Compound (COMP), a decentralized finance (DeFi) lending platform, experienced bullish momentum today, surging by 3.69% to $74.66, according to CoinMarketCap. This happened despite the fact that the digital currency ecosystem is going through an emphatic bearish slump, leading to major losses for some of the most popular cryptocurrencies.

COMP’s 24-hour success enabled the altcoin to gain strength against the two market leaders, Bitcoin (BTC) and Ethereum (ETH). At press time, COMP was up 3.13% and 3.75% against BTC and ETH, respectively. Furthermore, the cryptocurrency’s trading volume during this period surged by over 200%, reaching $169,596,804 as a result.

The significant rise in the cryptocurrency’s price has brought short-term gains and propelled its weekly performance further into the green zone to an impressive +11.33%. COMP’s latest feat has piqued the DeFi community’s interest as well, particularly in light of the recent exploit of Curve Finance.

At press time, the Curve DAO (CRV) token had dropped by more than 12% following the compromise of Vyper 0.2.15 due to a defective re-entrance lock. Surprisingly, instead of facing a decline itself, Compound was benefitting from Curve’s troubles, despite both protocols operating in a closely related niche.

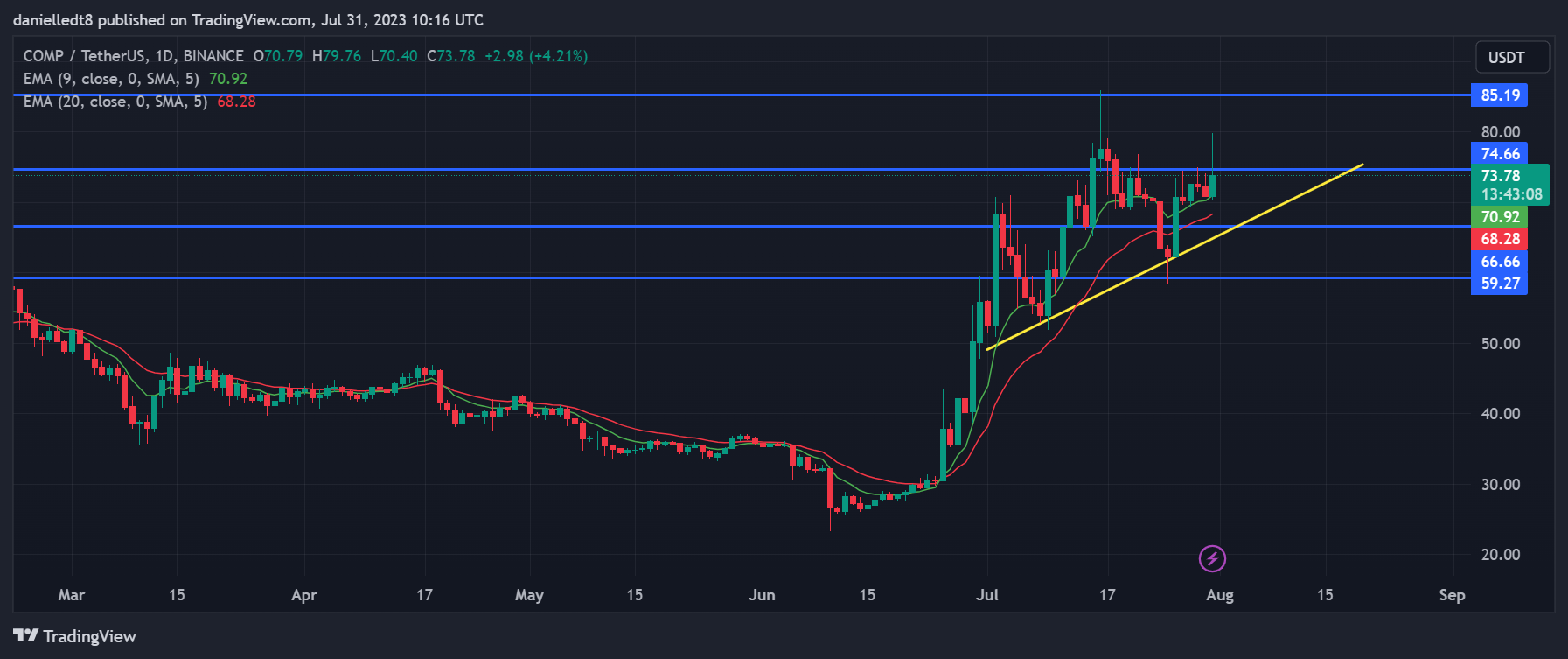

COMP’s price had attempted to break above the key resistance level at $74.66 earlier in today’s trading session, but bears were able to force it back below the mark. As a result, the altcoin’s price was also resting on the 9-day EMA line at press time.

Should it break below this technical indicator, COMP’s price may then be at risk of dropping between the 20-day EMA line at $68.28 and the next major support level at $66.66. Continued sell pressure could even push the altcoin’s price to as low as $59.27 if it breaks below the positive trend line that had formed on its daily chart over the past few weeks.

On the other hand, a daily close above the aforementioned $74.66 mark may lead to COMP rising to $85.19 in the upcoming week. This bullish thesis will be invalidated, however, if COMP closes a daily candle below the 9-day EMA line in the next 48 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com