BeInCrypto looks at the five biggest altcoin losers in the entire crypto market this week, specifically from April 7 to 14.

The underperforming altcoins that saw prices falling the most in the entire crypto market this week are:

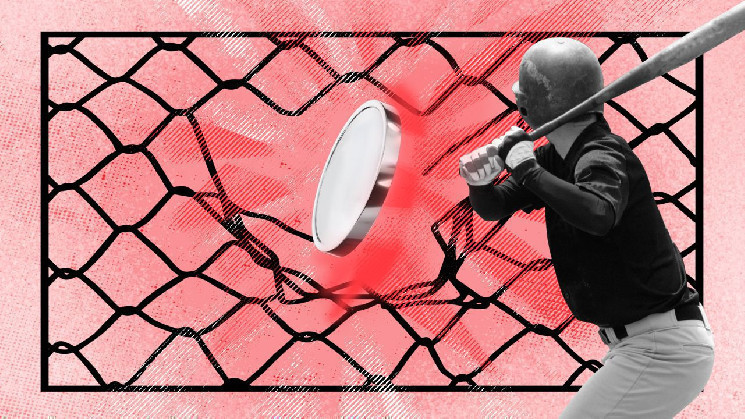

SXP (SXP) Price Leads Underperforming Altcoins

The SXP price was mired in a massive increase in a six-day period starting on March 27. This led to a new yearly high of $0.94 six days later.

However, the price has fallen since and reached a low of $0.57 on April 12. The ensuing bounce (green icon) during the next 24 hours validated the 0.5 Fib retracement support level.

If the bounce continues, SXP could move to the $0.93 resistance area again. However, if it closes below $0.58, another sharp drop toward $0.35 could ensue.

Enjin ($ENJ) Price Reclaims Bottom of Trading Range

The $ENJ price has increased since March 10. On April 5, it moved above the $0.41 horizontal support area and validated it as support on April 12 (green icon).

If the bounce continues, the $ENJ price could increase to $0.55. However, a loss of momentum could lead to a retest of the $0.41 support area.

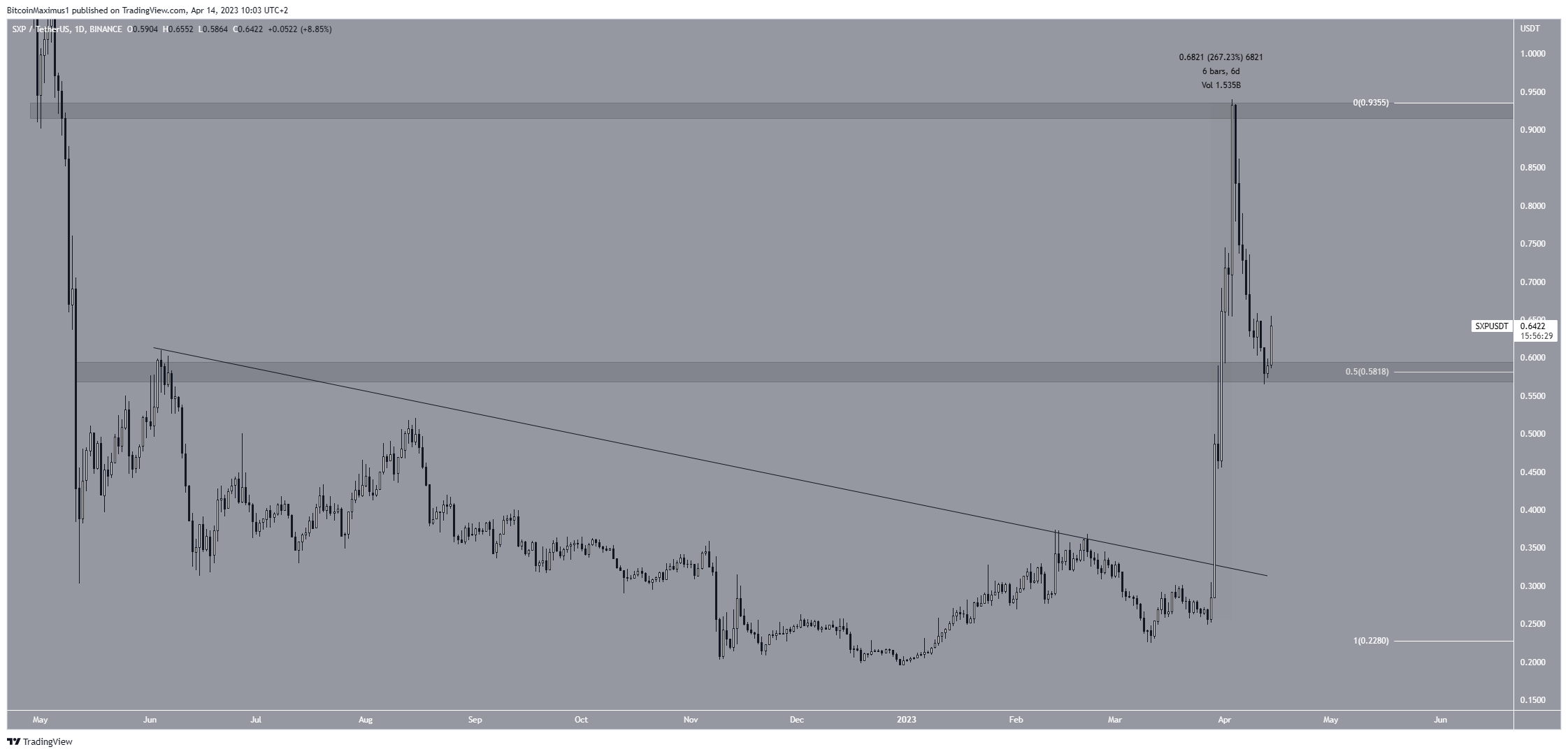

$IOTA ($IOTA) Price Breaks out From Resistance Line

The $IOTA price broke out from a descending resistance line on March 29. The breakout led to a high of $0.24 on April 6. However, the price was rejected by the 0.618 Fib retracement resistance (red icon) and fell afterward.

The digital asset fell to an ascending support line afterward. If it breaks down, a drop to $0.20 could follow. However, if $IOTA moves above the 0.618 Fib level, it could increase to $0.27.

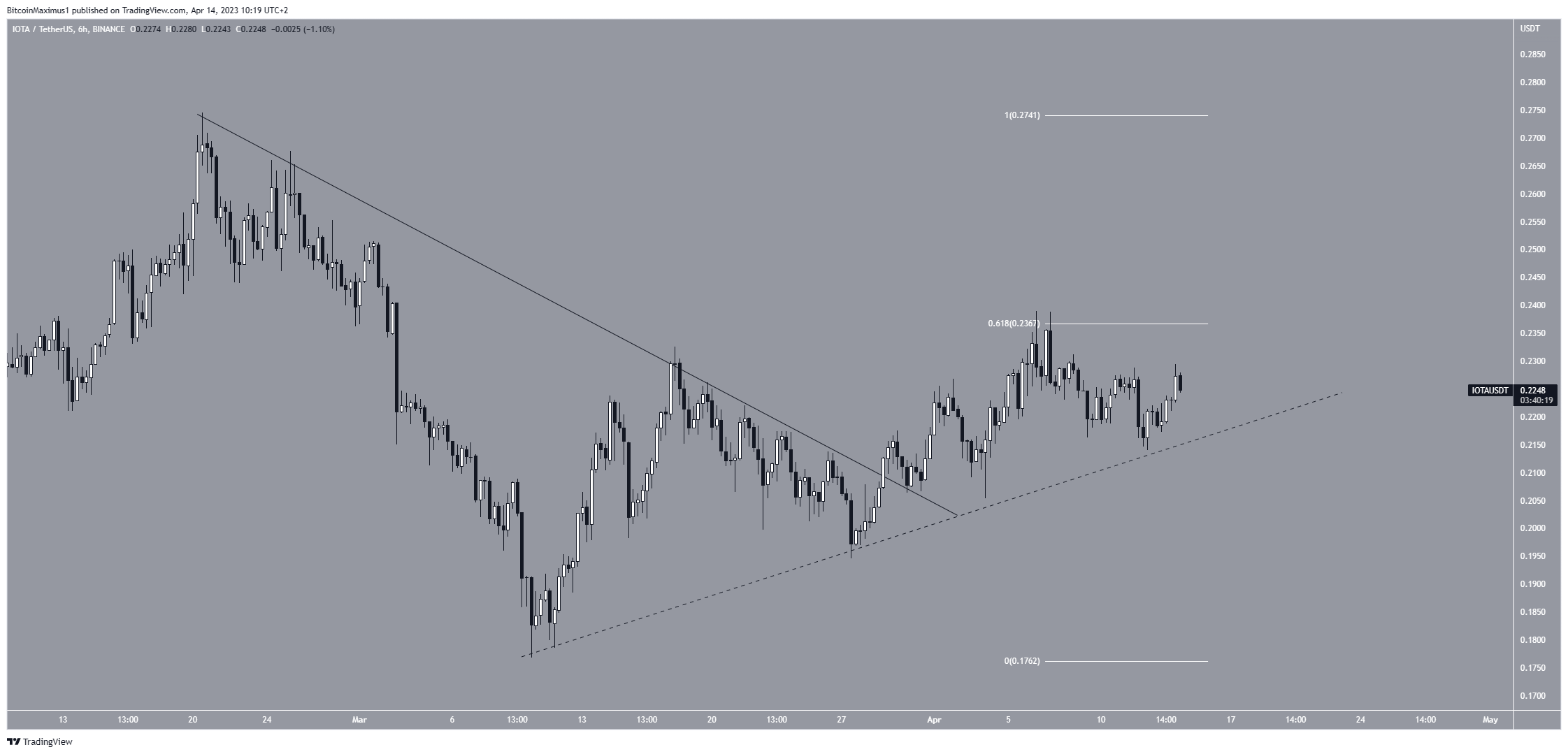

Quant ($QNT) Price Trades in Corrective Pattern

The Quant price has traded inside an ascending parallel channel since November 2022. Such channels usually contain corrective patterns. This means that an eventual breakdown is likely.

If that occurs, the $QNT price could decrease to $97.

However, if the crypto asset breaks out from the short-term resistance line (dashed), it could increase to the channel’s midline at $140.

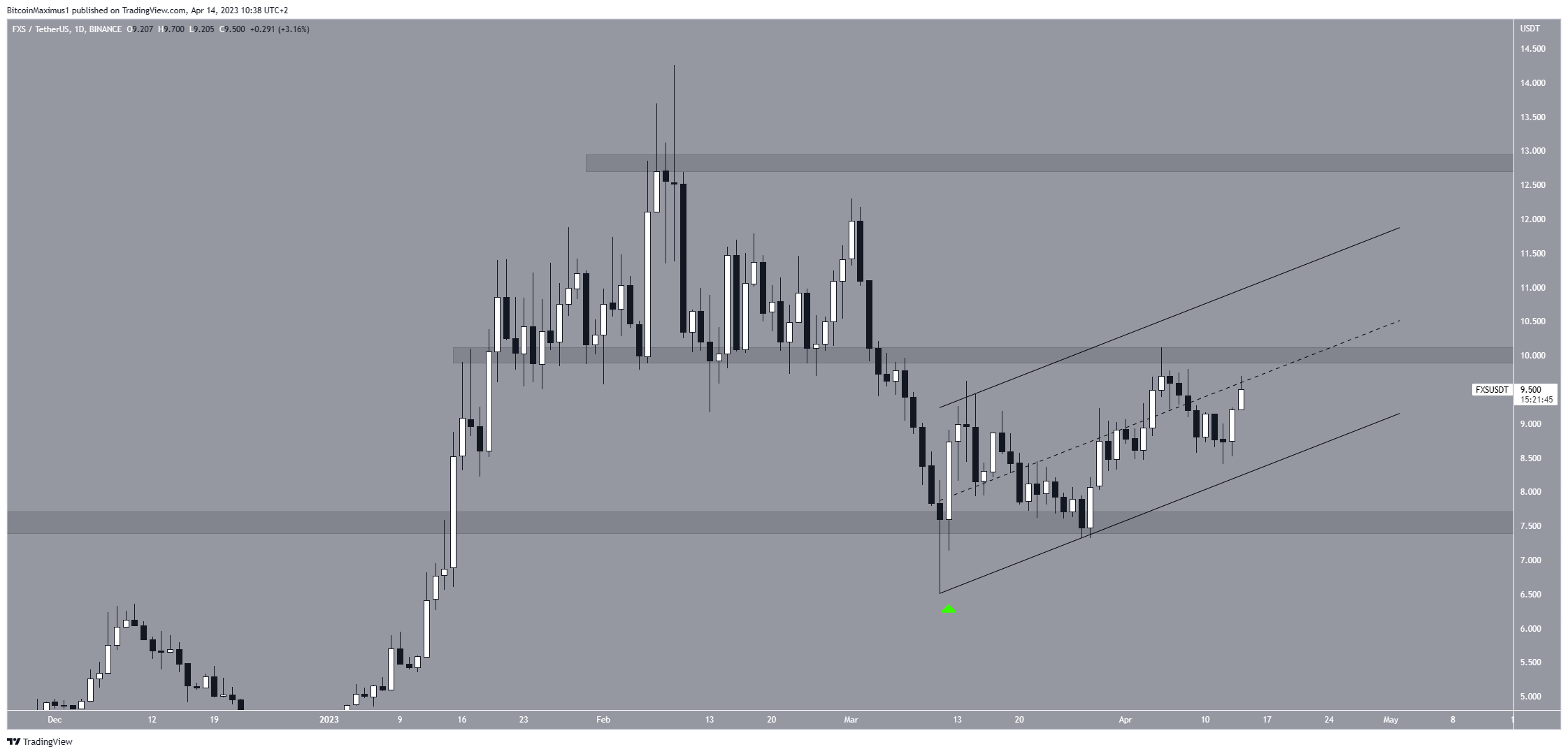

Frax Share (FXS) Price Approaches Critical Resistance

Similarly to $QNT, the FXS price also trades in an ascending parallel channel since creating a long lower wick on March 11. The price reached the $10 resistance area on April 5.

Whether FXS breaks out above this area or breaks down from the channel will likely determine the future trend. A breakout could lead to an increase toward the channel’s resistance line at $12, while a breakdown could lead to a retest of the $7.50 area.

beincrypto.com

beincrypto.com