After staging a notable rebound on June 7, cryptocurrency prices briefly fell into the red once again on Thursday, June 8, pushing the global crypto market cap down, as market hysteria stemming from recent legal actions by the Securities and Exchange Commission (SEC) against major crypto exchanges persists.

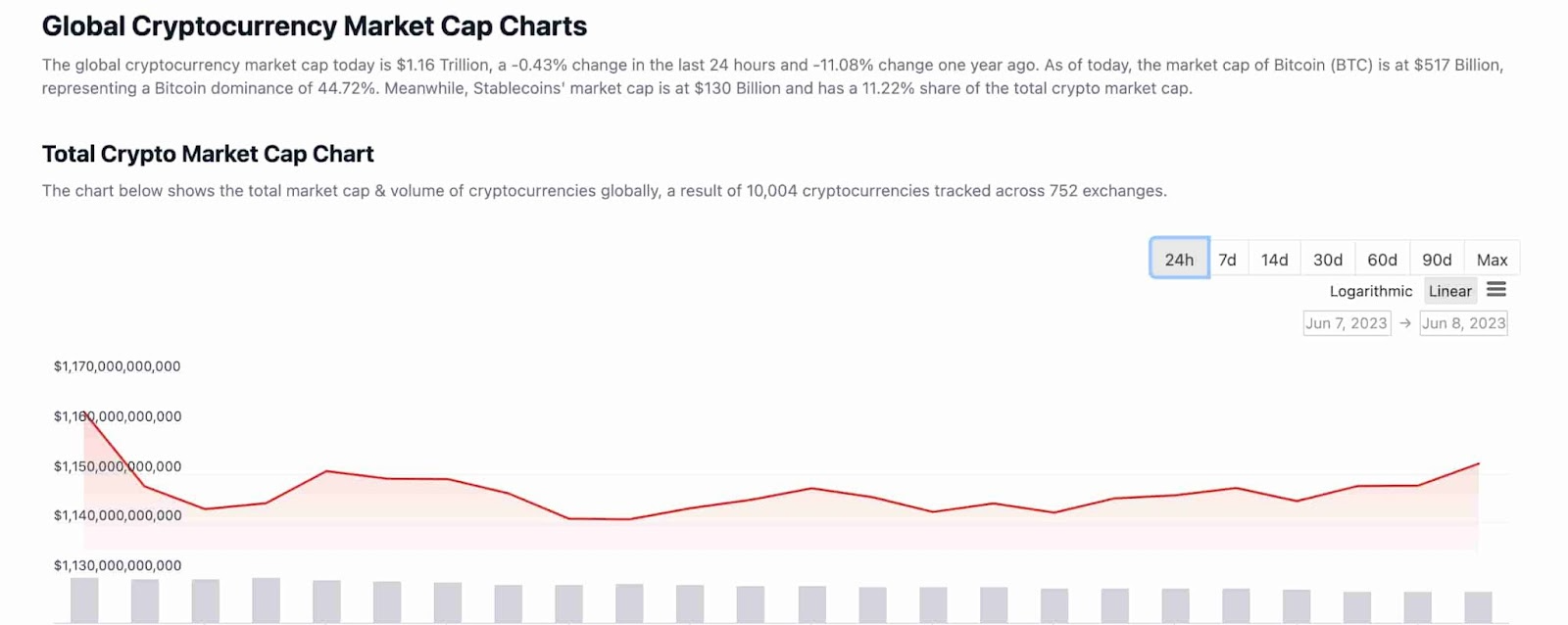

Specifically, the global market valuation slipped more than 0.4% in the past 24 hours to $1.16 trillion, eradicating roughly $11 billion in market cap, according to CoinGecko data. The dip comes just a day after crypto markets recovered around $30 billion following the initial sell-off.

Earlier in the day, a prominent crypto market expert Michaël van de Poppe, said on Twitter that holding above the 200-weekly moving average (MA) for the global crypto market “is a must” ahead of the upcoming consumer price index (CPI) report next week.

Intense volatility in Bitcoin

Unsurprisingly, the latest market move was spearheaded by the world’s biggest cryptocurrency, Bitcoin (BTC), which experienced severe volatility in the past 24 hours, trading in a significant trading range from $26,146 to $26,643.

BTC fell more than 1.8% at one point during the day, before recovering to $26,646 at the time of publication.

Similarly, several other major altcoins were even more affected by the wider market decline, with the most notable price drops seen in the likes of Solana (SOL), XRP (XRP), and Cosmos (ATOM), sliding more than 2.8%, 0.3%, and 1.45%, respectively.

What happened?

The latest sell-off in crypto markets comes amid persisting negative sentiment among crypto investors, who got spooked by two back-to-back litigations by the SEC against Binance and Coinbase – the two biggest crypto exchanges in the world by trading volume.

On Monday, the securities regulator filed 13 charges against Binance and its chief Changpeng Zhao, alleging violating securities regulations and commingling billions of dollars worth of investors’ assets, while “placing investors’ assets at significant risk.”

Similarly, a day later, the SEC charged Coinbase, alleging the company operated its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency. Additionally, Coinbase failed to register the offer and sale of its crypto asset staking-as-a-service program, the regulator said in its complaint.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com