Axie Infinity (AXS) price dipped below the critical $6 support level on Wednesday, August 2. On-chain data analysis reveals the critical factors behind the growing bearish momentum.

Like most GameFi projects in the top 50 crypto rankings, Axie Infinity (AXS) has delivered an underwhelming performance in 2023. Since the price surge that followed the much-heralded AxiETH gaming event hosted in Thailand, AXS is now struggling to attract new players.

Will this worsen the bearish AXS price momentum in the coming days?

The Number of New Users Joining Axie Infinity is Dwindling Fast

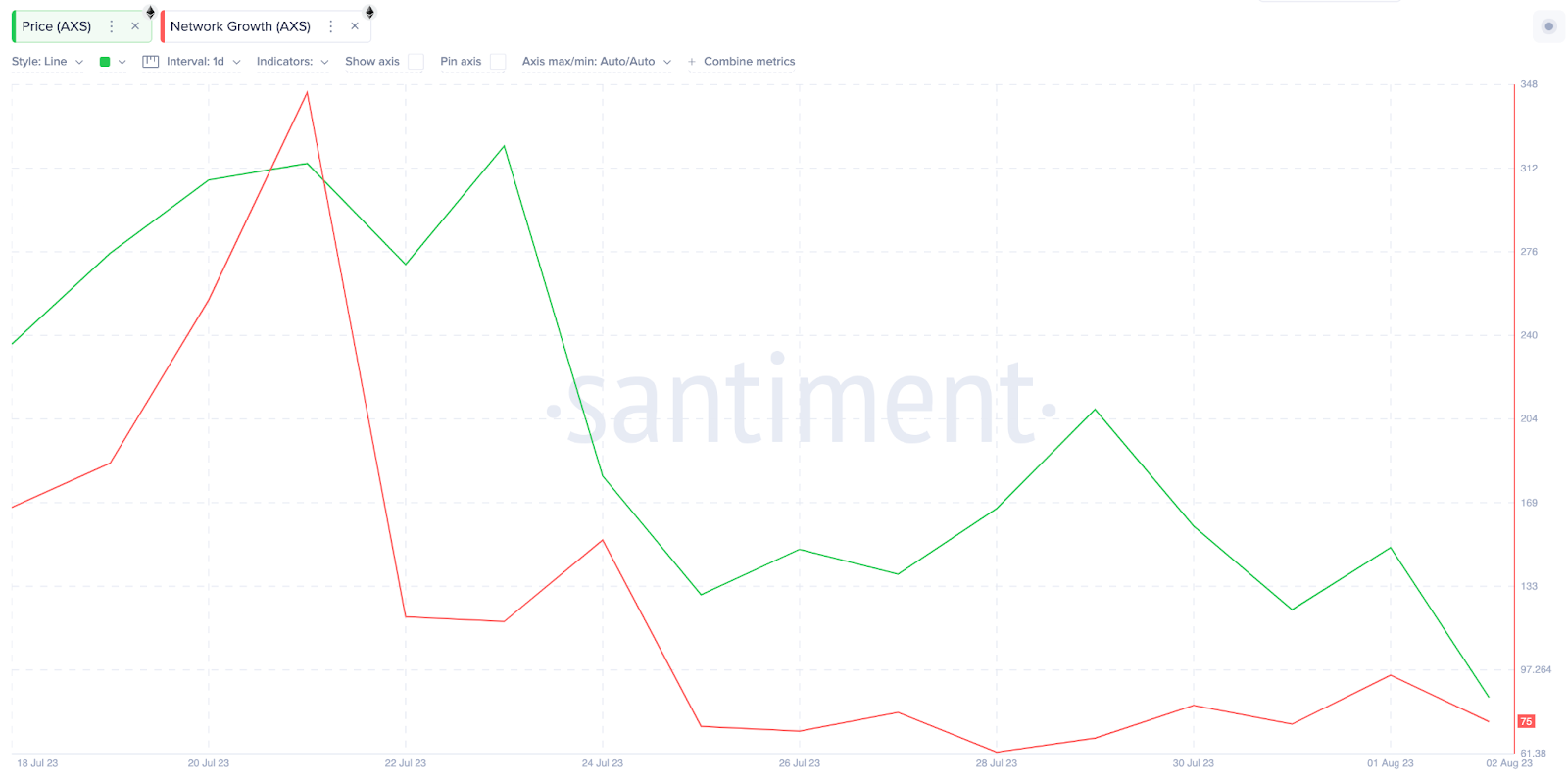

After a significant uptick in July, Axie Infinity has been struggling to attract new users to its GameFi ecosystem in the past week. According to data from Santiment, 345 new AXS wallet addresses were created on July 21. But at the close of Aug 2, the AXS Network Growth has now dwindled to just 75 new addresses.

This 78% decline in Network Growth suggests that a bearish momentum is growing within the Axie Infinity ecosystem.

Network Growth evaluates the daily number of new wallet addresses created on a blockchain network. This provides insight into the rate at which the ecosystem attracts new joiners.

A drop in Network Growth means that the underlying AXS tokens could struggle to find new demand in the coming days. Worryingly, this could further worsen the current bearish momentum and push AXS price further downward.

Long-term Investors are Exiting Amid Mounting Losses

With the price currently sitting at $5.90, AXS is down 58% from its 2023 peak of $13.94 recorded back in January. Amid the mounting double-digit losses, Axie Infinity’s long-term investors are now losing confidence.

Indicatively, AXS Mean Coin Age has declined considerably between July 25 and August 2. The red line in the chart below illustrates how it declined by 65% from 42.73 to 15.14 within the past week.

Mean Coin Age gauges the long-term investors’ confidence by calculating the average number of days that coins in circulation have spent in their current wallet addresses.

When it drops during a price rally, as seen above, it indicates that long-held tokens are on the move. By extension, this means AXS long-term investors are now exiting their positions as hopes of a potential rebound remain bleak.

In conclusion, the dwindling network growth and rising bearish momentum among long-term AXS holders will likely cause further AXS price corrections in the coming weeks.

AXS Price Prediction: Possible Bearish Reversal Toward $5

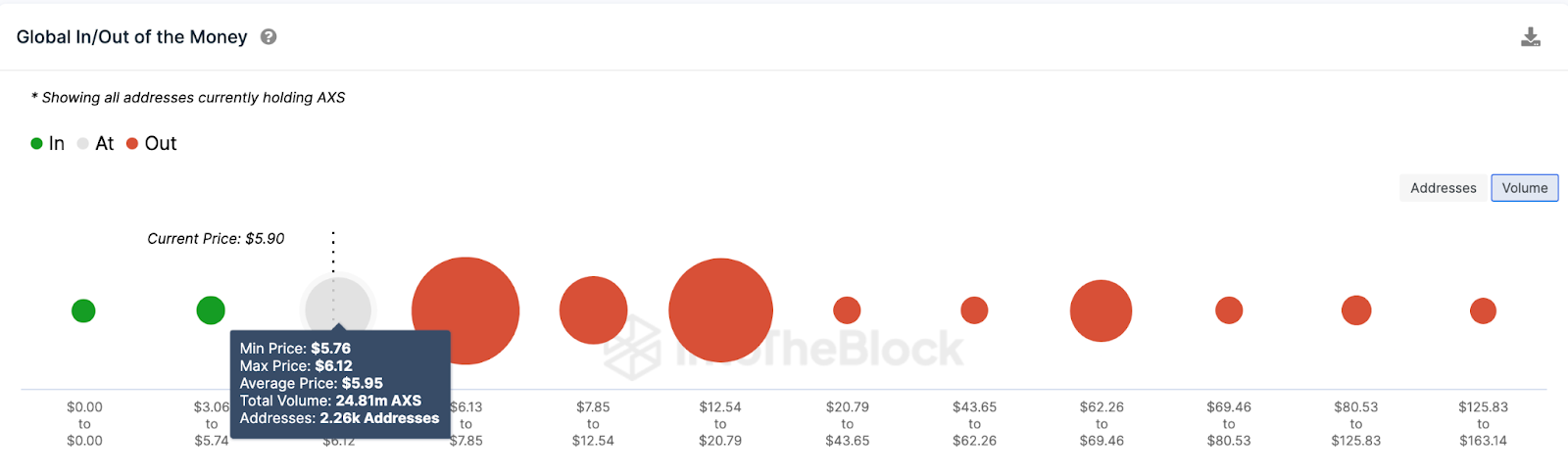

According to IntoTheBlock’s In/Out of Money Around Price (IOMAP) data, the growing bearish momentum will likely push AXS toward $5. As shown below, 2,260 addresses bought 24.81 tokens at the minimum price of $5.76. This is the only significant supply wall between AXS bears and the $5 price target.

If the AXS bearish momentum grows as predicted, the price could drop as low as $4.50.

Still, if the long-investors decide to cut their losses and stop selling, the bulls could force a rebound toward $7. But, 10,170 addresses that bought 103.2 million AXS tokens at the minimum price of $6.12 could pose significant resistance.

beincrypto.com

beincrypto.com