Optimism (OP), Chainlink (LINK), and Maker (MKR) may be set for substantial moves in the next 7 days as traders look to profit from the high levels of volatility currently in the market. Meanwhile, CoinMarketCap indicates that the total cryptocurrency market cap was able to recover 0.32% over the past 24 hours – taking the total to around $1.17 trillion at press time.

The market dominance of Bitcoin (BTC) dropped slightly over the past day of trading. Although its dominance only fell by 0.05%, altcoin traders may still try to identify trade opportunities for smaller capped cryptocurrencies in the coming week.

Optimism (OP)

According to CoinMarketCap, in the last 24 hours of trading, the price of OP experienced a slight drop of 0.15%. As a result, the cryptocurrency was valued at approximately $1.47 at press time. Unfortunately, this decline in price also impacted its weekly performance, pushing it further down to -1.50%.

A symmetrical triangle was present on OP’s daily chart, which suggested that the altcoin’s price may break out in the coming week. Furthermore, technical indicators suggested that this potential breakout may be towards the downside.

Firstly, a bearish technical flag was on the verge of being triggered with the MACD indicator, as the MACD line was looking to cross below the MACD Signal line. In addition to this, OP’s price had dropped below the 9-day EMA line over the past 48 hours. It also broke below the 20-day EMA line earlier today but was able to recover above the technical indicator.

Should OP close today’s daily candle below the 20-day EMA line at $1.437, then the altcoin’s price may be at risk of testing the crucial support at $1.320. A break below this level may even result in OP dropping to $1.015 in the following couple of days.

On the other hand, a daily close above the 9-day EMA line at $1.486 today may result in OP flipping the $1.690 resistance into support. Continued buy pressure may also push the cryptocurrency’s price to the next key resistance at $2.050.

Chainlink (LINK)

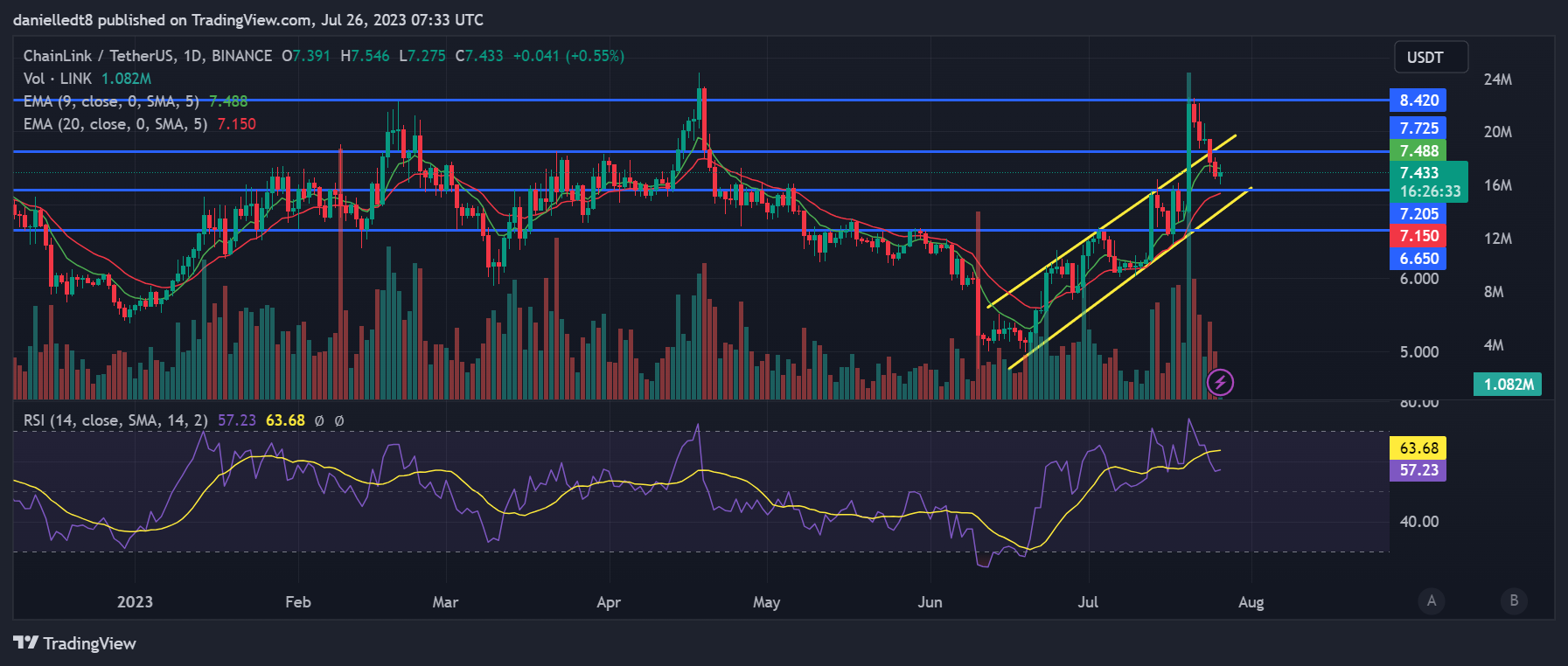

Over the past 24 hours, LINK also experienced a decrease in its price, dropping by 0.90% to trade at $7.44 at press time. However, despite this recent dip, LINK remained in a positive position over the past seven days, showing a growth of more than 7% for the past week.

Moreover, over the past day, the altcoin’s 24-hour trading volume surged by 9%, leaving it at $236,412,647. Meanwhile, its market cap of $4,004,142,227 meant that LINK was ranked as the 20th largest cryptocurrency in terms of market capitalization.

LINK’s price recently re-entered into a positive price channel that had formed on its daily chart over the past few weeks after its price started a bearish sequence over the past few days. This decrease in price also pushed the altcoin below the 9-day EMA line, where it continued to trade at press time.

If LINK closes today’s daily candle below the next major support at $7.205, then it may fall below the aforementioned price channel to test the next support at $6.650 in the upcoming week. On the other hand, LINK’s price rebounding off of the $7.205 support in the next 24-48 hours may lead to it breaking above $7.725.

Continued buy pressure could elevate the altcoin’s price to as high as $8.420 in the coming week as well. One technical indicator to keep an eye on is the daily RSI. This indicator showed that LINK was in neutral territory and suggested that there was still room for LINK to rise before it will be considered overbought.

In addition to this, the daily RSI line was trading below the RSI SMA line at press time. However, the two lines were looking to cross. Should this cross happen, it may signal that buyers have enough strength to rise to $8.420 in the following few days.

Maker (MKR)

In contrast to OP and LINK, MKR witnessed a surge of over 5% in its price during the past day of trading, resulting in the cryptocurrency being valued at $1,152.31 at press time. This 24-hour success also translated into a remarkable 12.08% growth in MKR’s weekly performance.

Additionally, MKR was also able to strengthen against both Bitcoin (BTC) and Ethereum (ETH) by 4.61% and 4.71%, respectively. Meanwhile, the altcoin’s 24-hour trading volume stood at $125,770,610, which was a 44.04% increase from the previous day.

MKR was able to close a daily candle above the $1,118 resistance over the past 48 hours, ultimately flipping the level into support. However, the altcoin’s price was trading dangerously close to the upper band of the Bollinger Bands indicator at press time. This may result in MKR’s price falling in the coming 24-48 hours.

If this bearish thesis is validated, then MKR could drop below the recently-flipped level at $1,118, and potentially drop to the 9-day EMA line at $1,072 in the coming days. Should the cryptocurrency’s price lose the support of the 9-day EMA line, then it will be at risk of falling to $1,000 in the next week.

On the other hand, if MKR is able to close the next 48 hours above $1,118, then it could break above the upper band of the Bollinger Band. It may then also attempt to challenge the next major resistance level at $1,305 in the upcoming week.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com