Despite recent legislative action in the United States to avert a government debt default, Bitcoin and other leading cryptocurrencies are experiencing price declines. This drop coincides with the U.S. House of Representatives voting to suspend the national debt ceiling. The bill passed 314 to 117, garnering bipartisan support.

Next in its legislative journey the bill will go to the Senate for approval. If enacted by June 5, it permits the U.S. Treasury to issue new debt, averting a potential default on its fiscal obligations.

Financial analysts predict this move could lead the Federal Reserve to consider hiking interest rates during their June assembly. As a result, uncertainty hangs in the air. What is the best crypto to buy under these volatile macroeconomic conditions?

At present, Bitcoin’s price is hovering slightly below the $27,000 mark. The leading digital currency shows a modest decline of 1.4% in the past 24 hours, resting around $26,900. Bitcoin's total 24-hour trading volume is touching $15.25 billion, with a market cap of $522 billion.

Comparatively, the worldwide crypto market capitalization stands at $1.099 trillion, marking a 0.72% dip today. Over the last 24 hours, the total crypto market volume is registered at $29.64 billion, showing an 11.74% decrease.

Meanwhile, DeFi volume sits at $2.23 billion, contributing 7.51% to the total crypto market's 24-hour volume. Stablecoins volume currently sits at $27.41 billion, constituting 46.05% of the total crypto market's 24-hour volume.

As the investing world holds its collective breath, potential triggers for the next significant price movement could come from the Federal Reserve's June meeting and its implications on monetary policy. Amidst this economic turbulence, cryptocurrencies such as WSM, IOTA, ECOTERRA, LTC, YPRED, XLM, and DLANCE emerge as noteworthy considerations for purchase.

A Peep Into Wall Street Memes Token: Best Crypto to Buy?

The Wall Street Memes ($WSM) token presale is resonating with the Reddit community Wall Street Bets and a leading NFT project, and is currently drawing noteworthy attention.

The project, with its rapidly growing digital audience exceeding a million across various platforms, has sparked interest from prominent figures such as Elon Musk. In under a week, the $WSM presale has witnessed the collection of over $2.4 million.

With its price currently at $0.0262, a subsequent rise to $0.0265 seems imminent. Enthusiastic investors are adding tokens to their crypto wallets at an impressive pace, contributing to a daily total of more than $300,000.

Wall Street Memes is no stranger to the crypto market spotlight. Its Wall Street Bulls NFT collection previously sold out in a mere 32 minutes, generating an impressive $2.5 million. This interest in the $WSM token offers a glimpse into the project's aim of shifting the existing power dynamics in digital markets.

Analysts speculate that the significant Wall Street Bets community could influence $WSM's listing on top-tier crypto exchanges, potentially creating a positive effect on the token price.

Of the total token supply, a generous 30% is reserved for community rewards, with a current contest offering a $50,000 $WSM airdrop to five fortunate members.

Balancing on the Tightrope: IOTA's Resistance and Support Levels

After hitting a new monthly high of $0.2266 on May 30, IOTA has fallen back to the Fib 0.5 level at $0.2002.

IOTA retested the Fib 0.382 level earlier today when it reached an intraday high of $0.2072. IOTA is now trading at $0.2019 with a small gain of 1.10% so far today.

The cryptocurrency could consolidate around these levels before trying to continue its bullish momentum. The 20-day EMA is at $0.1939, while the 50-day EMA stands at $0.1968.

These two EMAs are acting as potential supports for IOTA, providing a cushion if the price drops in the short term.

However, the 100-day EMA sits at $0.2045, acting as a resistance level that IOTA needs to overcome to sustain its bullish trajectory.

The RSI has slightly increased from yesterday's 56.46 to 58.25, indicating ongoing buying pressure, though not very strong.

This suggests that IOTA has room to continue moving up before becoming overbought.

The MACD histogram is now at 0.0026, down from yesterday's 0.0029. This shows that bullish momentum has slowed somewhat, but still remains.

Traders should monitor the MACD to see if it can stay in positive territory, which would support further price increases.

IOTA is currently consolidating around the Fib 0.5 level at $0.2002, with immediate support provided by the 20-day and 50-day EMAs.

The 100-day EMA at $0.2045, followed by the Fib 0.382 level at $0.2064, acts as resistance levels for the price to overcome.

Traders should closely track the RSI and MACD indicators to assess the strength of current bullish momentum and determine the best entry points for positions.

If IOTA can break through resistance levels while maintaining positive technical indicators, the cryptocurrency may continue moving up soon.

Buying into Green: Crypto May be More Earth-Loving than You Think

The presale for ecoterra, currently in its seventh stage, has already accumulated $4.6 million, nearing its objective of $4.775 million. Ecoterra's unique draw revolves around its Recycle-to-Earn (R2E) system, offering a fresh perspective on sustainable recycling.

Through decentralized blockchain, ecoterra will provide incentives for conscientious recycling behavior. But what makes ecoterra worthy of your attention? Consider the following reasons.

Ecoterra differentiates itself through a unique fusion of environmental conservation and blockchain. By creating a transparent record of each user's environmental impact and rewarding eco-friendly practices with its cryptocurrency, Ecoterra couples environmental responsibility with economic growth.

The timing seems ripe to join the crypto-based green movement, and ecoterra offers a unique opportunity to combat climate change with cutting-edge blockchain technology.

The ecoterra presale offers a unique chance to contribute to a project gaining traction in the crypto sphere, fresh off a recent accolade at the Blockchain Economy Summit in Istanbul.

The native $ECOTERRA token is available at $0.0085, expected to rise to $0.00925 once the presale goal is met. With the token price set to increase, early presale participants have an opportunity for substantial returns, supplemented by future staking protocols for income generation.

With the token price slated for an increase and a capped supply of two billion (half designated for presale), acting sooner rather than later could prove beneficial.

Litecoin's 'Bear-Market Bounce': A Silver Lining in the Crypto Cloud?

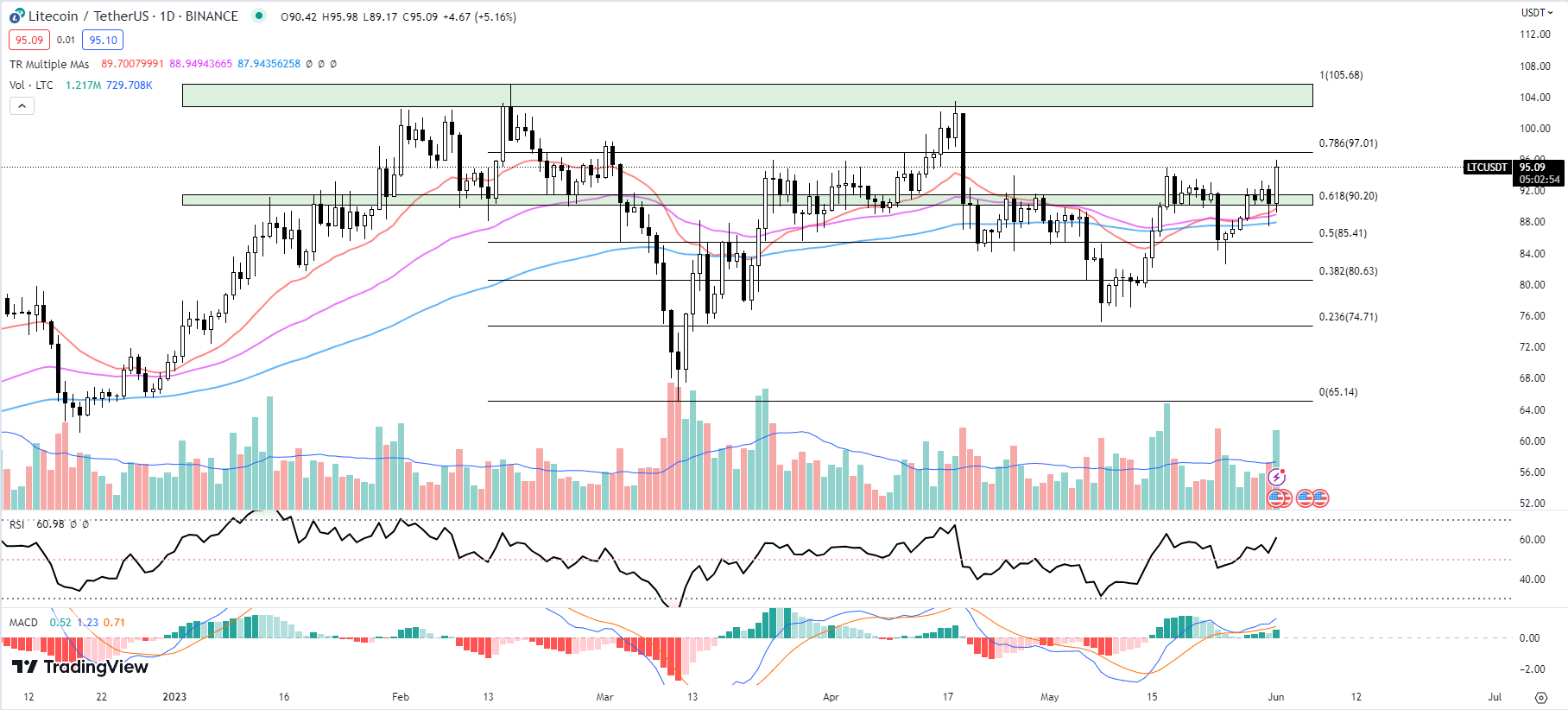

After retesting the significant 20-day, 50-day, and 100-day EMAs together with the Fib 0.618 level at $90.26 yesterday, Litecoin is experiencing a strong bounce of 5.16% off these levels despite the overall cryptocurrency market downturn today.

As Litecoin continues to trend sideways above the Fib 0.618 level support at $90.20, LTC is primed to retest the Fib 0.786 level at $97 in the coming days.

Litecoin's bullish bounce is backed by the robust support provided by the 20-day EMA ($89.707), 50-day EMA ($88.949), and 100-day EMA ($87.944).

These EMAs are converging with the Fib 0.618 level, forming a strong support zone for the cryptocurrency. As long as LTC maintains its position above these levels, the outlook remains positive.

The RSI has risen to 60.98, up from yesterday's 53.28, indicating growing bullish momentum in the market.

This suggests that buyers are currently in control, and the upward price movement could continue in the immediate future.

The MACD histogram has increased to 0.52 from yesterday's 0.28, further confirming the prevalent bullish pressure in the market.

This increase in the MACD histogram supports the idea that the current uptrend could persist, potentially pushing LTC toward the key resistance level at $97.

Today's bullish move is confirmed by the trading volume, which stands at 1.219 million, significantly higher than the previous day's volume of 730.322k and the volume moving average of 729.828k.

The increased volume indicates that there is a strong buying interest in LTC, which could help maintain the momentum.

Traders should keep an eye on the Fib 0.786 resistance level at $97.01, which was last seen on April 19 when LTC broke down from this level. A break above this level could signal a continuation of the bullish trend.

On the downside, immediate support is found at the Fib 0.618 level at $90.20, which is in confluence with the significant horizontal support level of $90.18 to $91.57. Upholding this support is vital for LTC to maintain its bullish outlook.

yPredict Decoding Trading Secrets: Hunting the Best Crypto to Buy

yPredict, an AI-powered crypto trading platform, is nearing an impressive $2 million benchmark in its fundraising efforts, attracting international attention. The platform's advanced AI capabilities offer refined insights to retail traders, with the potential to enhance their portfolios.

yPredict's token, $YPRED, has amassed $1.97 million in presale, launching the token into its 6th stage. This impressive performance places yPredict among 2023's notable crypto presales.

As of now, $YPRED is valued at $0.09, potentially offering favorable returns as the listing price will be $0.12. As the fundraising initiative nears $2 million, $YPRED's price increase to $0.10, an increase of 11%, is on the horizon.

yPredict's platform seamlessly integrates AI with crypto trading. By employing AI for comprehensive data analysis, yPredict equips retail traders with actionable insights, identifying promising crypto assets before they hit the mainstream.

This advanced technology, often exclusive to affluent trading firms, now empowers retail traders to pinpoint remarkable investment opportunities.

yPredict's platform doesn't merely forecast prices. It integrates an array of AI-fueled features including signals, breakouts, pattern recognition, and sentiment analysis of social/news data - all in real-time, designed by highly-rated Machine Learning specialists.

The $YPRED token, residing on the Polygon blockchain, is integral to yPredict's platform. To enjoy premium features, users are required to pay in $YPRED tokens. Additionally, a portion of these fees is shared with existing token holders, incentivizing them to maintain their investments.

Jacob Crypto Bury, an esteemed British crypto analyst, has speculated a 10x growth for $YPRED, enhancing the excitement around this presale.

In the evolving market landscape favoring AI-powered trading tools, yPredict presents a unique opportunity. The $YPRED token could offer exponential growth as we advance into 2023, placing you ahead in the AI-integrated crypto trading domain."

Between Stellar Lines: A Balanced View of XLM's Cryptographic Conundrum

Stellar's (XLM) price found some support around $0.0856 to $0.0866 before moving upwards over the past week. XLM climbed past resistance at $0.0882 to $0.0889, as well as the 20-day and 50-day moving averages.

However, XLM now faces selling pressure as it tries to break through the $0.0924 level. This level represents the Fib 0.236 retracement and also aligns with the 100-day moving average.

The XLM price is currently sandwiched between the 20-day EMA ($0.0897) and the 100-day EMA ($0.0922).

Though it has managed to stay above the 50-day EMA ($0.0915), the price is struggling to break through the 100-day EMA.

If the price manages to clear this level, it could indicate a bullish trend. On the other hand, if the price fails to break through and falls below the 20-day EMA, it could signal a potential downtrend.

The RSI has dropped to 55.95 from yesterday's 61.07, indicating a neutral momentum in the market.

This suggests that the XLM price is currently in a state of indecision, and traders need to keep a close eye on the RSI for any significant shift in momentum.

The MACD histogram is currently at 0.008, up from yesterday's 0.007, which suggests that there's increasing bullish pressure in the market.

However, this pressure has not been strong enough to propel the price through the resistance at the 100-day EMA and the Fib 0.236 level.

The trading volume for XLM has decreased significantly, with the current day's volume at 38.109 million, down from the previous day's volume of 61.887 million.

This could be a sign that traders are losing interest or are hesitant to commit to a position until there's a clearer indication of the market direction.

Traders should keep an eye on the 100-day EMA resistance at $0.0922 and the Fib 0.236 level at $0.0924. A break above these levels could indicate a bullish trend.

On the downside, immediate support can be found at the 20-day EMA at $0.0897. If the price drops further, it may retest the potential significant support area of $0.0892 to $0.0896.

Casting the 'Net' for the Best Crypto to Buy: A Glimpse at DeeLance

DeeLance, the up-and-coming Web3 freelance metaverse platform, recently reached a significant milestone. A notable influx of presale funding has propelled the project past the $1.2 million mark, with its native crypto token, $DLANCE, being the driver behind this robust growth.

The platform's objective to disrupt the traditional structure of remote work and the $761 billion recruitment sector is capturing attention. DeeLance proposes a decentralized approach, seeking to dislodge prominent intermediaries like Fiverr and Upwork by empowering both freelancers and employers.

Investor interest in the project has escalated, prompting an endorsement from crypto experts who regard DeeLance as a promising crypto startup of 2023.

The presale is advancing swiftly, with four stages remaining. Once the accumulated $DLANCE sales reach $6.8 million, the fundraising efforts will conclude, and $DLANCE will list across major cryptocurrency exchanges.

Simultaneously, DeeLance announced a $100k $DLANCE token giveaway competition. The conditions for participating involve ownership of at least $100 worth of $DLANCE tokens and completion of eleven tasks, primarily on DeeLance's social media platforms.

The recent surge in presale support coincides with the project securing a strategic investment from venture capital firm Bitgert Ventures, to the tune of $1.12 million.

The focus of Bitgert Ventures on decentralized infrastructure makes this investment a considerable vote of confidence for DeeLance, suggesting possible further institutional funding.

DeeLance's metaverse platform is a work-focused digital space powered by blockchain technology, designed to address the challenges of digital freelancing, such as copyright infringement and payment fraud.

A unique feature is the tokenization of freelance work products into NFTs, ensuring secure and reliable transfer of work ownership.

cryptonews.com

cryptonews.com