The Sandbox, whose native crypto is SAND, has seen significant growth since the beginning of the year, a +60% to be exact. However, the month of March is closed on a negative note with -8% for the crypto.

It now needs to go above $0.7250 to recover, with its main support being $0.50. Below are all the details regarding the price trend.

Price analysis of The Sandbox (SAND) crypto

At the current price, The Sandbox (SAND) stands at $0.6075 and closed the month of March with a negative sign of -8%. February had also closed in the red by -5%, but, as anticipated above, since the beginning of 2023 it remains largely up and stands at +60%.

In any case, it is important to note that at the beginning of February it had peaked at +144%, with a relative high of $0.9414. Hence, it can be understood that the setback in the last two months is substantial.

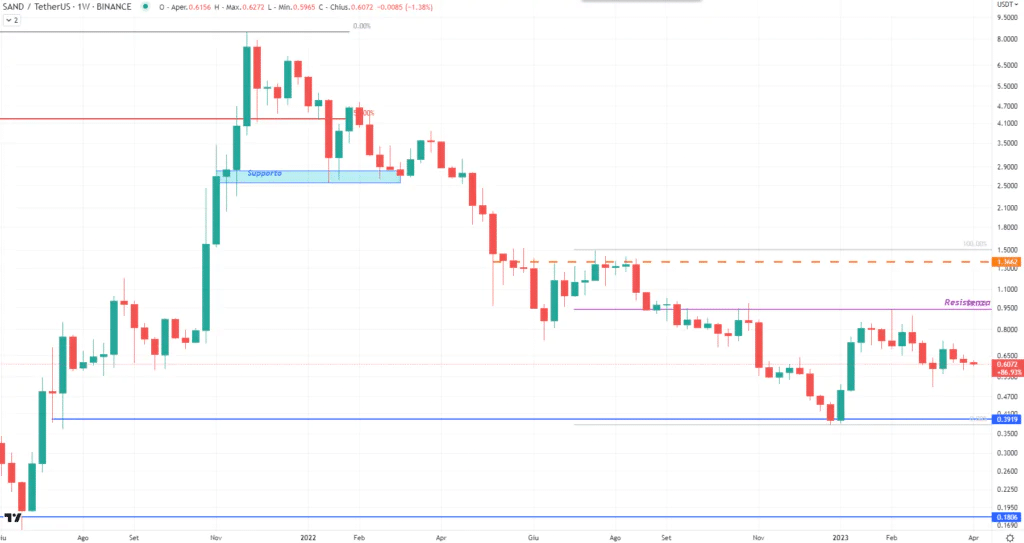

Furthermore, looking at the weekly chart, it is possible to see the historical trend of The Sandbox (SAND) from the beginning of 2021 until today. Standing out are the highs at $8.48, which were touched in November of that year and which correspond to a growth of almost 30,000%.

On the other hand, the daily chart shows how the price of the crypto in February halted its bullish trend at $0.9414, which was a resistance area indicated around mid-January.

From that same resistance then began the corrective phase, which within 30 days led to a loss of almost 50%. Indeed, SAND fell to the support at $0.50 around the beginning of March.

Since then, the crypto has bounced back reaching the resistance area again at $0.7250 in mid-late March. In conclusion, in the current scenario The Sandbox (SAND) is in a dead zone.

Now, the two main levels for directional moves remain the resistance at $0.7250 and a first level at $0.6545, at the same time it is important that the support at $0.50 is not violated.

User activity drops in The Sandbox metaverse

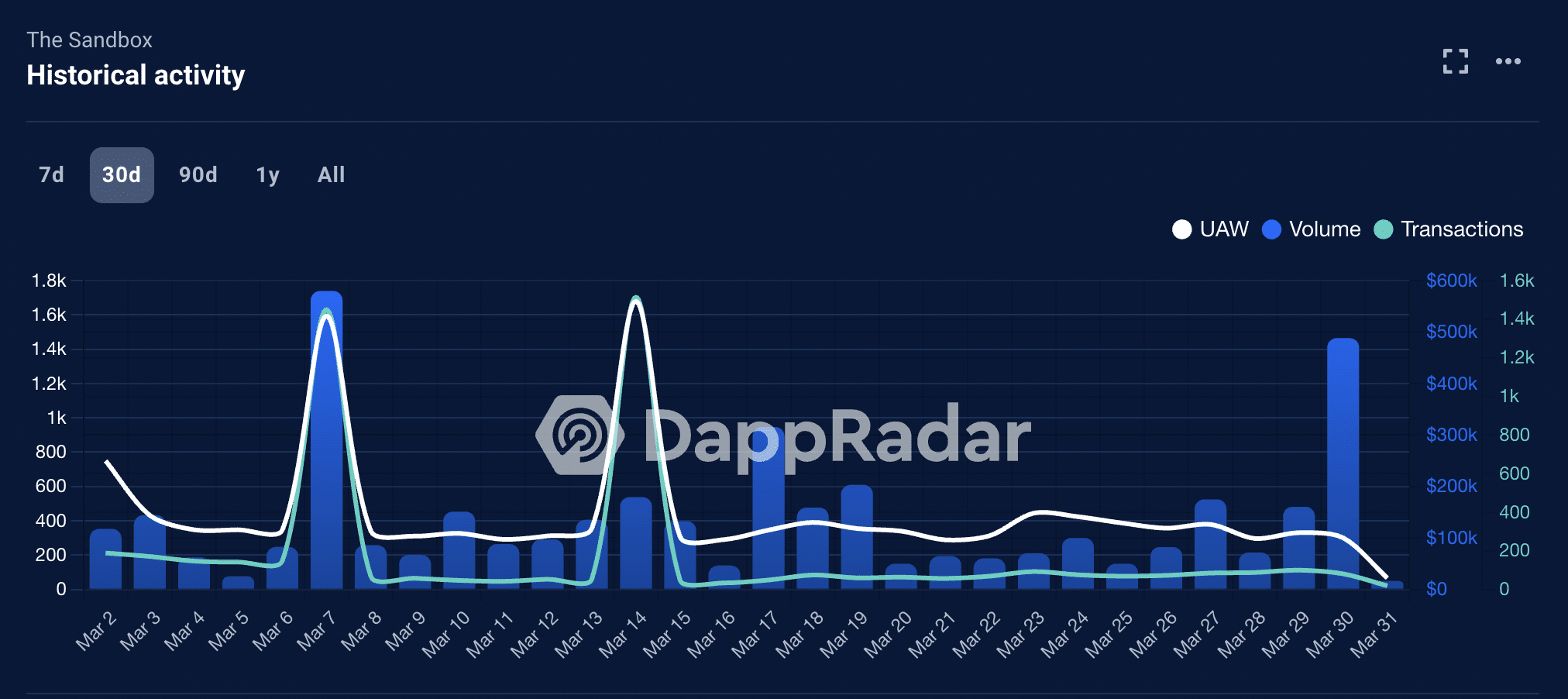

The Sandbox (SAND), which is the leading metaverse-based project, ended the first quarter of 2023 with a drop in user activity, according to data from DappRadar.

In fact, according to the decentralized applications (dApps) data provider, The Sandbox recorded a 9% decrease in the number of unique active wallets that interacted with its smart contracts or executed a transaction with any of its smart contracts last month.

Specifically, the protocol recorded only 7,500 unique active wallets. Interestingly, while the protocol experienced a near double-digit decline in the number of unique active wallets last month, The Sandbox recorded a 10.29% increase in transaction count.

According to data from DappRadar, the number of transactions conducted between unique active wallets and the dApp’s smart contracts was 5,360 in the past 30 days. While the transaction count has increased, the fiat value of transactions completed on the metaverse-based protocol has decreased dramatically by 80%.

In the past month, the value of all transactions completed by active wallet addresses on The Sandbox was $4.11 million.

However, this is not the end of the story, this is because, unfortunately, the decrease in the number of users on the protocol over the past 30 days has led to a corresponding decrease in the values of NFT collections in The Sandbox metaverse.

Currently valued at 0.665 ETH per NFT, The SandBox’s LAND Collection has seen its value drop by 17% in 30 days. With only 498 sales completed during that period, the average price per LAND NFT was 0.7946 ETH, down 11%.

Crypto news: The Sandbox (SAND) price down 92% from its highs

At the same time, the price of The Sandbox (SAND) crypto is still crushed in the area of lows. Indeed, the growth this early in the year is little compared to the descent from the highs.

At the current price, SAND is still down from the November 2021 highs by 92.23%. In this sense, it is very useful to consider the law of statistical ruin thought up by Thomas Gresham. With this particular law, he showed that the chance of recovering the initial value of the lost capital is inversely proportional to the loss.

In other words, this means that if one has lost 50% of a value, to recover the same, it is not enough to gain 50%, but rather 100%. Hence, as the loss increases, the recovery rates increase: if you have lost 90%, you will have to increase by 900%.

In addition, the addresses of The Sandbox in earnings are also very low to date. From the on-chain data, provided by the Intotheblock site, it can be seen that those in the money are 16.62%. By contrast, in mid-February, they were close to 40%. At the current price, 75.21% of holders are out of the money, in other words, at a loss, while 8.50% are in the break even area.

en.cryptonomist.ch

en.cryptonomist.ch