Barely 48 hours after the latest 3.63 million token unlock event, Axie Infinity (AXS) price has retraced 8%, hitting the $6 mark on Tuesday. With the Axie Infinity sell-off in full swing, where will AXS price find support?

On June 22, Axie Infinity increased its circulating supply by another 3.6 million tokens. This latest token unlock has brought the total emission over the past 1 year to 31.6 million AXS.

As expected, this inflationary pressure of $20.6 million worth of newly-minted tokens has triggered a network-wide Axie Infinity sell-off.

Long-Term Axie Infinity Holders have started to Sell-Off

The June 22 Token unlock was allocated as staking rewards for holders who locked up their tokens in dedicated smart contracts.

Barely 48 hours after the completion of the token allocation, on-chain data shows that a number of long-term holders have started selling again.

As seen below, AXS Age Consumed has spiked 250% from the figures recorded prior to the token unlock event. Specifically, between July 20 and July 25, the Age Consumed values increased from 1.54 million to 5.43 million.

Age Consumed tracks the rate at which long-term holders are trading their tokens. Essentially, it is derived by multiplying the number of recently traded tokens by the number of days they spent in their previous wallet addresses.

Persistent spikes in Age Consumed are considered a bearish signal, indicating that, on average, long-term investors are selling more of their holdings.

With the anticipated staking rewards-based token unlock now completed, they have a lesser pecuniary incentive to keep HODLing. Hence they are likely to intensify the Axie Infinity sell-off in the coming days

And notably, considering that long-term holders currently control 63% of the total AXS supply, they could influence the price significantly.

Read More: Best Upcoming Airdrops in 2023

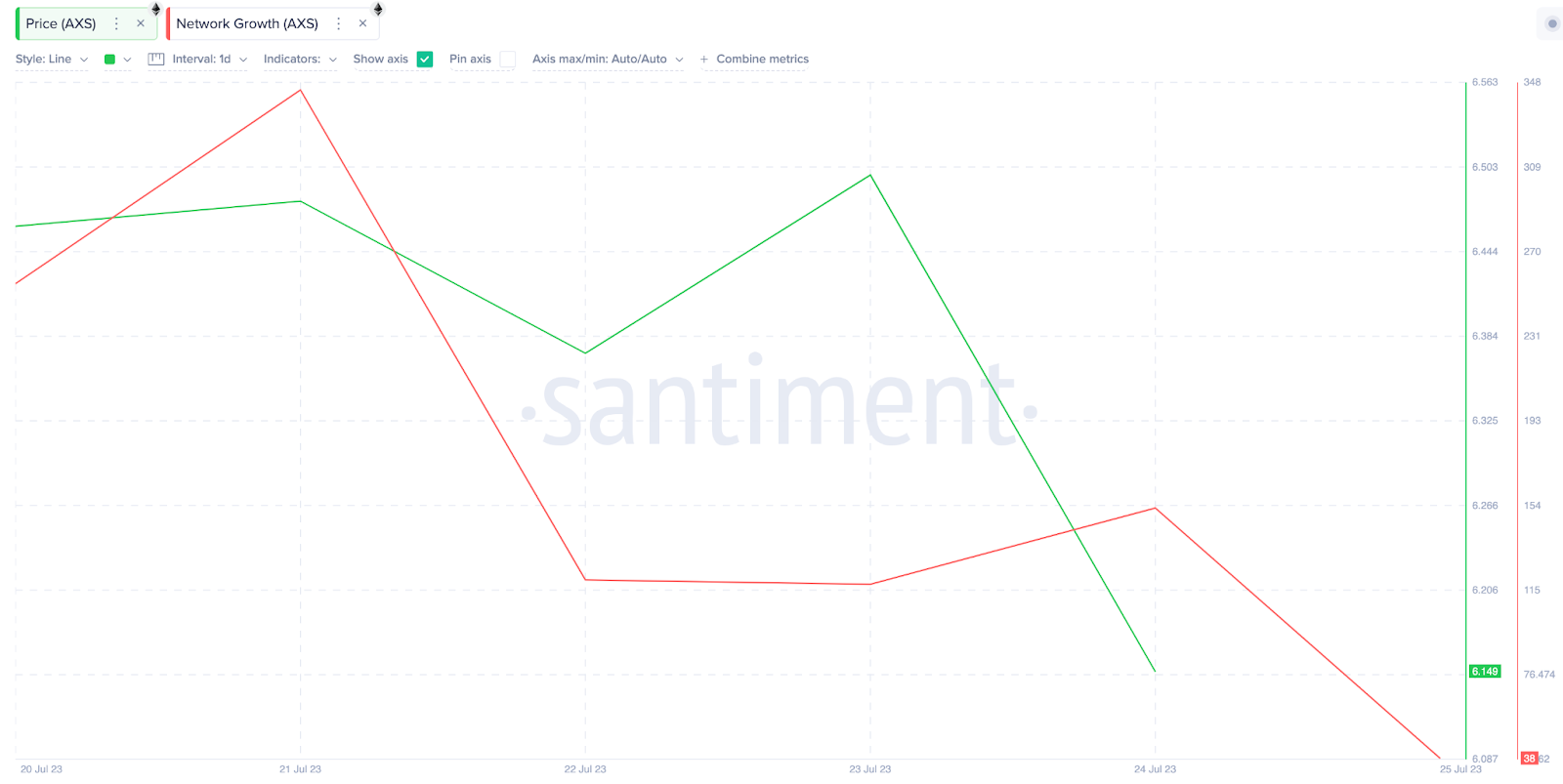

Slowing Network Growth Could Result in Excess Supply

On-chain data shows that Axie Infinity’s new-user acquisition rate is in a downtrend. The chart below depicts that on July 19, 345 new AXS wallet addresses were created. But as of July 24, it has dwindled to just 153 new addresses.

This 55% drop in user acquisition rate could impact price action significantly in the coming weeks.

Network Growth measures the rate at which a blockchain network attracts new users. A drop in Network Growth means that the underlying token may struggle to attract sufficient demand in the near future.

With the freshly injected $20.16 million gradually making its way into several exchanges, this demand dearth could exacerbate the sell-offs impact.

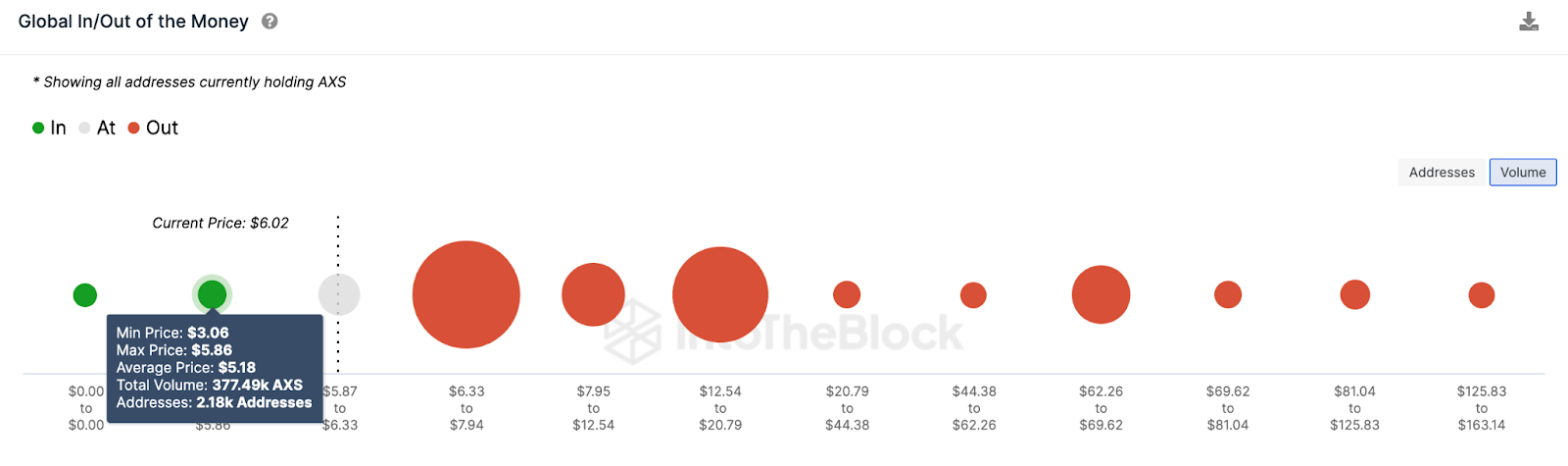

AXS Price Prediction: The Bears Could Force a Downswing to $5

Considering the on-chain indicators identified above, AXS bears will likely make an audacious move to retest $5.0. However, the bears must first scale the critical support level at $5.20.

At that territory, 2,180 investors had bought 378 million AXS tokens at the average price of $5.18. It could trigger a rebound if they mount a buy-wall to cover their long positions.

Nevertheless, if long-term holders intensify the Axie Infinity sell-off, AXS could inevitably retrace toward $4.50.

Still the bulls have a slim chance to wrestle control if AXS price rebounds above $7. However, this is unlikely because 9,250 investors that purchased 125 million AXS at the average price of $6.97 could book profits and repel the rally.

Nevertheless, if they can flip the $7 resistance, AXS may rally toward $8.50.

beincrypto.com

beincrypto.com