Uniswap (UNI) price has recently reclaimed the $6.50 milestone for the first time since March 2023. Will investors hold out for more gains amid growing sell pressure?

Uniswap (UNI) started the month negatively, dropping toward $5.08 on July 10. However, since then, UNI price has surged 28% to reach a new 4-month peak. With investors’ unrealized profits on the rise, how much longer will they hold?

Some Long-term Investors are Looking to Book Profits Early

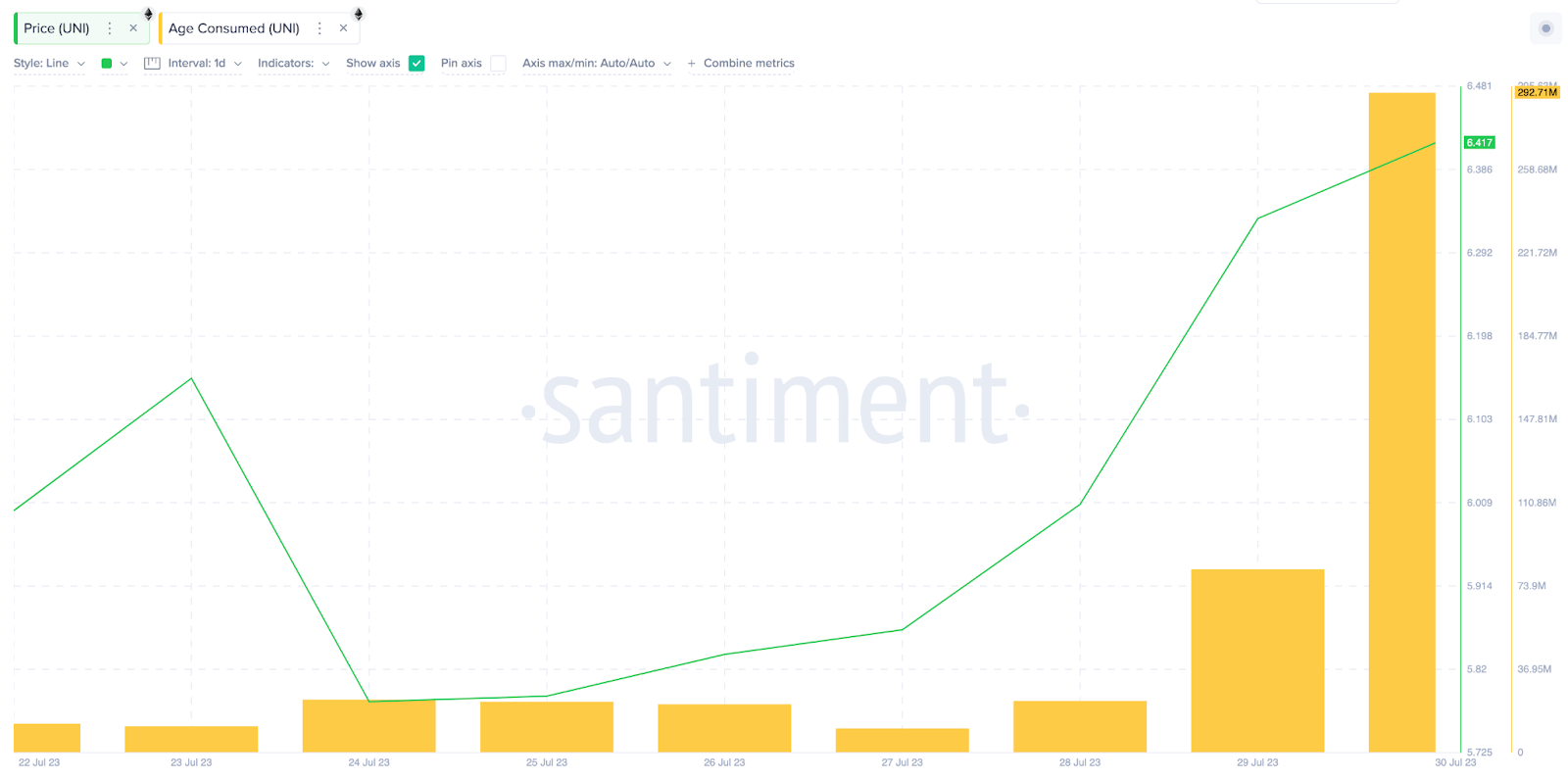

With the UNI price at a 4-month peak, some investors are looking to book profit early. On-chain data compiled by Santiment reveals that Uniswap witnessed a sizeable spike in Age Consumed over the last few days.

As depicted in the chart below, UNI Age Consumed increased astronomically from 11.66 million on July 22 to 292.71 million at the close of July 30.

Age Consumed is computed by multiplying the number of recently traded tokens by the number of days since they were last moved. This, essentially, evaluates the current trading sentiment among long-term investors.

As observed above, a significant spike in Age Consumed means that long-term investors sell more of their holdings. This can trigger a price retracement if it is not matched by sufficient market demand.

With UNI price approaching a euphoric high, it appears that Uniswap long-term investors are looking to book profits early rather than hold out for more gains.

Read More: 11 Best Sites To Instantly Swap Crypto for the Lowest Fees

Uniswap Sell-Orders are Starting to Outpace Buy Orders on Exchanges

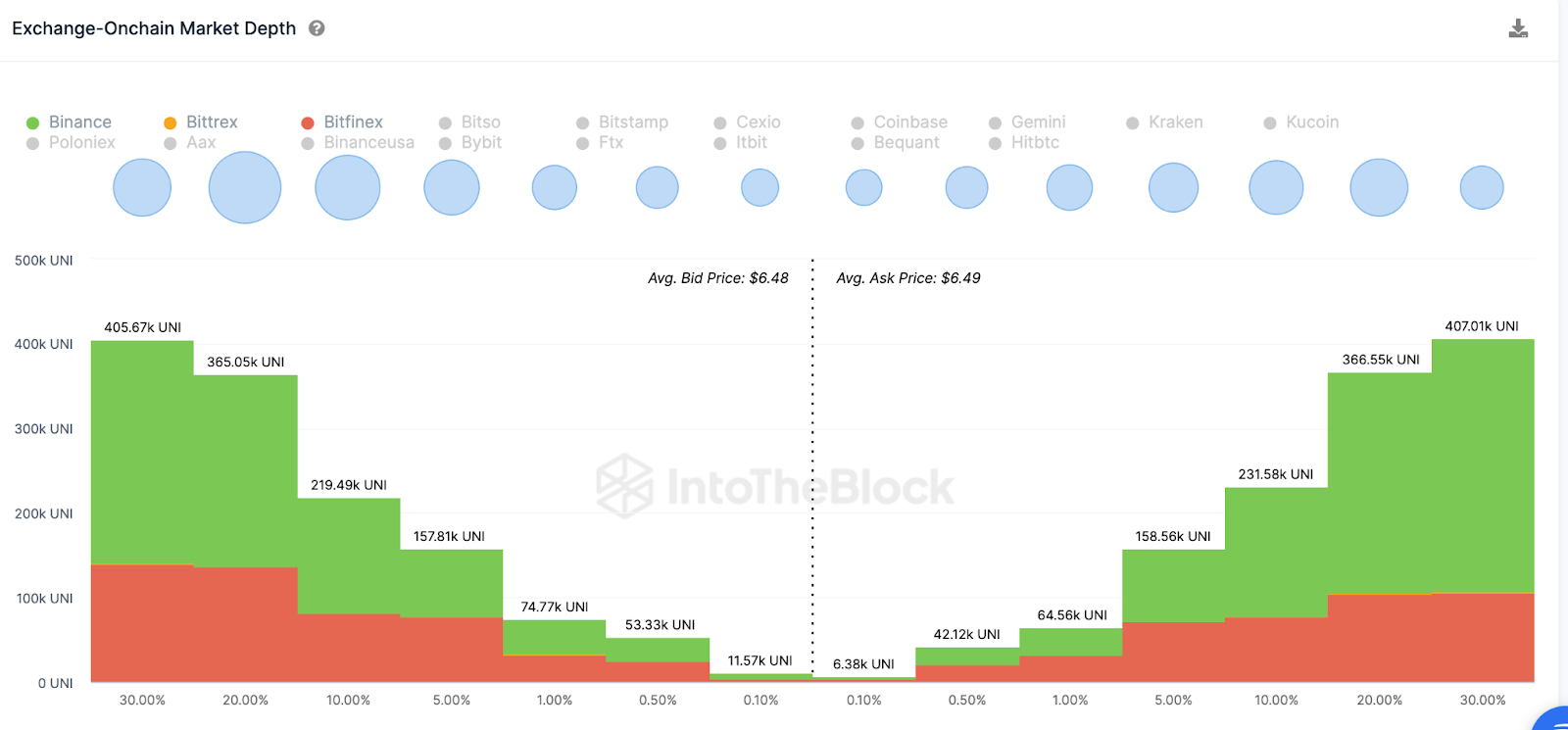

In further confirmation of the growing bearish pressure, UNI sell-orders have now outpaced demand across various crypto exchanges.

According to the Exchange On-chain Market Depth chart below, crypto traders have placed orders to buy 1.29 million Uniswap tokens. But this is marginally lower than the current active sell-orders of 1.31 million UNI.

The Exchange On-chain Market Depth shows the price distribution of the active buy and sell orders placed across various exchanges. When the “ask/buy” side rises higher than the “sell/bid” side, as seen above, it signals impending sell pressure.

Currently, there is a market surplus of nearly 20,000 UNI. If more of the long-term investors decide to book profit, the sell-orders could mount even higher in the coming days.

Your financial future is a click away. Predict crypto prices now:

UNI Price Prediction: A Mild Retracement Toward $5.80

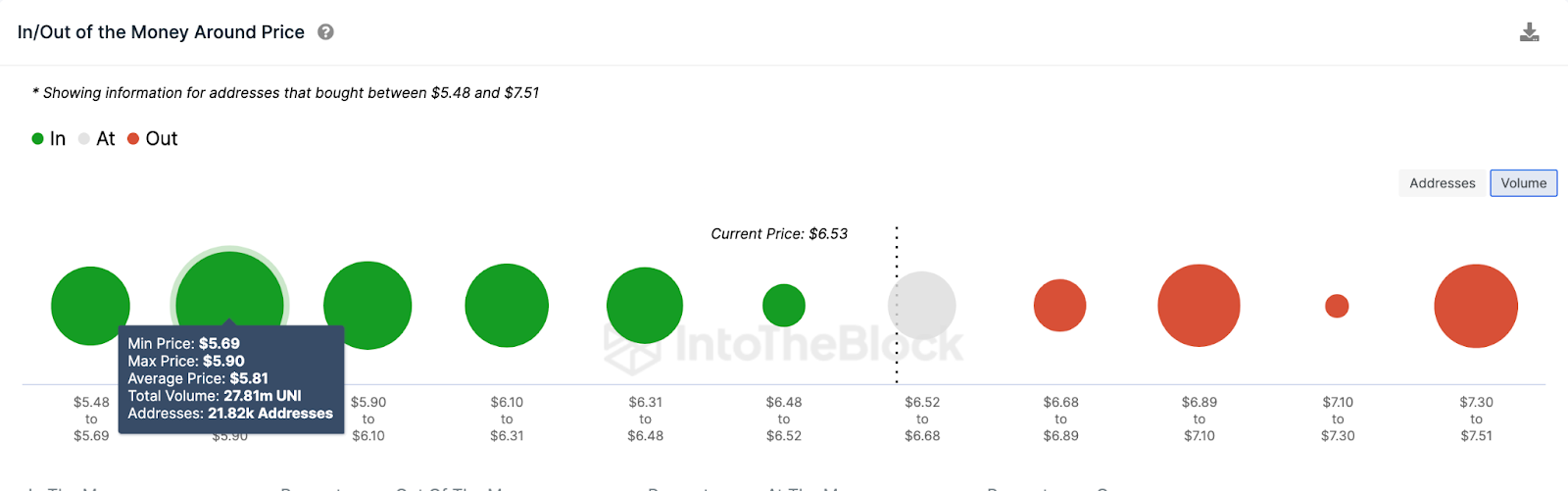

As highlighted above, Uniswap investors will likely sell to book some profit and inadvertently trigger a correction in the coming days. But first the bulls will mount a support buy-wall around $6.

At that territory, 12,400 wallets had bought 16.8 million UNI tokens at an average price of $6.10. To cover their positions, they could attempt to buy more tokens.

However, if that does not hold, the next significant support level for UNI could be $5.80.

Still, the bulls could push the rally toward $8 if the investors decide to hold out for more gains. But UNI will have a hard time breaking above the $7 resistance. As seen above, 5,000 wallets that bought 13.5 million Uniswap tokens at the maximum price of $7.10 could slow the rally.

Nevertheless, UNI could reclaim $8 if that resistance level gives way.

Read More: Top 11 Crypto Communities To Join in 2023

beincrypto.com

beincrypto.com