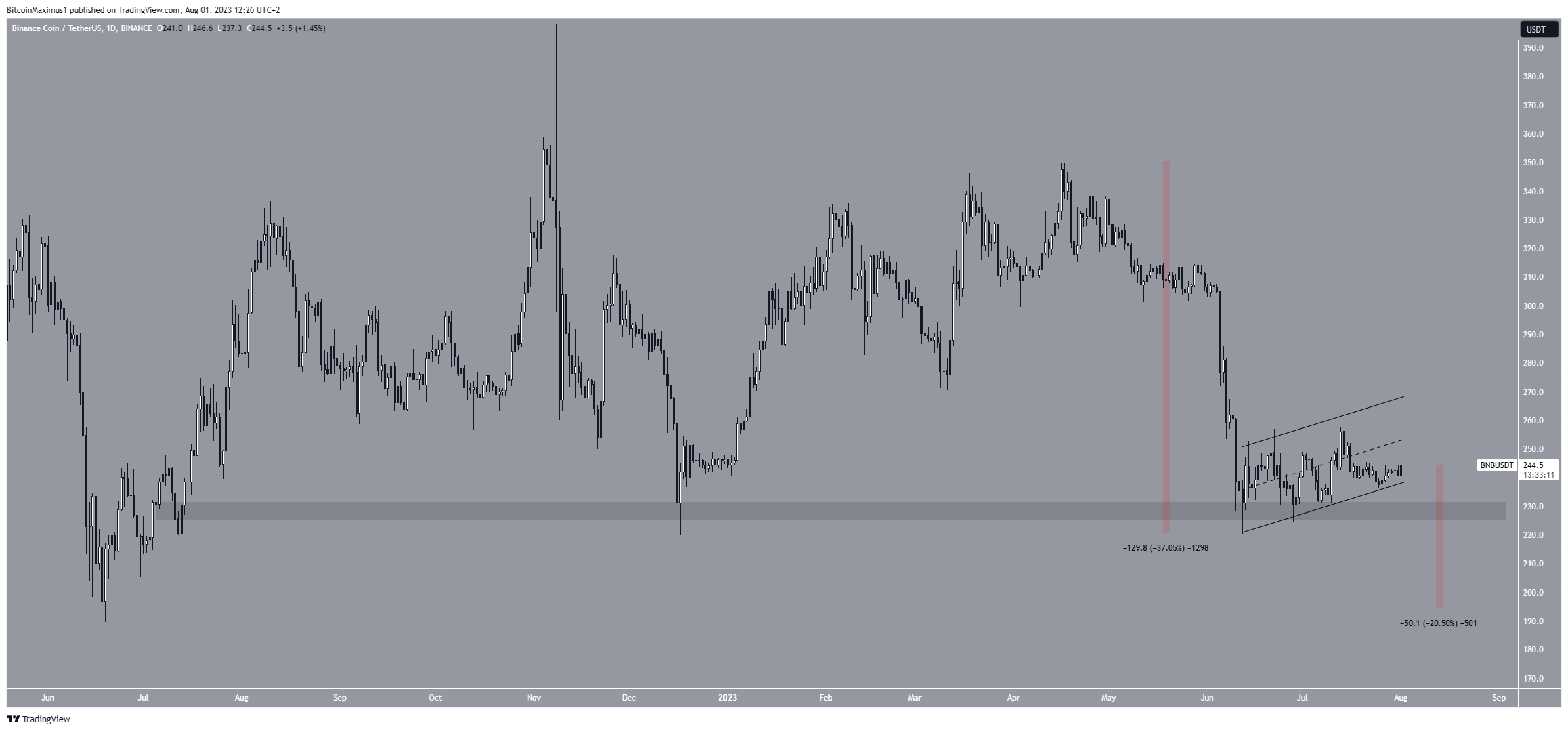

BNB Price Risks Channel Breakdown

The BNB price has fallen since reaching a yearly high of $350 on April 16. The downward movement led to a low $220 on June 12. This was a decrease of 37% measuring from the high.

Afterwards, the BNB price bounced, validating the $230 horizontal area as support. However, the bounce has not let to a significant increase.

Step into the future of crypto with price predictions:

To the contrary, the BNB price has traded inside an ascending parallel channel, which is considered a bearish pattern. The fact that the price trades in the lower portion of this channel further aligns with the possibility of a breakdown.

Since the $230 area is very close to the current price, a breakdown from the channel will likely also cause a breakdown from the $230 area. In that case, the BNB price could fall by another 20% and reach the $190 support, falling to a new yearly low in the process.

Despite this bearish BNB price prediction, a strong bounce at the channel’s support line can lead to an increase towards the resistance line at $270. This could be sparked by the positive news that the Binance exchange received an operational license from Dubai’s Virtual Assets Regulatory Authority.

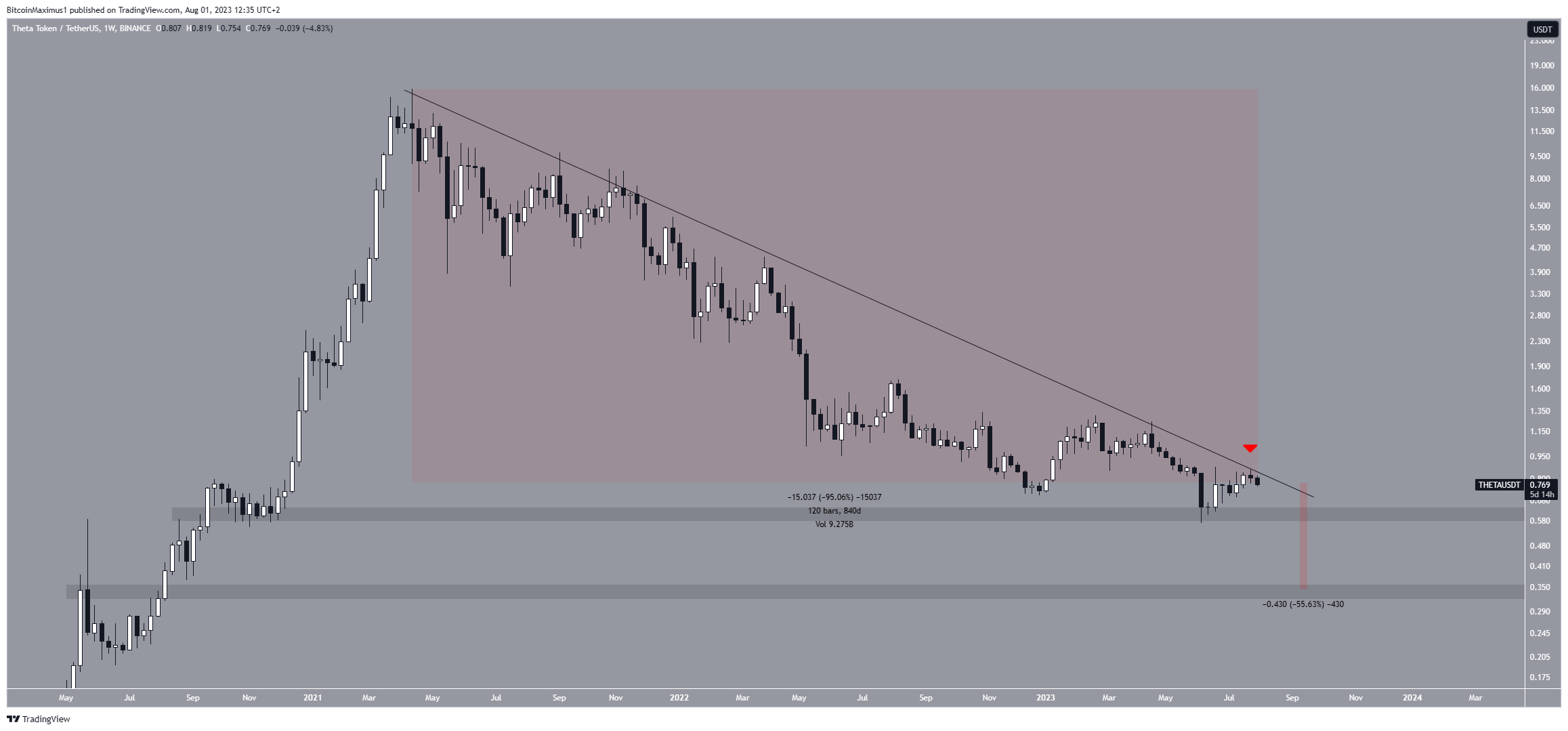

Theta Token (THETA) Price Gets Rejected by Long-Term Resistance

The THETA price has fallen under a descending resistance line since the all-time high price of $15.88 in April 2021. The line has been in place for 840 days and has catalyzed a 95% price decrease.

More recently, the THETA price was rejected on July 24 (red icon). The rejection is worrisome since the price trades just slightly above the $0.60 horizontal support area. If THETA were to break down from the area, it could quickly fall to $0.34, a decrease of 55% measuring from the current price.

However, despite this bearish THETA price prediction, a breakout from the descending resistance line will likely lead to an increase of 100%, taking the price to $1.50.

Curve DAO (CRV) Concludes Bearish Cryptos

The CRV price has increased alongside an ascending support line since November 2022. The support line has caused numerous bounces so far (green icon).

While it seemed that a bounce began on July 31, the CRV price quickly broke down from the line, falling to a new yearly low of $0.48. The breakdown could have been sparked by fears of liquidation in CRV founder Michael Egorov’s loan.

Read More: Best Upcoming Airdrops in 2023

However, the ensuing bounce has caused the price to almost reclaim this ascending support line. Whether CRV is successful in doing so or gets rejected instead could determine the future trend’s direction.

A breakdown will likely lead to a 45% drop to $0.33 while a breakout will likely lead to an increase to the $0.85 resistance area, an upward movement of nearly 50% measuring from the current price.

beincrypto.com

beincrypto.com