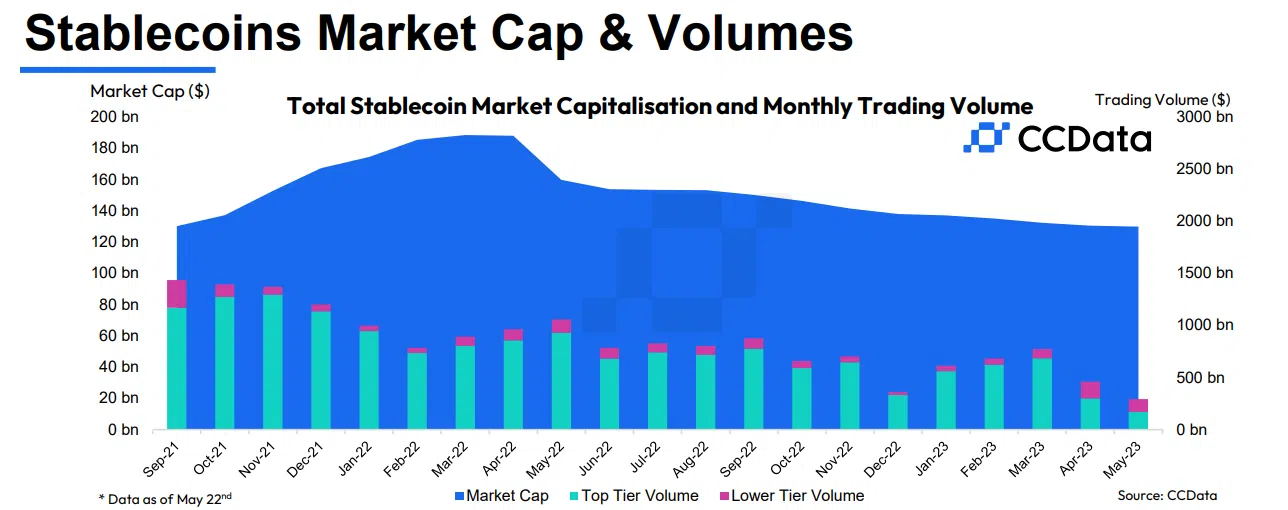

Stablecoins’ total market cap is down significantly, with a decline of more than $50 billion over the past 14 months.

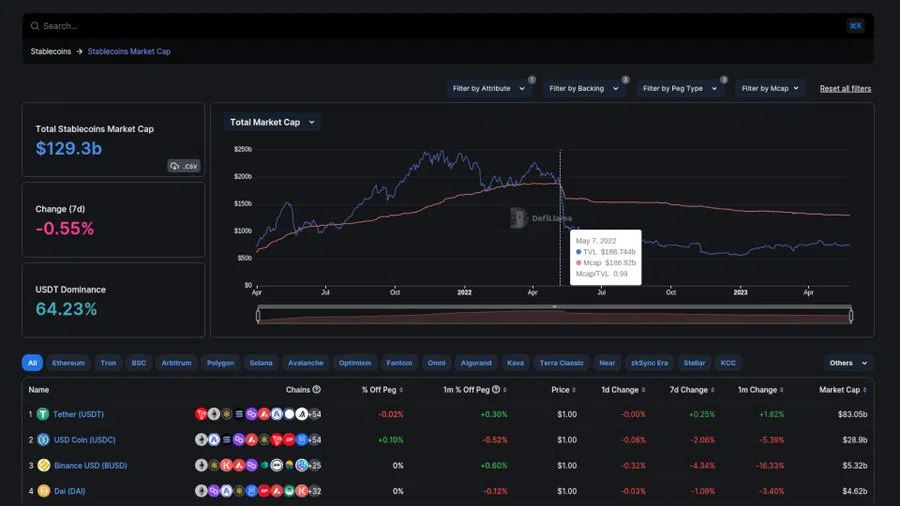

According to Defillama, the stablecoin market cap is currently at $129 billion, down from over $186 billion in May 2022 when Terra UST depegged.

Stablecoins Decline For 14 Straight Months

At this rate, the industry’s market cap is at its lowest since September 2021, according to CCData.

Even before the UST collapse, the stablecoin market was already seeing declines. But the crash further hastened the drop. CCData reported that stablecoins’ total market cap fell by 0.45% in May, making it the 14th consecutive month of decline.

Besides the drop in market cap, the asset’s trading volume also dropped significantly in May. It fell by 40.6% to $460 billion. This is the lowest trading volume on centralized exchanges since December 2022.

Meanwhile, the declining trading volume and market cap have not affected its dominance. Stablecoin’s market dominance increased to 11.1% from 9.76% in April — though it is still below the all-time high of 16.6% recorded in December 2022.

Tether USDT Remains Dominant

Tether’s USDT is the largest stablecoin by market cap and controls 63.9% of the market, its highest share since December 2021. According to BeInCrypto’s data, stablecoin’s circulating supply sits at $83.2 billion — inching closer to its all-time high of $83.7 billion.

The issuer recently reported an excess reserve of $2.4 billion, adding that it would use 15% of its net realized operating profits to purchase Bitcoin.

Meanwhile, other stablecoins like TrueUSD (TUSD) and Gemini Dollar (GUSD) have seen their market caps rise. GUSD’s market cap is up 18.4% to $576 million, while TUSD gained 3.82% to hit an all-time high of $2.07 billion.

BUSD, USDC Slips

However, other major stablecoins have slip-ups in their market cap. Binance USD (BUSD) market cap fell for the sixth consecutive month as Paxos continued its gradual winding down of the digital asset. It fell by 11.9% to $5.48 billion.

Circle-backed USD Coin (USDC) also recorded a 3.5% drop in market cap and has now fallen below $30 billion. Investor’s confidence in USDC has declined following its exposure to the U.S. banking crisis.

beincrypto.com

beincrypto.com