The Securities and Exchange Commission (SEC) named these cryptos as securities in its lawsuit against Binance and Coinbase on June 8. While this caused an initial sell-off, most of them have recovered since to pre-crash levels.

On June 8, the SEC launched lawsuits against cryptocurrency exchanges Binance and Coinbase. The charges against them range from a simple lack of disclosure to serious regulatory violations. The essence of this lawsuit boils down to the Howey Test, a legal framework that determines if an investment is a “security.”

The full list of cryptocurrency tokens that have been labeled as securities is as follows:

- Cosmos ($ATOM)

- Binance Coin (BNB)

- Binance USD (BUSD)

- COTI (COTI)

- Chiliz (CHZ)

- Near (NEAR)

- Flow (FLOW)

- Internet Computer (ICP)

- Voyager Token (VGX)

- Dash (DASH)

- Nexo (NEXO)

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

- Filecoin ($FIL)

- The Sandbox (SAND)

- Decentraland (MANA)

- Algorand ($ALGO)

- Axie Infinity ($AXS)

If these tokens are ultimately classified as securities, they would be delisted from US exchanges.

SEC chairman Gary Gensler states that “everything other than Bitcoin” can be labeled as a security. While Mr. Gensler is now a proponent of cracking down on cryptocurrencies, he was a more positive figure during his teaching period in 2018 when he taught a blockchain course at MIT.

At the time, he said in a lecture, “Three-quarters of the market is non-securities. It is just a commodity, a cash crypto.”. Thus, his position now is a direct contradiction to that of 2018.

However, not all in the financial community share Mr. Gensler’s belief. He has recently come under fire from various lawmakers, who are introducing a bill that could replace him as the head of the SEC.

Coins are Pumping Despite SEC Lawsuit

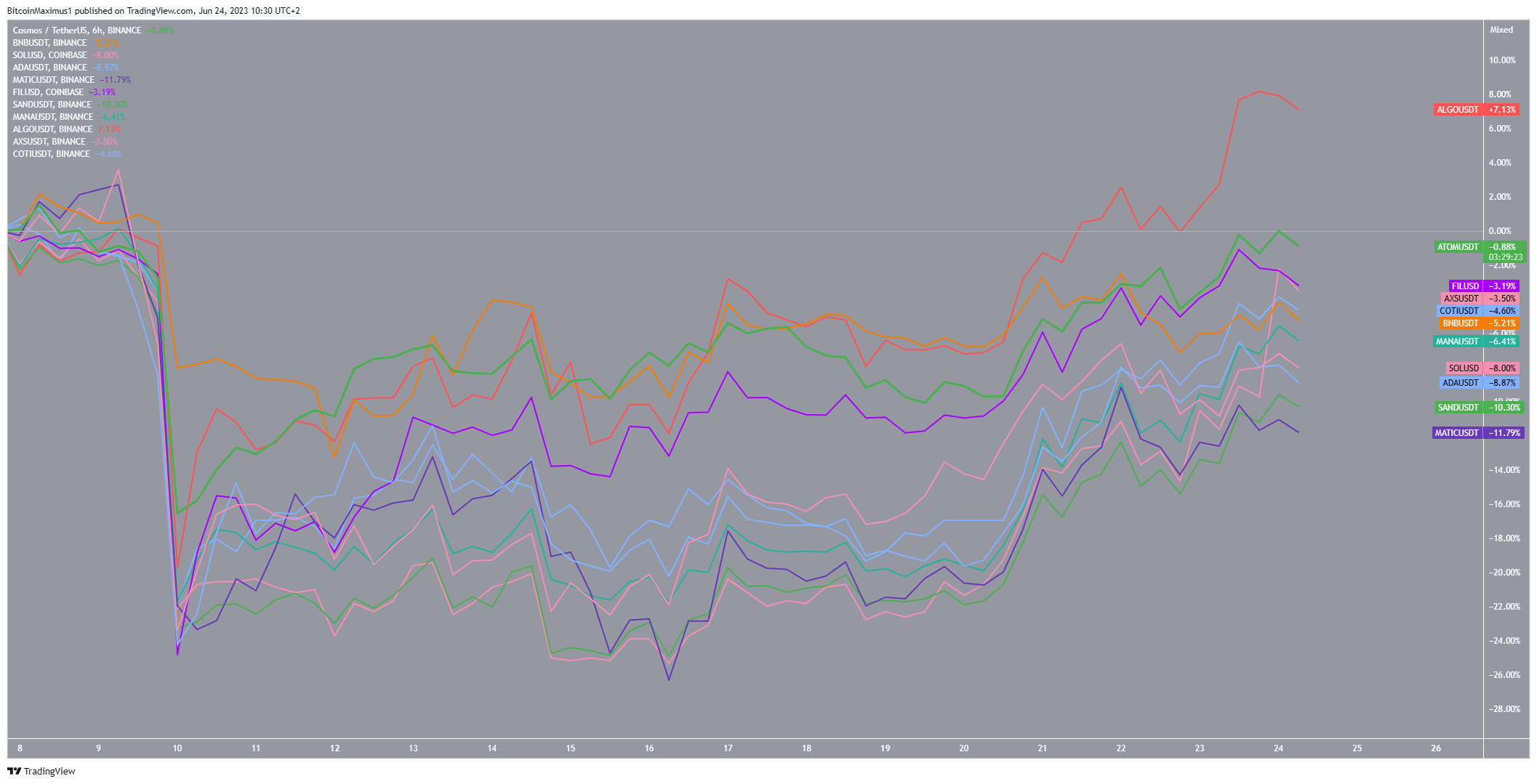

While the introduction of the lawsuit caused a sharp crash on June 8, the market has recovered since. Interestingly, some of the tokens named as securities are leading this charge.

Algorand ($ALGO) has increased by nearly 6% (red) since June 8, while Cosmos ($ATOM), Filecoin ($FIL), Axie Infinity ($AXS), and Coti Network (COTI) have recovered nearly all of their losses since the crash.

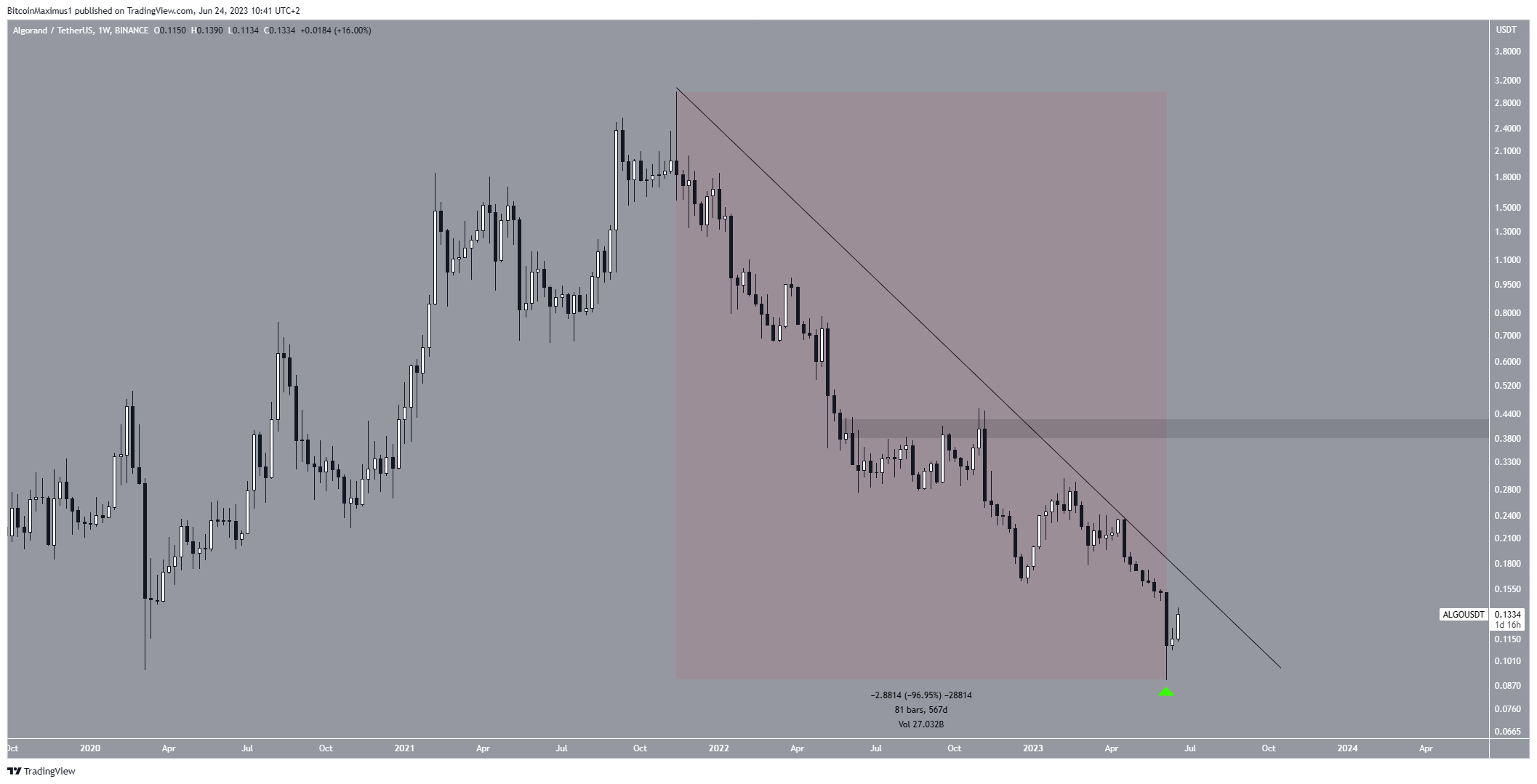

Algorand ($ALGO) Price Leads the Charge

The $ALGO price has experienced a difficult time since November 2021, falling by 97% in 567 days. During the week of the lawsuit (green icon), $ALGO briefly fell below the March 202 lows of $0.095. However, the price has recovered admirably since and is now trading at $0.13.

Moreover, the price is approaching the aforementioned long-term descending resistance line. If it breaks out, it will mean that the preceding correction is complete and a new upward trend has begun. This could initiate a rally to the closest resistance area at $0.41.

However, if the price gets rejected at the resistance line again, a drop to the next closest support area at $0.05 could ensue. This would amount to an all-time low price.

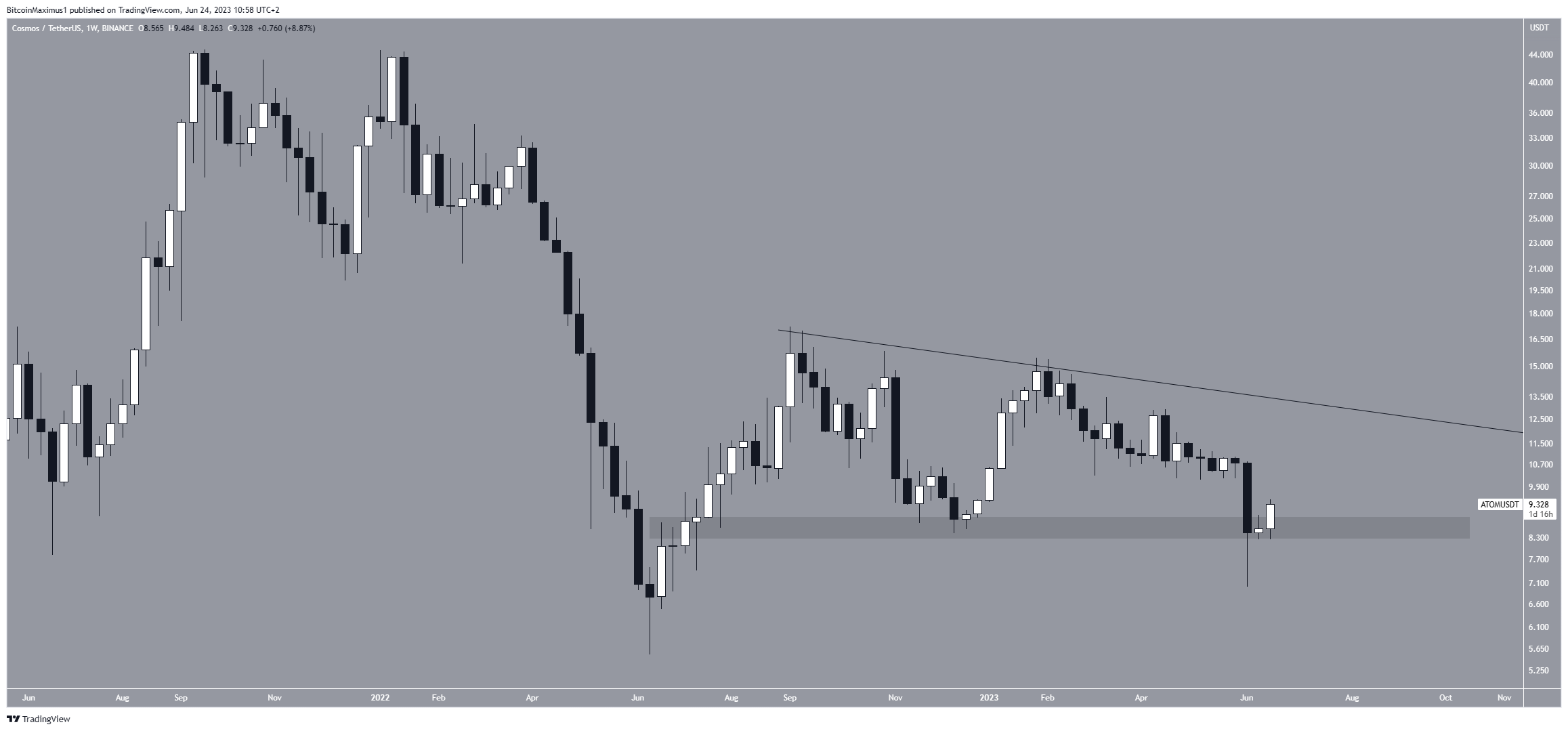

Cosmos ($ATOM) Attempts to Reclaim Key Level

Unlike $ALGO, the $ATOM price is not yet close to its 2020 lows. Rather, the price has fallen to a new yearly low but is considerably above even its 2022 lows.

During the week of the SEC lawsuit, $ATOM briefly fell below its $8.50 horizontal support area. However, the price has recovered since, creating a long lower wick in the process (green icon).

Additionally, it reclaimed the horizontal area and validated it as support. If the current close holds, it would be a decisive bullish development since it would indicate that the previous breakdown was not legitimate. In that case, the $ATOM price could increase to the next closest resistance at $12.

On the other hand, if the $ATOM price reversed the trend and closed below $8.50, a sharp fall to $6 could ensue.

Filecoin ($FIL) Nearly Reaches Resistance

Similarly to $ATOM, the FILE price has fallen under a descending resistance line since the beginning of February. More recently, the line caused a rejection at the beginning of June, initiating a significant drop (red icon). This coincided with the SEC lawsuit.

However, the same week of the crash, $FIL created a very long lower wick, which was considered a sign of buying pressure. This also validated the $2.90 horizontal area as support.

Currently, $FIL is attempting to break out from the resistance line. If successful, it could surge to the next resistance at $3.90.

On the other hand, if the $FIL price gets rejected, it could fall to the $2.90 horizontal area again, validating it as support.

For BeInCrypto’s latest crypto market analysis, click here.

beincrypto.com

beincrypto.com