The Conflux (CFX) price has fallen since its yearly high and created a lower high, which is considered a sign of weakness.

CFX is attempting to hold on above the $0.325 horizontal support area. Will it be able to do so, or will the rate of decrease accelerate further?

Conflux Price Holds Above Support

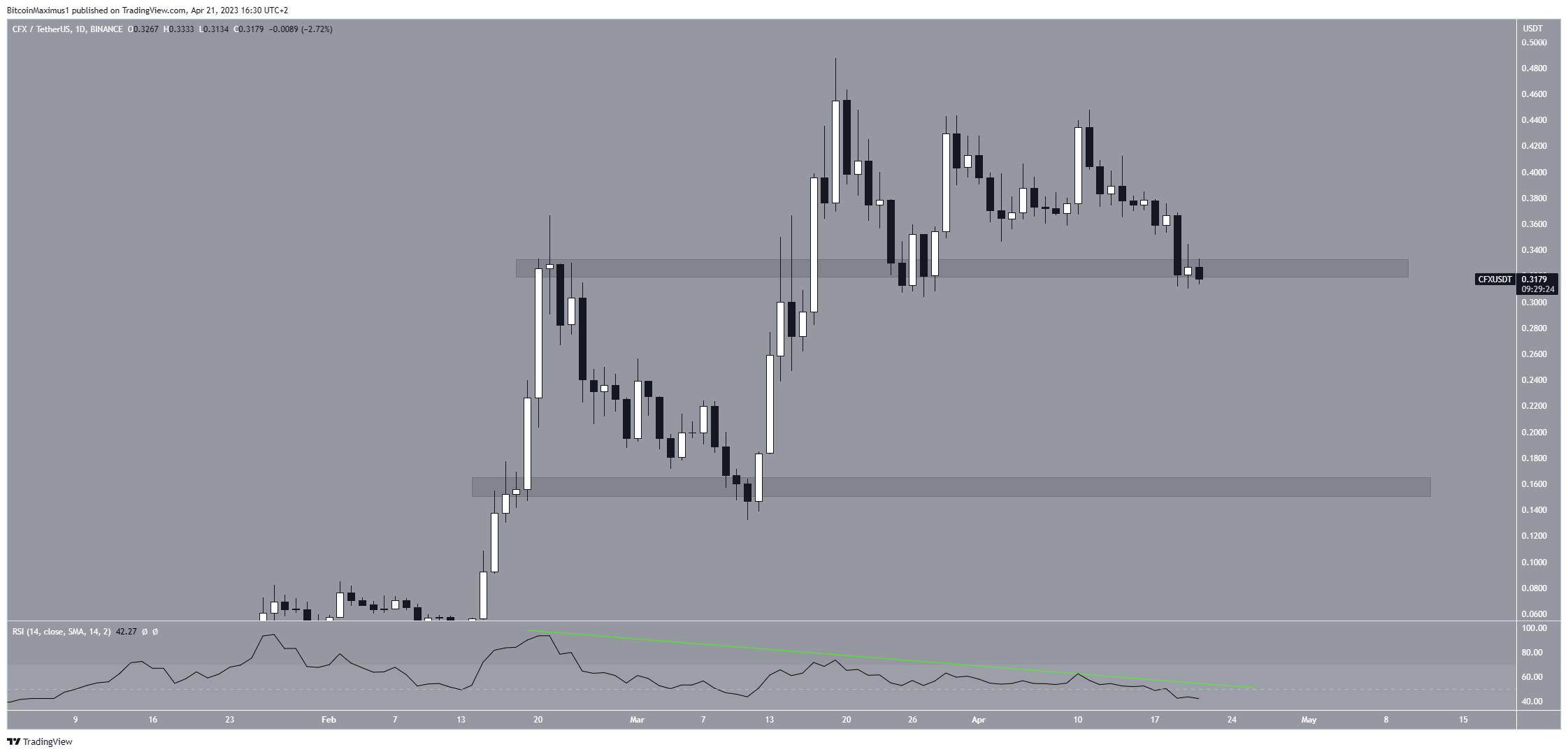

The Conflux price has fallen since reaching its yearly high of $0.49 on March 19. The price created a lower high and is now trading inside the long-term horizontal support area at an average price of $0.32. The area acted as resistance before the breakout, leading to the yearly high. After horizontal resistance levels are broken, they usually provide support once the price returns to them. Therefore, whether CFX bounces or breaks down from this area will be crucial in determining the future trend.

The daily RSI indicates that the price will break down. Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold and to determine whether to accumulate or sell an asset. If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

There are two reasons why the trend is bearish. Firstly, the indicator has fallen below 50. As outlined above, this is a sign of a bearish trend. Secondly, there is a bearish divergence trendline that is still intact (green line). This means that an increase in momentum did not accompany the previous increase in price. As a result, it indicates that the CFX price will decrease. The next closest support area is at $0.16.

CFX Price Prediction: Bounce or Breakdown?

The technical analysis from the short-term six-hour time frame provides a bearish CFX price prediction.

Since the aforementioned yearly high, the CFX price has traded inside a descending parallel channel. When the price movement is contained inside such a channel, the price bounces between the resistance and support lines of the pattern numerous times.

Since the Conflux price now trades below the channel’s midline, a decrease to the support line is the most likely outlook.

This is also supported by the Relative Strength Index (RSI), which is below 50 and decreasing.

The channel’s support line also coincides with the 0.618 Fib retracement support level at $0.27. Fibonacci retracement levels operate on the principle that after a significant price change in one direction, the price will retrace or revisit a previous price level, partially, before resuming in its original direction. Therefore, due to this confluence, it is likely to act as the local bottom.

However, if the CFX price reclaims the channel’s midline, it would invalidate this bearish CFX price prediction. In that case, an increase to the channel’s resistance line will be the most likely scenario.

beincrypto.com

beincrypto.com