After encountering resistance at the 24-hour high of $2.26, the Worldcoin ($WLD) price retraced as bears seized market control. However, the $WLD market settled into a consolidation pattern at $2.06. This support level indicates that there is still significant buying interest in the market, which could lead to a bullish reversal soon.

$WLD was trading at $2.22 as of press time, up 0.59% from its consolidation level. This rise indicates buyers are gaining traction and may push the price above the previous resistance level of $2.26. $WLD could see a breakout and upward movement if this bullish trend continues.

$WLD’s market capitalization fell by 0.70% to $245,872,885, while its 24-hour trading volume fell by 13.12% to $166,094,117 during the. Despite these mild dips, the overall bullish sentiment and potential breakout suggest that investors remain bullish on $WLD’s future performance.

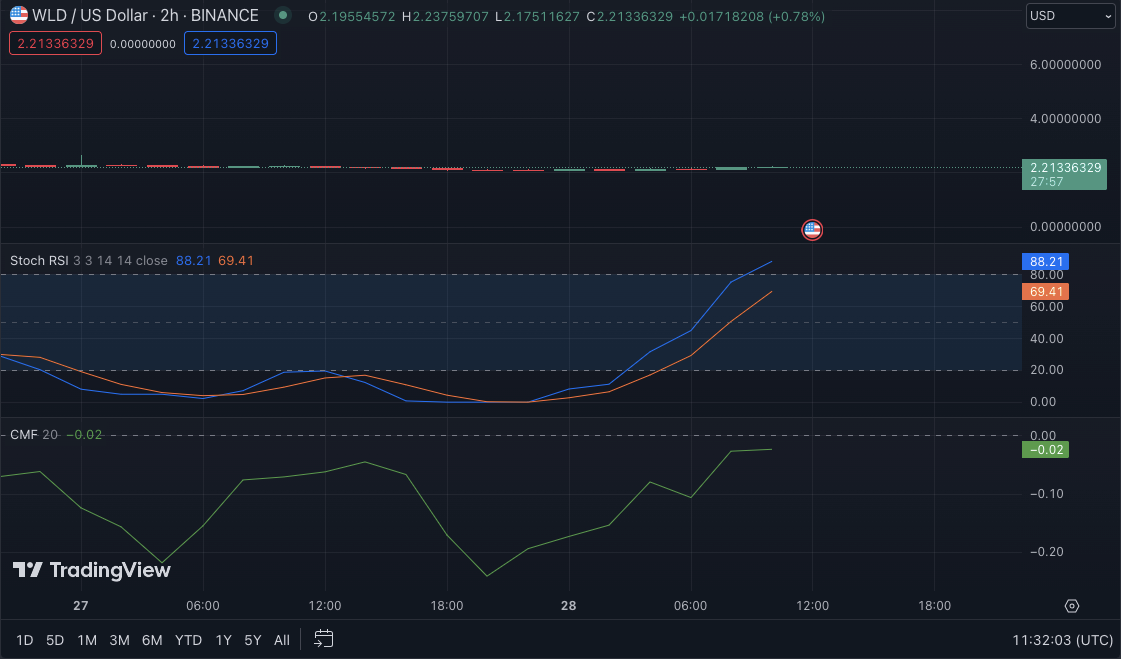

The stochastic RSI on the $WLD/USD price chart is 88.21 and moving upward, indicating that the bearish momentum is weakening and a bullish trend may be forming.

This pattern reflects rising buying pressure and the possibility of further price increases shortly. Furthermore, the positive divergence between the price and the stochastic RSI indicates a possible reversal in the current downtrend, which adds to $WLD’s bullish sentiment.

The Chaikin Money Flow at -0.03 and pointing upwards indicates a slight increase in buying pressure and potential stock accumulation. This trend is consistent with the bullish sentiment indicated by the stochastic RSI and adds to the case for a possible bullish trend in $WLD.

The Aroon up (orange) is 14.29% and points up, while the Aroon down (blue) is 64.29% and points south. This movement reflects a potential shift in momentum in $WLD from bearish to bullish.

The Aroon indicator shows that there is still some selling pressure, but the upward movement of the Aroon up indicates that buying pressure is beginning to gain strength. This trajectory indicates the starting of a bullish trend in $WLD.

With a reading of 2.51, the Rate of Change has shifted into the positive region, adding to $WLD’s upward momentum. The positive reading indicates that the price of $WLD has risen by 2.51% over a given period, indicating potential buying interest and a possible bullish trend. Traders and investors may interpret this as an opportunity to enter long positions in $WLD, anticipating further price appreciation.

In conclusion, $WLD’s price analysis suggests a potential bullish trend ahead, with rising buying interest and positive indicators pointing towards further upward movement.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

coinedition.com

coinedition.com