The world of cryptocurrencies is a captivating and rapidly evolving landscape, where price movements can sway within a matter of hours. Traders, investors, and enthusiasts alike are constantly seeking insights into the recent trends of prominent cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Dogecoin (DOGE), Chainlink (LINK), Magic Internet Money (MIM), Stellar (XLM), and Augur (REP).

In this article, we conduct a comprehensive price analysis of these coins, examining their recent price movements, key support and resistance levels, and potential trading opportunities. By delving into the market dynamics of these cryptocurrencies, we aim to provide valuable insights to navigate the ever-changing world of digital assets.

Bitcoin (BTC) Price Analysis

Bitcoin (BTC) continues to show resilience in the market with its current price of $30,004, with a slight uptrend of 0.86% in the past 24 hours. Despite facing periodic volatility, Bitcoin maintains its position as the leading cryptocurrency by market capitalization. Upon analyzing the daily chart, we can observe a bearish double-top pattern forming close to the significant resistance zone at $30,000.

Furthermore, the price is facing robust dynamic resistance from the middle-trendline of the ascending channel, leading to some degree of rejection. Moreover, there is a prominent and extended divergence between the price and the RSI indicator, signaling a potential change in market conditions. Should the current supply at this critical region outweigh the demand for the cryptocurrency, the next support level to watch for would be around $28,500, which coincides with the 100-day moving average.

Ethereum (ETH) Price Analysis

Over the past week, Ethereum has displayed a lack of clear direction, resulting in indecision among traders. This allowed sellers to gain control of the price action, ultimately leading to a 5% loss by the end of the week. Despite this correction, Ethereum managed to hold above the crucial support level at $1,820. As of now, ETH is trading at $1,901, with a 0.74% increase in the past 24 hours.

Currently, the cryptocurrency faces resistance at the $2,000 mark. Although ETH attempted multiple times to establish this level as support, buyers lacked the necessary strength, causing the price to fall below it on each attempt. Looking ahead, it appears that Ethereum will likely continue to trade within a range above the key support at $1,820 until market forces drive a decisive breakout. Given the prevailing bearish sentiment, it’s essential to consider the possibility of a potential test of the crucial support level at $1,820 in the near future.

XRP Price Analysis

XRP, currently trading around $0.7878, has successfully maintained its recent gains, experiencing a modest gain of 0.08% in the last 24 hours. While many other altcoins faced more significant corrections, XRP has demonstrated resilience, holding relatively strong at its current levels. The key resistance level for XRP is situated at $0.93 cents, and so far, sellers have prevented the price from surpassing it.

The psychological threshold of $1 is likely to attract a considerable number of sellers in the future, as they aim to secure their profits. Looking ahead, XRP appears to be well-positioned to remain above the 68 cents support, as buyers prepare for another attempt at breaking through the key resistance at $0.93. As the market dynamics evolve, traders and investors should closely monitor XRP’s price action for potential opportunities and developments.

Dogecoin (DOGE) Price Analysis

Dogecoin (DOGE) is displaying a notable gain of 4.88% in the last 24 hours with its current price of $0.0732. Following a corrective decline, Dogecoin’s price discovered a support level in the vicinity of $0.0680. Subsequently, DOGE formed a stable base and initiated a fresh uptrend, demonstrating stronger performance compared to Bitcoin and Ethereum. Over the last two trading sessions, the cryptocurrency experienced bullish movements, successfully surpassing the $0.070 resistance zone.

Furthermore, the price managed to break above the 50% Fibonacci retracement level of the previous downward move, calculated from the $0.0750 swing high to the $0.0670 low. Currently, DOGE is trading comfortably above both the $0.070 zone and the 100 simple moving average. Additionally, a significant bullish trend line is taking shape, offering support near $0.070 on the 4-hour chart of the DOGE/USD pair.

Chainlink (LINK) Price Analysis

Chainlink (LINK), currently trading at $8.193, has been experiencing positive price movement, with a 0.90% increase in the last 24 hours. In mid-June, LINK’s price experienced an uncommon uptrend, coinciding with Blackrock’s submission of the initial Bitcoin ETF application on June 15. Prior to this event, LINK had undergone a substantial 38% decline from its peak in April 2023, which stood at $8.57.

Fast forward to July 21, and Chainlink has now reached a three-month high of $8.19, benefiting from the increasing global demand for seamless interoperability between the decentralized finance (DeFi) and traditional finance (TradFi) ecosystems. On-chain data reveals that prominent whale investors began making significant bets on LINK around June 2023. Considering these factors, it appears likely that LINK will aim to reclaim the $10 milestone.

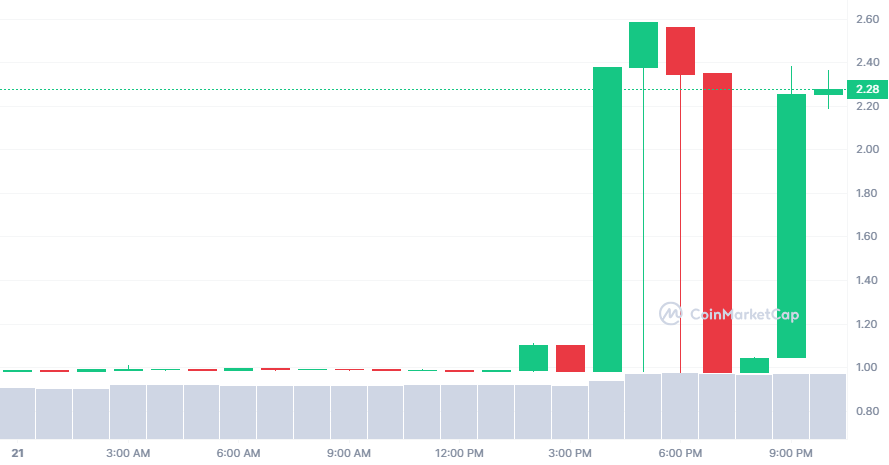

Magic Internet Money (MIM) Price Analysis

In the past 24 hours, Magic Internet Money (MIM) has experienced a jaw-dropping surge, with its price soaring by an astounding 121.03%. At the current price of $2.2806, MIM has demonstrated remarkable growth, capturing the attention of the cryptocurrency community and investors alike.

Being a relatively new player in the market, MIM’s sudden and substantial price movement warrants closer examination. There are several factors that could have contributed to this impressive gain. However, it’s essential to exercise caution and conduct thorough research before investing in any cryptocurrency, especially those that experience such significant price swings in a short period. The crypto market is notorious for its volatility, and prices can fluctuate rapidly in both directions.

Stellar (XLM) Price Analysis

As of the latest update, Stellar (XLM) is experiencing a minor decline of 2.21% in the last 24 hours, with the current price standing at $0.1604. While this dip may be a cause for concern for some investors, it’s essential to consider the broader context and market trends affecting the cryptocurrency.

Stellar’s platform is designed to enable swift and cost-effective cross-border transactions, positioning it as a direct competitor to XRP in the remittance space. This particular use case has garnered attention from both individuals and financial institutions seeking more efficient and affordable ways to facilitate international money transfers.

Augur (REP) Price Analysis

Augur (REP) has displayed positive price movement, recording a notable gain of 4.17% in the last 24 hours. The current price stands at $2.49, reflecting a promising uptrend for the cryptocurrency. The recent uptrend in Augur’s price may be attributed to increased interest and activity on the platform. As more users participate in predictions and place bets on various events, demand for the REP token, the native cryptocurrency of Augur, could rise, resulting in a positive impact on its price.

Augur operates as a decentralized prediction market platform, enabling users to speculate on real-world events. The innovative concept of allowing users to bet on the outcomes of various events, such as elections or sporting events, has attracted interest from the crypto community and beyond. This decentralized approach ensures transparency, security, and censorship resistance, which are appealing features in the world of prediction markets.